XTSC Secures Shareholder Approval for Capital Raising Plans and Elects New Board Members

The resolution passed on August 29, 2025, entailed amendments and supplements to the previous resolution by the Board of Directors on August 4, 2025. These changes pertained to adjusting the foreign ownership ratio, updating the registration dossier for the offering, and appending a list of registration documents for the offering of 135 million shares to existing shareholders.

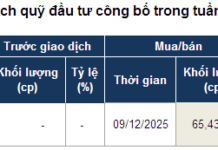

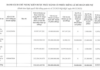

This resolution also approved the utilization of 1,350 billion VND in proceeds from the share offering. XTSC will allocate 60% to margin lending (810 billion VND), 5% to pre-sale lending (67.5 billion VND), 30% to proprietary trading (405 billion VND), and the remaining 5% to supplement working capital for other activities (67.5 billion VND). The company plans to deploy these funds in 2025 and 2026.

As of August 4, 2025, XTSC had 62 shareholders, including six major shareholders: Mr. Le Huy Dung, holding 20.03%, Agricultural Trading Company Khang An, holding 20%, Ho Ngoc Bach, holding 19.88%, Thai Kieu Duong, holding 15.13%, Vo Van Von, holding 9.9%, and Construction Materials Corporation No. 1 – Fico, holding 5%.

|

Capital Allocation from the Offering of 135 Million Shares to Existing Shareholders

Source: XTSC

|

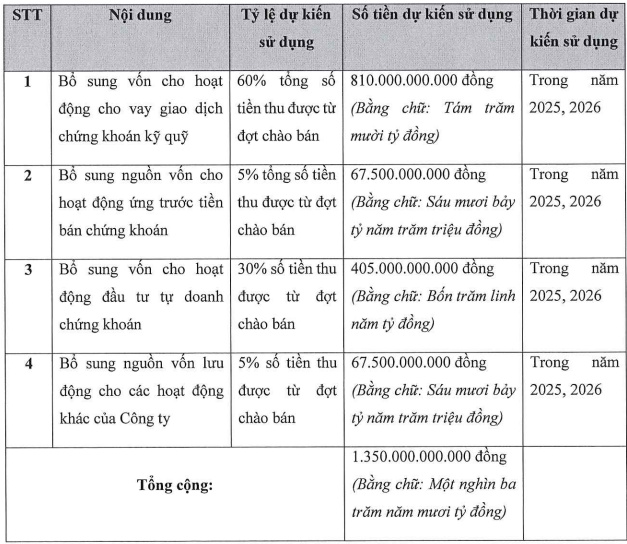

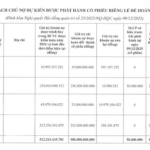

This allocation mirrors the planned usage of proceeds from the upcoming private placement of 151.5 million shares. Specifically, out of the 1,515 billion VND raised, the company will allocate 65% to margin lending and pre-sale lending of securities (nearly 985 billion VND), 30% to proprietary trading (nearly 455 billion VND), and 5% to supplement working capital for other activities (nearly 76 billion VND). This capital will also be disbursed in 2025 and 2026.

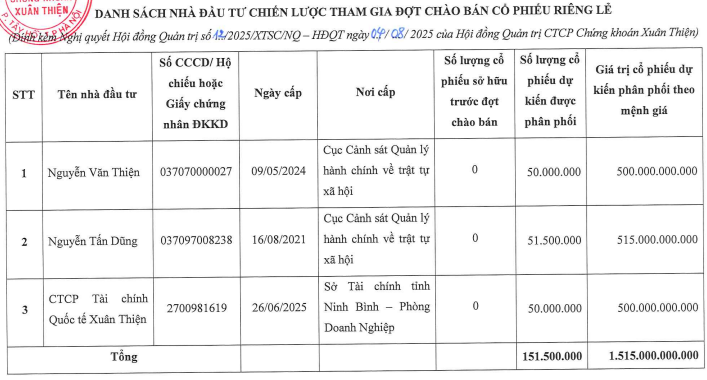

The list of strategic investors includes two individuals, Mr. Nguyen Van Thien, who will receive an allocation of 50 million shares, and Mr. Nguyen Tan Dung, who will receive 51.5 million shares. The remaining 50 million shares will be allocated to XT International Finance Joint Stock Company.

