Investment Consulting Company Nguyen Binh Joint Stock Company (Nguyen Binh Investment) recently submitted a document to the Hanoi Stock Exchange (HNX) announcing its key financial indicators for the first half of 2025.

As of June 30, 2025, the company’s equity decreased slightly by VND 7 billion, to over VND 292 billion; of which, owner’s investment capital remained at VND 300 billion.

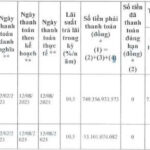

According to the issuance announcement on HNX, Nguyen Binh Investment issued two lots of bonds, NBCCH 2124002 and NBCCH 2124003, to make advance payments to APAC Construction Consulting and Supervision Joint Stock Company and Dat Viet Construction and Trading Co., Ltd. to carry out items at the Cam Dinh – Hiep Thuan Ecological Garden Project (Phuc Tho district, Hanoi city).

The security is all development rights and other property rights arising from or related to the above project.

In addition, these assets are also used to secure the obligations of Hoang Long Construction and Development Co., Ltd.

Regarding Nguyen Binh Investment, the company was established on June 24, 2019, with its main business activity being real estate business.

The initial chartered capital was VND 300 billion, with two shareholders contributing capital: Mr. Nguyen Van Cuong (50%) and Mr. Do Xuan Ky (50%). Mr. Nguyen Van Cuong (DOB: 1976) is the Director and legal representative of the company.

Returning to the Cam Dinh – Hiep Thuan Ecological Garden Project, this project is invested by Kim Thanh Trading Co., Ltd.

Kim Thanh was established in June 2001 with a chartered capital of VND 5,550 billion as of October 2021. The shareholder structure at that time was: Cam Dinh Ecological Investment Co., Ltd. (99%); Mr. Nguyen Van Kinh (0.9%) and Mr. Do Van Truong (0.1%).

According to the latest change registration (June 2024), Kim Thanh has two legal representatives: Mr. Do Van Truong (DOB: 1979) – General Director and Mr. Nguyen Van Kinh – Chairman of the Board of Directors.

“ESOP Bonanza: 313 SHS Employees Bag Shares at a Whopping 66% Discount to Market Price”

SHS announces the issuance of 5 million ESOP shares to 313 employees at a price of 10,000 VND per share, an incredible 66% discount on the market price.

The Ever-Elusive Novaland: A Tale of Deferred Debt and Intrigue

Novaland has encountered challenges in arranging funds, leading to a delay in repaying over VND 857.4 billion in principal and interest for two bond lots, NVLH2123009 and NVLH2123013.