Mr. Nguyen Duc Lenh, Deputy Director of the State Bank – Branch of Region 2, shared insights into the distribution of the government’s holiday cash gifts to citizens ahead of the upcoming Independence Day celebrations.

As of noon on September 1st, banks in Ho Chi Minh City and Dong Nai had distributed 1,125 billion VND in 500,000 VND and 100,000 VND denominations, tailored for households and individuals. Dong Nai province alone disbursed 345 billion VND to credit institutions for distribution as Independence Day gifts to the local communities.

“The banking system is ensuring uninterrupted payment and fund operations during the holiday period,” said Mr. Nguyen Duc Lenh. “Credit institutions have been proactive in facilitating the distribution of the government’s Independence Day gifts to the people.”

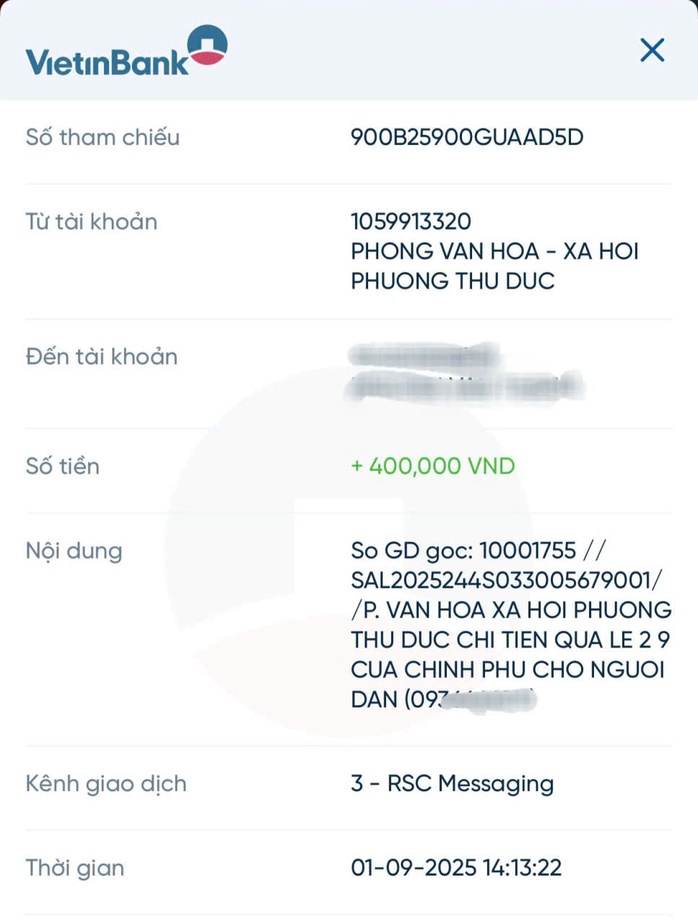

According to reports from customers of various banks, many have received the 100,000 VND gift deposited into their accounts. Mr. Nguyen Thanh, a resident of Thu Duc District, Ho Chi Minh City, shared that his VietinBank account received a total of 400,000 VND for his family of four by noon today.

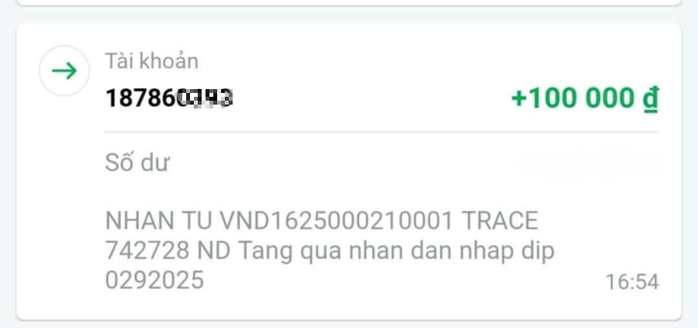

Customers of VPBank and other financial institutions also confirmed receiving the holiday gifts in their accounts.

In addition to distributing the 100,000 VND cash gifts, credit institutions are promoting cashless payment solutions with innovative and inclusive products. These include initiatives such as providing smartphones to the underprivileged, offering gifts and rewards for opening accounts, and integrating services with the VneID application for social welfare payments.

Mr. Thanh’s family of four received a total of 400,000 VND as a gift from the government for Independence Day.

A VPBank account holder confirms receiving the holiday gift on September 2nd.

The Race to the Top: How Vietcombank, MB, VPBank, and HDBank Soar After a 50% Cut in Reserve Requirements

The decision by the State Bank of Vietnam to reduce the mandatory reserve ratio by 50% for credit institutions participating in the restructuring process has provided a significant liquidity boost for the four banks involved in the transfer. This policy move has had a multifaceted impact, simultaneously reducing funding costs, directly enhancing liquidity, and promoting credit growth.

Sacombank Offers a Generous Gift: Up to 600,000 VND for Customers Who Install the Payment Speaker

Let me know if you would like me to tweak it further or provide additional suggestions.

From now until the end of October 2025, Sacombank is offering a special cash-back program for individual and business customers who adopt its innovative soundbar payment solution. This initiative aims to encourage a shift towards a cashless society by incentivizing customers to embrace this modern and convenient payment method.

“Vietnam’s Central Bank Meets With Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself, with a key focus on maintaining stability in deposit interest rates. Institutions are also encouraged to further reduce operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to lower lending rates.