Mr. Nguyen Van Thien is the son of Mr. Nguyen Xuan Thanh, the founder of Xuan Thanh Group (Ninh Binh), and the brother of Mr. Nguyen Duc Thuy, the Chairman of LPBank. Mr. Thien is also known as the Chairman of Xuan Thien Group, a diversified conglomerate with interests in energy, materials, and agriculture.

XT International Finance Joint Stock Company (XT Global Capital) has also drawn attention as it was only established on June 26, 2025, in Ninh Binh province, with its primary business activity being other monetary intermediation.

Despite its recent incorporation, XT Global Capital boasts an initial charter capital of 8,000 billion VND, with three founding shareholders: Mr. Nguyen Van Thien, holding 70%, Mr. Nguyen Tan Dung, holding 15% (both individuals also participated in the private placement of XTSC shares), and Mrs. Nguyen Thi Hong Nhung, holding the remaining 15%. Mr. Pham Vu Tung serves as the company’s General Director and legal representative.

The involvement of these parties sheds light on the recent name change of Xuan Thanh Securities (formerly known as Sen Vang Securities).

|

Capital Allocation from the Private Placement of 151.5 Million Shares

Source: XTSC

|

Source: XTSC

|

Upon the completion of these two offerings, XTSC’s charter capital will increase from 135 billion VND to 3,000 billion VND. These plans were approved at the company’s 2025 Annual General Meeting of Shareholders.

At the AGM, a company representative stated: “The 3,000 billion VND target is appropriate for the current context. Firstly, the company will supplement its business operations in accordance with the Securities Law. We will allocate capital to core business activities, including securities brokerage, margin lending, and the development of financial products.”

Notably, the company also announced plans to further increase its charter capital to 20,000 billion VND and aims to join the top 3 in the market.

Important decisions were made at the 2025 Annual General Meeting of Shareholders – Source: XTSC

|

In another significant development on August 29, 2025, the XTSC Board of Directors passed a resolution to provide services to customers borrowing funds to trade securities on margin and for pre-sale lending.

In terms of financial performance, XTSC recorded revenue of nearly 7.5 billion VND in the second quarter, a 3.8-fold increase from the same period last year. This revenue was primarily derived from consulting activities and interest income from term deposits. The company reported a post-tax profit of nearly 2.3 billion VND, an improvement from the loss of over 1.1 billion VND in the previous year. This result contributed to a post-tax profit of over 593 million VND for the first half of the year, following a challenging first quarter.

However, this performance still falls short of the company’s target of achieving a post-tax profit of 70 billion VND for the full year.

| XTSC’s Quarterly Financial Performance in Recent Years |

– 13:56 03/09/2025

“Masan’s Mineral Segment to Witness Significant Growth: Vietcap Predicts Surge in Tungsten Prices”

As of Q2 2025, Masan High-tech Materials has turned a corner, reporting positive profits after consecutive quarters of losses.

“LPBank Securities Offers 878 Million Shares to Boost Chartered Capital.”

LPBank is set to offer its existing shareholders a lucrative opportunity to invest in its growth journey. The company is offering a rights issue of 878 million shares at an attractive price of VND 10,000 per share, with a subscription ratio of 1000:2258.23. Mark your calendars, as the record date for this offering is September 8, 2025.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.

Unlocking Profits: Damsan’s Audited Semi-Annual Report Reveals Nearly VND 45 Billion in Earnings, with August Marking the Launchpad for a String of New Projects

In recent times, Damsan Company has emerged as a prominent investor and developer of numerous real estate projects in the Hung Yen province.