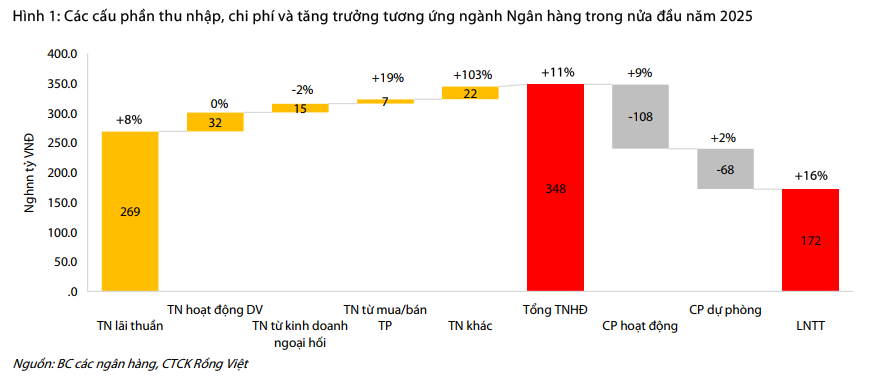

Pre-tax profits up 17% year-on-year

Pre-tax profits of 27 listed banks in Q2 2025 reached nearly VND 89 trillion, up 17% year-on-year (YOY), thanks to strong credit growth, positive bad debt recovery, and stable credit costs. Accumulated in the first six months of 2025, the pre-tax profit of these banks reached VND 172 trillion, up 16% and completing 49% of the pre-tax profit plan for the whole year.

The main growth driver for revenue (+11% YoY) continues to come from net interest income (+8% YoY) and other income (+103% YoY). For net interest income, credit growth since the beginning of the year reached 20.3%, equivalent to a 10% increase, while NIM (12-month sliding) decreased by 0.25 percentage points to 3.2%. Other income saw outstanding growth thanks to income from the recovery of off-balance sheet bad debts (risk-handled) – reaching nearly VND 20 trillion, up 57% YoY.

In terms of expenses, operating expenses (+9% YoY) increased at a slower pace than total operating income, and credit risk provisions remained unchanged from the same period (+2% YoY), consolidating the growth of pre-tax profit in the first half of 2025.

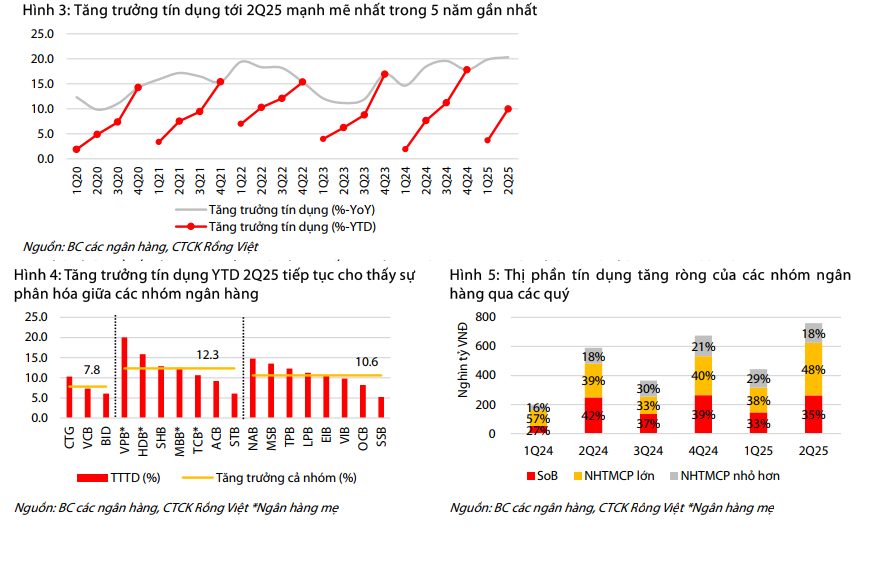

Q2 2025 credit growth strongest in five years

Regarding credit, the credit growth since the beginning of the year of listed banks by the end of Q2 reached 10.0%, recording a positive growth rate in the past five years and equivalent to that of 2022. With this result, the banking industry completed about 62% of the State Bank’s credit growth target of 16% set for the year.

The gap in credit growth rates continued to widen between groups of banks. While the group of large joint-stock commercial banks grew by 12.3% YTD, led by the outstanding growth of VPBank, HDBank, and SHB, the group of state-owned banks grew by about 7.8%, as the listed bank with the largest scale, BIDV, continued to grow cautiously (as of June 30, up 6.1%). This helped large joint-stock commercial banks account for 48% of new credit market share in the second quarter, compared to a market share of 35% for the state-owned bank group.

