Each TCB employee brings in the most net profit, while VCB falls to fifth place

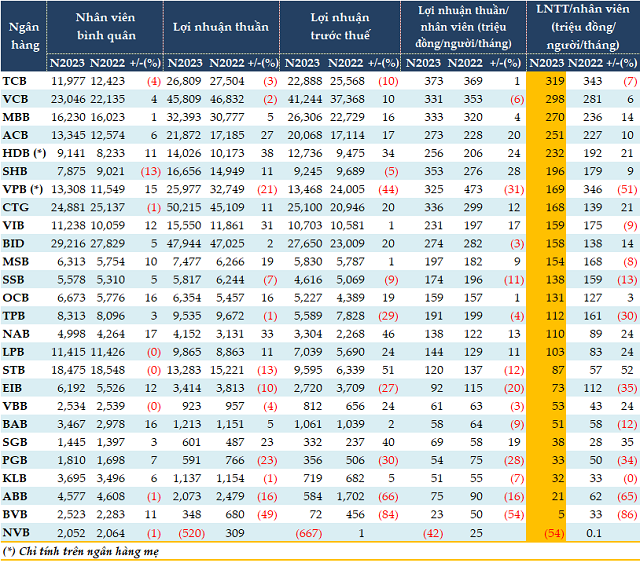

In 2023, 12 out of 26 banks recorded a decrease in net profit compared to the previous year, with an average decrease of 12% and one bank reporting a loss.

The remaining banks grew at an average rate of 18%. The strongest growth was HDBank (HDB, +38%) with a profit of 14,026 billion VND, although this is only calculated on the parent bank. Next are NAB (+33%), VIB (+31%), ACB (+27%)…

In terms of absolute value, the leading group is the state-owned banks with advantages in scale. The top three in the system are VietinBank (CTG, 50,215 billion VND), BIDV (BID, 47,944 billion VND), and Vietcombank (VCB, 45,809 billion VND).

MB tops the private bank group with 32,393 billion VND, although this net profit only increased by 5% compared to the previous year. Next are Techcombank (TCB) with a profit of 26,809 billion VND and VPBank (VPB) with 25,977 billion VND, only calculated on the parent bank.

Source: VietstockFinance

|

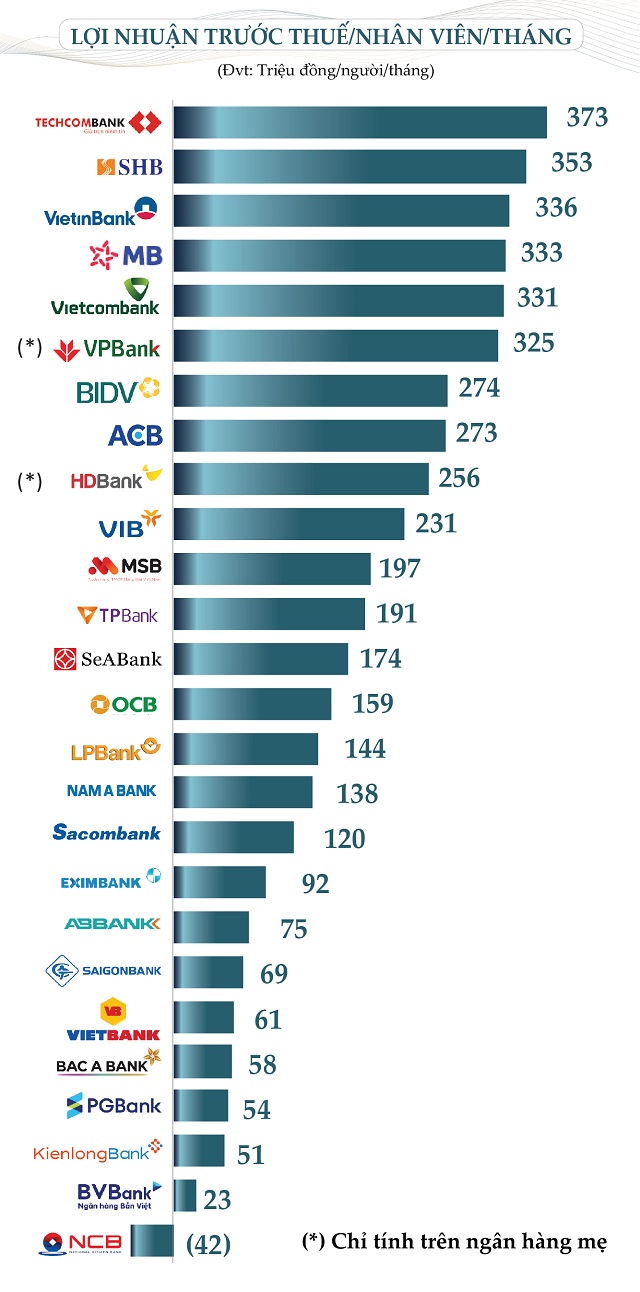

Considering the net profit per employee, 14 out of 26 banks experienced a decrease compared to the previous year.

