HoSE saw over 200 stocks appreciate, nearly double the number of decliners, but the VN-Index couldn’t shake off the drag from large-cap stocks.

VCB had the most negative influence, followed by the Vingroup trio of VIC, VHM, and banks VPB, CTG, ACB, and HDB, which added pressure. The VN30 basket also witnessed a dominant red hue, with 15 constituents in the red.

Meanwhile, real estate and steel stocks attracted substantial capital inflows, propelling their share prices higher. Real estate names DIG, PDR, DXS, and CII hit the daily limit-up, with PDR witnessing a notable surge in liquidity, exchanging nearly 56 million shares. Trading volume more than doubled compared to the previous session.

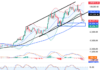

PDR has rallied over 40% in just one month.

In just one month, PDR has rallied over 40%. Mr. Nguyen Van Dat, Chairman of Phat Dat Real Estate Development Joint Stock Company (PDR), has registered to sell 88 million shares (over 9% of the company’s capital), starting September 5th. The expected trading period is one month, through matched negotiations.

DIG also hit the ceiling price after the company announced its reviewed semi-annual financial statements for 2025, revealing a significant profit increase compared to the previously published unreviewed report.

According to the audited report, net profit for the first six months reached VND 28 billion, nearly seven times higher than the same period in 2024. In contrast, the previously published unreviewed report showed only VND 6.7 billion. However, by the end of the first half, the company had achieved only 5.3% of its annual profit plan.

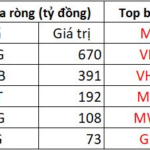

Steel stocks, backed by robust capital inflows, rallied across the board, with NKG and HSG hitting the daily limit-up. HPG witnessed a liquidity explosion, with over 119 million shares changing hands, valuing more than VND 3,350 billion, the highest on the exchange. Conversely, foreign investors’ trading activities were a detractor, as they net sold HPG aggressively, offloading nearly VND 950 billion—the most substantial net selling value in the session.

The Winning Stocks for the $1.3 Billion Foreign Fund

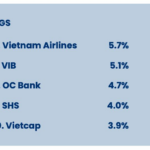

PYN Elite Fund had an impressive run in August, with a focus on banking stocks (+20%) and securities firms (+19%)—the two sectors that dominated the fund’s portfolio—leading to substantial gains.

Steel Stocks Continue to Soar

The HPG, HSG, NKG, and TLH stock series witnessed an unprecedented surge in liquidity, skyrocketing in the trading session on September 4th.

A Company at Risk of Delisting from HoSE Despite an Eightfold Increase in Profit for the First Half of 2025

The Ho Chi Minh Stock Exchange (HoSE) has issued a warning to the Company regarding the potential risk of delisting its stock (SRF) if the audited financial statements for 2025 receive a qualified audit opinion. This cautionary note highlights the importance of timely and accurate financial reporting to maintain the confidence of investors and comply with the exchange’s listing requirements.