Term credit in Q2 recorded more balanced growth compared to Q1/2025, with a positive recovery in medium and long-term loan demand. This was supported by positive developments in consumer loan demand and real estate purchases by individual customers, which have regained growth momentum with an increase of nearly 10% YTD (data of the 10 largest commercial banks) and higher than the 6% of the same period last year.

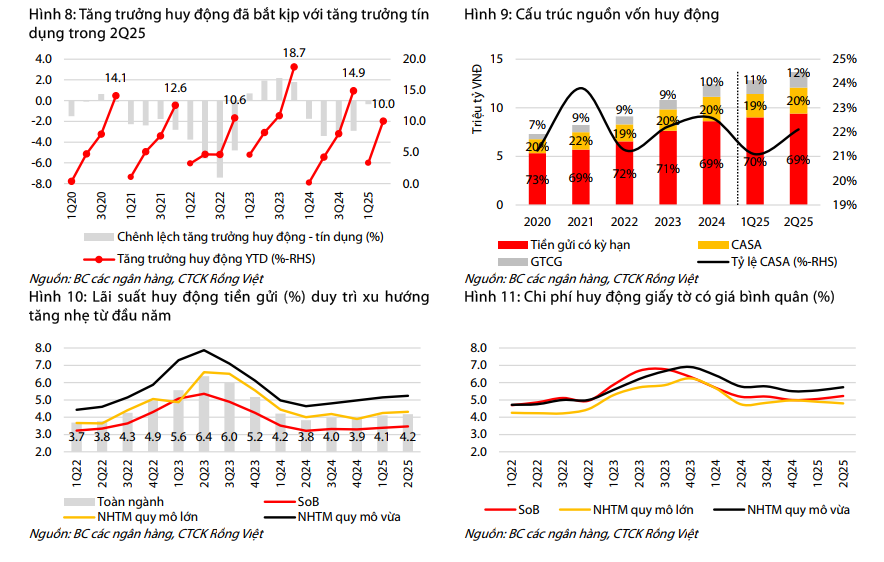

In terms of capital mobilization structure, banks continued to promote capital mobilization through the issuances channel with mobilization growth reaching 25.0% YTD, bringing the proportion of issuances in the capital structure to 11.9% (10.3% in 2024 and 11.1% in Q1/2025), while deposit mobilization increased by 8.3% YTD.

According to VDSC, the focus on issuances in this quarter continues to reflect the increasing demand for automatic profit models, in which depositors will invest in banks’ short-term certificates of deposit to enjoy higher interest rates than non-term deposits (CASA) while still having flexibility in capital. In addition, the trend of increasing issuances with terms of more than one year also shows the intention to control stable capital costs in the medium term, before credit growth puts pressure on interest rates in the coming time.

Regarding customer deposits, the CASA ratio in Q2/2025 improved by 1 percentage point from the previous quarter to 22.1%. However, the average capital mobilization cost of the industry continued to increase by nearly 0.1 percentage points to 4.2%, implying that savings interest rates in the market continued to inch up slightly before strong credit growth. This trend brought the change in average capital mobilization cost in the first half of the year to nearly 0.3 percentage points.

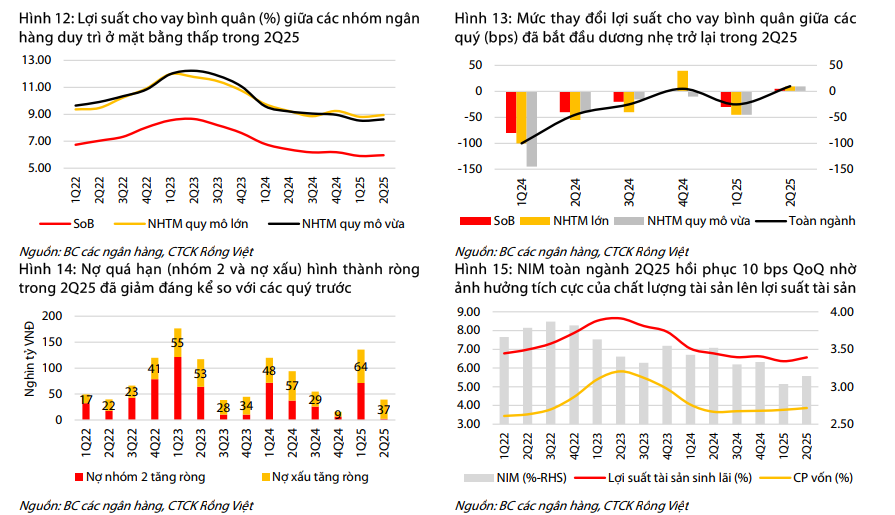

NIM recovered in Q2/2025

The industry’s NIM in Q2/2025 increased by 0.1 percentage points from Q1/2025 to 3.15%, but was still lower than the same period last year by about 0.4 percentage points. This development was driven by a marked improvement in the asset quality of the entire industry, with net formed non-performing loans (NPLs, including Group 2 and bad debts) decreasing sharply compared to the previous quarters. This helped banks significantly reduce the amount of expected credit losses in Q2/2025 and increase the loan yield (Q) and average yield on earning assets (Q) by 0.1 percentage points and 0.2 percentage points, respectively, compared to the previous quarter. This, combined with only a 0.1 percentage point increase in capital costs, helped improve the industry’s NIM slightly in Q2/2025.

