Some Banks Increase Lending Rates

The State Bank of Vietnam has recently released data on interest rate movements among credit institutions in July, revealing a stable interest rate environment with distinct trends in both deposits and lending.

In terms of deposits, Vietnamese Dong (VND) interest rates at commercial banks mostly ranged from 0.1-0.2%/year for non-term and less than 1-month term deposits; 3.3-4.0%/year for 1 to less than 6-month term deposits; and 4.6-5.5%/year for 6 to 12-month term deposits. For deposits over 12 months to 24 months, interest rates stood at 4.9-6.1%/year, while those above 24 months fluctuated between 6.9-7.3%/year.

While 12-month deposit rates remain below 6%/year at most banks, the slight upward trend in deposit rates recently will have a ripple effect on lending rates.

A majority of commercial banks have disclosed their average lending rates for July, with some institutions increasing their rates compared to June, the highest increase being 0.42%/year.

Lending rates are on an upward trend.

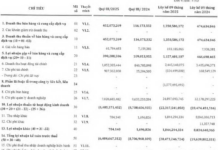

Banks that increased their average lending rates in July compared to June include: PGBank (up by 0.42%/year) to 7.52%/year, Sacombank (up by 0.32%/year) to 7.25%/year, BVBank (up by 0.18%/year) to 8.82%/year, OCB (up by 0.14%/year) to 7.86%/year, MB (up by 0.02%/year) to 6.95%/year, and SCB (up by 0.01%/year) to 5.4%/year.

Conversely, the average lending rates at the four state-owned banks continued to witness a slight decrease and remained the lowest in the system. Specifically, Vietcombank’s rate was 5.6%/year, a decrease of 0.34%/year from June; BIDV’s rate was 5.49%/year, a slight drop of 0.01%/year; Agribank’s rate was 6.5%/year, also down by 0.01%/year; and VietinBank’s rate stood at 5.22%/year.

Smaller-scale banks exhibited relatively higher average lending rates, surpassing 8%/year: Saigonbank (8.9%/year), Bac A Bank (8.61%), BVBank (8.57%/year), Viet A Bank (8.52%), PVCombank (8.29%/year), and KienlongBank (8.17%/year).

Forecast of Rising Lending Rates

Analysts from MSB Securities Company predict that by the fourth quarter, deposit rates may edge slightly higher as credit growth tends to surge towards the year-end, coinciding with the peak business season. Consequently, they anticipate that 12-month deposit rates at large commercial banks will hover around 4.7%/year.

In addition to endogenous factors influencing deposit activities, exchange rate pressures and the risk of rising inflation also impact lending rates.

“We estimate that credit growth will outpace deposit growth by approximately 1.3-1.5 times. This has, to some extent, exerted pressure on deposit rates at private commercial banks as they strive to attract deposits,” remarked the MBS analyst.

Financial and banking expert Nguyen Tri Hieu shared his perspective, stating that from now until the end of the year, deposit rates are likely to continue their upward trajectory to attract more funds from the public. Consequently, lending rates may also increase. Moreover, when exchange rates rise, banks are compelled to consider adjustments to maintain the competitiveness of their credit offerings. Thus, tweaking lending rates becomes a tool to balance the pressures from the monetary market and the goal of sustaining credit growth.

Mr. Hieu added that while lending rates might rise, they are unlikely to surge significantly, given the government’s and State Bank’s directives for banks to strive to reduce costs and, subsequently, lending rates.

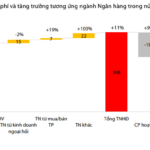

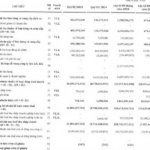

The Evolution of Banking in Q2 2025: A Comprehensive Overview

The recently released investment banking report by Rong Viet Securities (VDSC) offers intriguing insights into the industry’s performance in Q2 2025. This comprehensive report paints a detailed picture of the sector’s health, providing valuable information for investors and industry stakeholders alike.

The Time to Adjust: Mastering the Art of Bank Interest Rate Changes

The central bank stated that when inflation rises, it increases interest rates to curb inflation. Conversely, when inflation is under control and aligns with the set targets, the central bank reduces interest rates to stimulate economic growth.

“Claim Exclusive Gifts and Government Welfare with Your OCB Account on VNeID”

“In a bid to offer an enhanced and seamless experience to its customers, Orient Commercial Joint Stock Bank (OCB) has collaborated with the Research and Application Center for Population Database and Civil Status (RAR) under the Ministry of Public Security. Together, they have introduced a groundbreaking initiative – a linked payment account service. This service enables individuals to directly receive social security payments and government support credits via the VNeID application. This innovative move underscores OCB’s commitment to ensuring its customers can readily access and benefit from the government’s welfare initiatives and policies.”