Proposed Amendments to the Tax Management Law in Vietnam: A Focus on Debt Forgiveness and Tax Assessment

The Ministry of Finance is seeking feedback on the draft Law on Tax Administration (amended) with significant provisions related to debt forgiveness and tax assessment. The first notable change is the addition of a provision prohibiting debt forgiveness for land use fees, land rental fees, late payment fees, and penalties.

This adjustment aims to ensure consistency with the Land Law and mitigate potential disputes arising from financial obligations associated with land being considered for debt forgiveness.

Illustrative image

Additionally, the Ministry of Finance proposes adjustments to the criteria for tax debt forgiveness to address current shortcomings. Accordingly, debt forgiveness will only be applicable in genuinely unavoidable circumstances, such as when a business or cooperative has gone bankrupt under the Bankruptcy Law and has no assets to fulfill its obligations.

The same applies to individuals who are deceased or incapacitated and lack the assets, including inherited assets, to meet their financial obligations.

Moreover, tax debts older than ten years, despite enforcement measures, will also be considered for forgiveness. In cases where debt arises from natural disasters, widespread calamities, or pandemics that cause severe damage and impair the recovery of production and business operations, the taxpayer will be exempt from their obligations.

Notably, if a taxpayer resumes business operations after having their debt forgiven under the category of debts older than ten years, they will be required to repay the previously forgiven debt.

In tandem with the provisions on debt forgiveness, the draft Law on Tax Administration (amended) also introduces a mechanism to tighten tax assessment procedures. Tax authorities will be empowered to apply this measure when taxpayers use documents or records that do not accurately reflect the nature of the transactions, deliberately reducing their tax liabilities.

This will also apply when taxpayers engage in transactions that deviate from economic reality to evade taxes or use illegal invoices, even if the goods are genuine and revenue has been declared.

According to the Ministry of Finance, these adjustments will enhance transparency and practicality in tax administration while providing a comprehensive legal framework for tax authorities to conduct tax assessments rigorously, in compliance with regulations and international practices.

The Great Tax Debt Forgiveness: Erasing 240,000 Billion Dong Over a Decade

As per the proposal by the Ministry of Finance, tax debts that have lingered for over a decade and remain uncollectible despite exhaustive enforcement measures, will be considered for write-off. However, should the defaulting individuals or businesses resume operations, they will be liable to repay the previously waived debt. As of June this year, the total estimated tax debt under the management of the tax industry stood at a staggering 240 trillion VND.

One-Minute Tax Talk: Are Electronic Invoices Mandatory for Private Clinics with Annual Revenue of 950 Billion?

“The Tax Authority has shed light on tax rates applicable to business households, offering much-needed clarity to entrepreneurs across the nation.”

The Tax Defaulters: Unraveling the Story of Billion-Dollar Debts in Binh Duong Province.

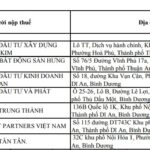

On November 26, the Binh Duong Provincial Tax Department disclosed a list of tax debtors to the State budget as of October 31, 2024. The list comprises 365 individuals and businesses delinquent in tax payments, totaling over VND 1,400 billion. Notably, several prominent names feature on this list, highlighting the significance of tax compliance among all entities and individuals.

The Taxman Cometh: How Three Businesses Were Slapped with a Hefty $40,000 Tax Bill

The Ministry of Finance’s Inspectorate unearthed tax irregularities in three businesses in Dak Lak. A total of nearly VND 1 billion in additional tax payments was uncovered, indicating potential under-declaration by these enterprises.