In the latest report, Maybank Securities (MSVN) stated that the VN-Index fluctuated below the 1,700-point threshold in the last week of August due to profit-taking and foreign net selling pressure. However, the index maintained its green status, led by the finance sector, particularly securities, banking, and insurance. This group is supported by robust domestic credit growth and market upgrade expectations.

In terms of valuation, securities stocks are now trading around fair levels, while bank and real estate stocks reflect higher expectations.

Nevertheless, there is still room for re-rating in some sectors, especially as interbank interest rates have stabilized. Improved system liquidity after July’s pressure has facilitated bank credit expansion and supported stock market flows.

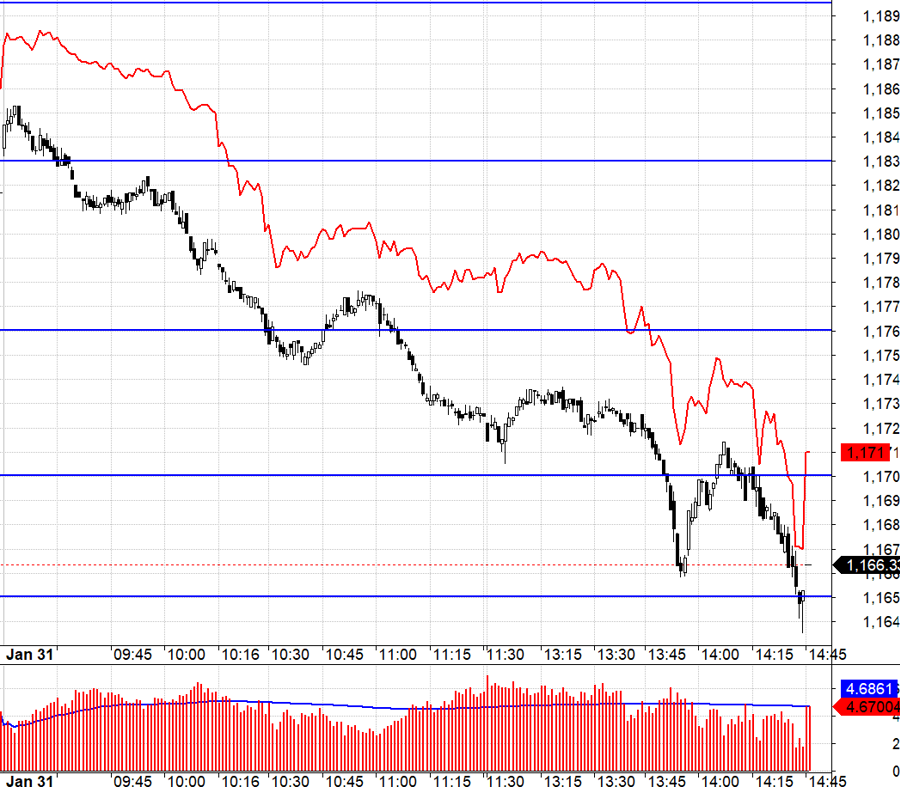

MSVN highlights an important event in September: the Fed’s interest rate decision on September 17, with a likely 25-basis-point cut. This move will help ease domestic exchange rate pressure, the biggest challenge for the SBV’s current loose monetary policy.

Accordingly, Maybank maintains its target of 1,800 points for the VN-Index by the end of 2025 , driven mainly by the finance and real estate sectors, while export industries need more time to recover.

Sharing the same view, Vietcombank Securities (VCBS) strategic report for the last months of the year assesses that with the rise of the VN-Index in July and August, the general index is trading at P/E 14.9x.

The current P/E is attractive compared to the regional average (~15.3x) and the 5-year average (~14.4x). At the same time, low-interest rates and strong credit growth in the last months of the year are expected to continue to support abundant market liquidity and lift the P/E valuation of industries to new highs.

With the expectation of market upgrade, decisive policies to promote growth, and the next steps from flexible diplomatic art, VCBS expects VN-Index to continue towards the positive scenario of 1,838 points (with the latest EPS of the whole market reaching 18%) in the last months of 2025.

Expert Insights: Market Rally Has Further to Run – Smart Stock Picks Needed for Investors to Stay Afloat.

“According to investment guru, Mr. Do Thanh Son, the investment narrative for the latter part of the year revolves around the fundamentals of individual businesses. With pricing no longer being the sole competitive advantage, the focus shifts to growth potential and intrinsic value.”

What’s in Store for the Stock Market Post the 2nd of September Holidays?

The stock market closed off an impressive August rally, with the VN-Index soaring past 1,680 points and consecutive record-breaking liquidity. Experts believe that several variables, such as expectations of a Federal Reserve rate cut in September, exchange rate dynamics, and the potential for an FTSE upgrade for the Vietnamese stock market, will keep investor sentiment buoyant post the September 2nd holiday.

What Stocks to Buy After the September 2nd Holiday?

For short-term traders, a recommended strategy is to focus on stocks with strong momentum, maintaining a short-term upward trend, and belonging to leading sectors.