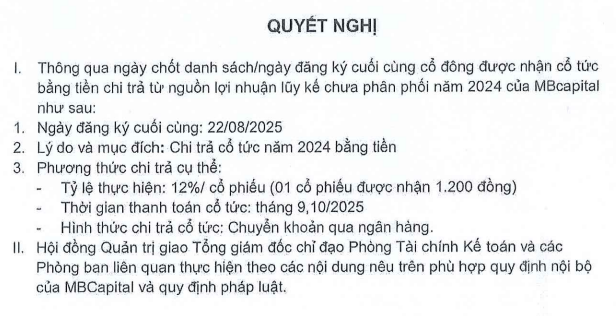

Specifically, MB Capital will pay a cash dividend for 2024 at a rate of 12% (VND 1,200/share). With over 35.6 million shares currently in circulation, the estimated scale of this dividend is nearly VND 43 billion.

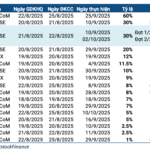

According to the plan, MB Capital will make dividend payments in September-October 2025 via bank transfers. The record date for shareholders was previously set as August 22, 2025.

Source: MB Capital

|

It’s worth noting that the majority of this money will go to the Military Commercial Joint Stock Bank (MB, HOSE: MBB). As of June 30, 2025, MB served as the parent bank of MB Capital with a significant ownership stake of 90.77%, entitling them to receive nearly VND 39 billion in dividends.

MB and MB Capital not only share a close relationship in terms of ownership but also engage in notable transactions. As of the end of the second quarter of 2025, MB Capital had deposits worth nearly VND 227 billion with its parent bank.

During the first half of the year, MB Capital entered into a term deposit transaction of VND 266 billion with MB, while also withdrawing VND 408 billion in term deposits. The fund management company also recorded revenue of over VND 2 billion in interest and fees from MB.

In terms of business performance for the first six months of 2025, MB Capital generated nearly VND 48 billion in revenue, a 2.9-fold increase compared to the same period last year, ranking fifth in the fund management industry in terms of revenue growth rate. The main driver of this growth and the largest contributor to revenue was investment portfolio management.

Finally, the company reported a 33% increase in post-tax profit, amounting to over VND 36 billion.

Another notable aspect is the significant growth in the scale of investment portfolios of trust investors, increasing from nearly VND 7,443 billion at the beginning of the year to nearly VND 8,984 billion at the end of the second quarter, surpassing the total assets by 14 times. The entire portfolio was entrusted by domestic investors, mainly channeled into unlisted bonds exceeding VND 4,585 billion, unlisted shares of over VND 1,615 billion, and listed shares of nearly VND 1,280 billion.

– 17:02 27/08/2025

Is There Room for the Market to Reach New Heights?

The Vietnamese market is poised for new heights, according to Dao Hong Duong, Industry and Stock Analyst at VPBank Securities. With a diverse portfolio strategy, there are strong foundations for optimism in the coming months. This expert insight suggests a bright outlook for Vietnam’s economic landscape, indicating potential peaks in the market and emphasizing the importance of strategic investment approaches.