Despite a 4% decrease in average personnel scale, the growth in net profit has made TCB the most productive bank of the year, with each staff member bringing in 373 million VND/month; a slight increase of 1% compared to the previous year.

The second position belongs to SHB employees, who bring in 353 million VND/month, followed by VietinBank employees with 336 million VND/month. The fourth position is MB (333 million VND/month), pushing VCB (331 million VND/month) down to fifth place.

Which bank employees are the most productive?

In 2023, 9 out of 26 banks experienced a decrease in pre-tax profit with a decrease rate of 34% and one bank reporting a loss. Meanwhile, the remaining banks had an average growth rate of 21% in pre-tax profit.

Sacombank (STB) had the highest growth rate at 51%, followed by NAB (+46%) and SGB (+40%).

Source: VietstockFinance

|

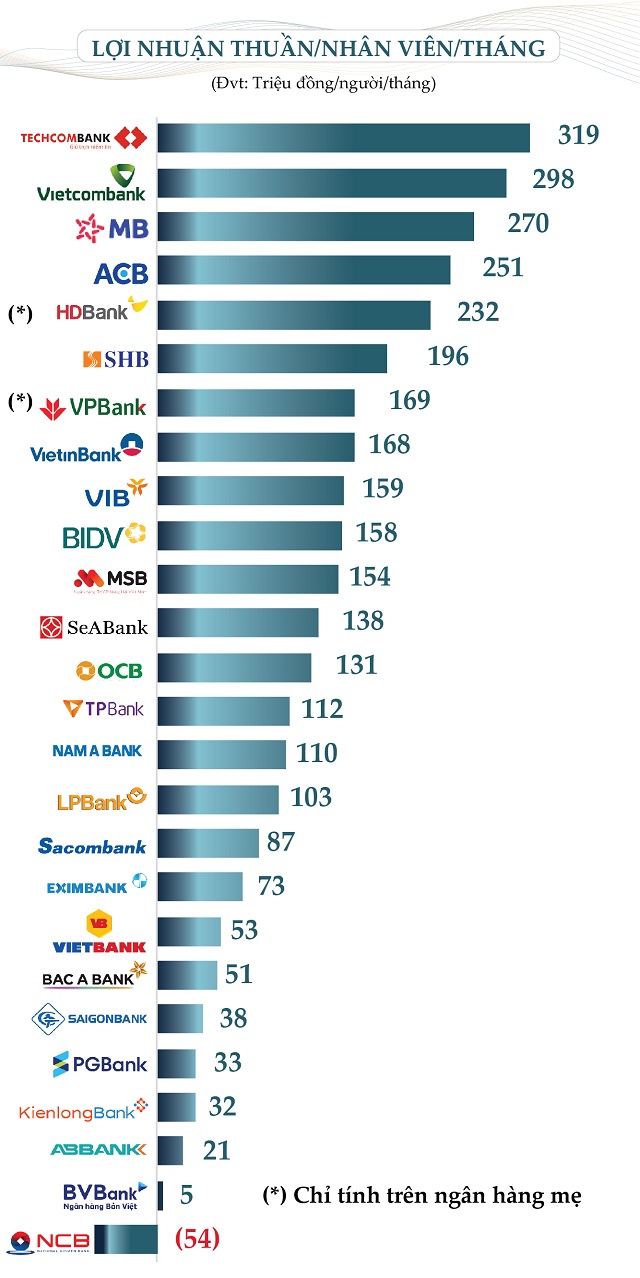

In terms of pre-tax profit efficiency, 13 banks experienced a decrease compared to the previous year.

TCB leads the way in efficiency, with each employee bringing in 319 million VND/month, although this is a 7% decrease compared to the previous year.

Vietcombank holds the second position, with each employee bringing in 298 million VND/month. The third position belongs to MB employees (270 million VND/month), followed by ACB (251 million VND/month) and HDBank (HDB, 232 million VND/month) in fifth place.

Employees of the banks who bring in between 100 and below 200 million VND/month include SHB, VPB, CTG, VIB, BID, MSB, SBB, OCB, TPB, NAB, and LPB.

|

Comparison of work efficiency in banks in 2023 (Unit: Billion VND)

Source: VietstockFinance

|