**Vietnam’s Industrial Production Index Surges: A Comprehensive Overview**

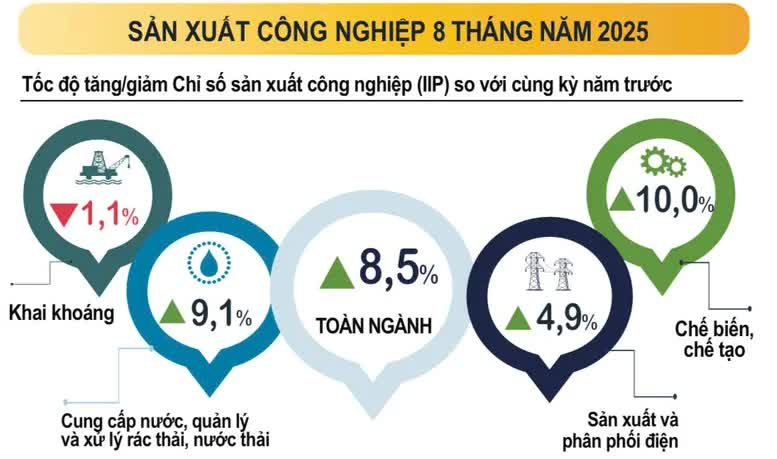

The processing and manufacturing sector surged by 10.0% year-on-year (compared to a 9.5% increase in the same period in 2024), contributing 8.1 percentage points to the overall growth. Water supply, waste management, and wastewater treatment activities increased by 9.1% (up from 9.2% in 2024), contributing 0.1 percentage points, while electricity production and distribution rose by 4.9% (an improvement from 11.7% in 2024) adding 0.5 percentage points to the total.

The IIP for several key secondary industries increased compared to the previous year. Specifically, motor vehicle production soared by 27.4%, rubber and plastic product manufacturing rose by 17.5%, and non-metallic mineral product manufacturing expanded by 15.0%. Additionally, garment manufacturing increased by 13.9%, and leather and related product manufacturing grew by 13.4%.

On the other hand, some industries showed lower or negative growth: Hard coal and brown coal mining increased by 3.9%, beverage production rose by only 2.6%, and crude oil and natural gas extraction declined by 5.5%.

Notably, the IIP rose in all 34 localities. Several regions achieved significant growth, thanks to robust performance in the processing and manufacturing industries, as well as electricity production and distribution.

From the beginning of the year until now, several key industrial products have shown growth compared to the same period last year, including: Automobiles (up 59.6%), televisions (up 21.4%), NPK compound fertilizers (up 17.9%), ready-to-wear garments (up 14.7%), cement (up 14.6%), and leather shoes (up 13.9%).

In August alone, the IIP is estimated to have increased by 2.2% compared to the previous month and by 8.9% compared to the same month last year. The processing and manufacturing sector led the way with a 9.5% increase, followed by mining at 9.1% and electricity production and distribution at 6.1%.

As of August 1, the number of employees in industrial enterprises rose by 0.9% compared to the previous month and by 4.7% compared to the same period last year.

“The $100 Aircraft-Grade Fastener Conundrum: Why Vietnam’s Manufacturing Sector is Yet to Take Off.”

“Vietnam’s current focus on manufacturing neglects the crucial need to invest in infrastructure and technology. Without a shift in focus, we risk remaining confined to low-end segments and missing out on global supply chains. A telling example is the country’s inability to produce a $100 bolt used in commercial aircraft wheels, highlighting the urgent need for a strategic rethink to elevate our position in the global market.”

Trade Minister: 2025 Trade Volume Set to Break Records

Let me know if you would like me to tweak it further or provide additional ideas!

The Ministry of Industry and Trade forecasts a remarkable milestone for Vietnam’s trade this year, with expectations of reaching a record-breaking $800 billion in import and export turnover. This unprecedented achievement surpasses the $786 billion mark set in 2024, showcasing the country’s thriving economic landscape and promising future prospects.

Title: Experts: The Financial Clout and Contributions of Private Enterprises Have Far Surpassed the “Start-up” or “Complementary” Stages.

“The growing presence of private sector involvement in government budgets is indicative of a maturing Vietnamese economy, where resources are allocated in a more multi-pillar and balanced fashion.” – Mr. Phan Vu Hoang, Deputy General Director of Tax and Legal Advisory Services at Deloitte Vietnam, commented on the recently released PRIVATE 100 list by CafeF.

“The Benefits of Registering for a 17% Tax Rate: Why It’s a Smart Move for Your Business”

The Ministry of Finance has recently submitted to the Ministry of Justice a dossier for appraisal of the Personal Income Tax Law (amended). This latest draft features several significant changes, most notably the introduction of a mechanism to calculate taxes on income and apply a 17% tax rate for households and individuals with business revenues exceeding the prescribed threshold.