VDSC believes that NIM likely bottomed out in Q1/2025, which was pressured by write-offs and competitive output interest rates, and expects a slight improvement in the second half. The drivers for NIM include: (1) more favorable medium and long-term loan demand from the economy, combined with healthy asset quality prospects, will help improve the yield on earning assets; (2) Abundant disbursement of public investment capital from now until the end of the year (estimated at over VND 500 trillion) and the reduction of the reserve ratio for four commercial banks participating in the compulsory transfer of weak banks from Q4/2025 (estimated at nearly VND 40 trillion) will help ease liquidity pressure in the market and stabilize deposit interest rates.

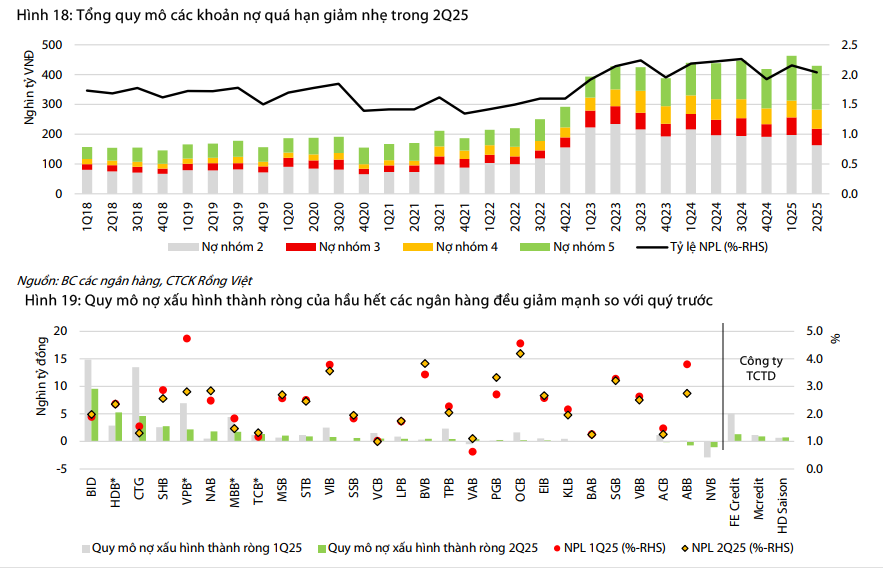

Group 2 loans decreased significantly, bad debts tended to increase slowly

The scale of net formed Group 2 loans and bad debts decreased significantly in Q2 in terms of the whole industry as well as individual banks, except for a few banks such as HDBank, NamABank, and MSB. This reflects a positive improvement in the repayment capacity of borrowing customers on a large scale. Combined with the risk handling activities of the banks (VND 35.5 trillion in Q2/2025), the industry’s on-balance sheet bad debts increased by only VND 2 trillion compared to the previous quarter, and the bad debt ratio of the industry decreased by 0.12 percentage points to 2.04%.

In the context of a slow increase in bad debts, banks also proactively controlled provisioning costs at VND 37 trillion, equivalent to net formed bad debts in the period and up 5% YoY. As a result, the bad debt coverage ratio remained unchanged from the previous quarter at 91%.

Bad debt recovery activities also progressed favorably and were in line with the real estate market developments, recording nearly VND 12 trillion in income (up 52% QoQ and 37% YoY).

What’s Affecting Interest Rates?

In a thriving economic landscape, with surging credit growth and intense competition for funds, banks are offering varying lending rates. Experts predict a slight upward trend in interest rates by the end of 2025, creating a diverse landscape for borrowers.

The Year-End Credit Sprint: Optimistic Expectations, Quality Assurance Needed

As we move into the final quarter of 2025, a surge in credit is expected, potentially surpassing the annual target set by the State Bank of Vietnam. This presents both opportunities and challenges for the financial and banking system. Experts emphasize the critical need to direct credit to the right sectors, primarily production and business, while effectively managing risks to ensure sustainable development.

The Vietnamese Stock Market: On the Verge of a Golden Growth Cycle

The VN-Index is surging towards the 1,700-point mark, accompanied by record-high market liquidity, with many sessions reaching 70,000 to 80,000 billion VND. This remarkable performance reflects investors’ strong confidence and the allure of the stock market, especially in the context of low-interest rates and tightened speculative real estate investments.