Palace Saigon Hotel.

Trading below cost, auditor refuses to give opinion

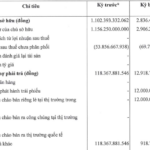

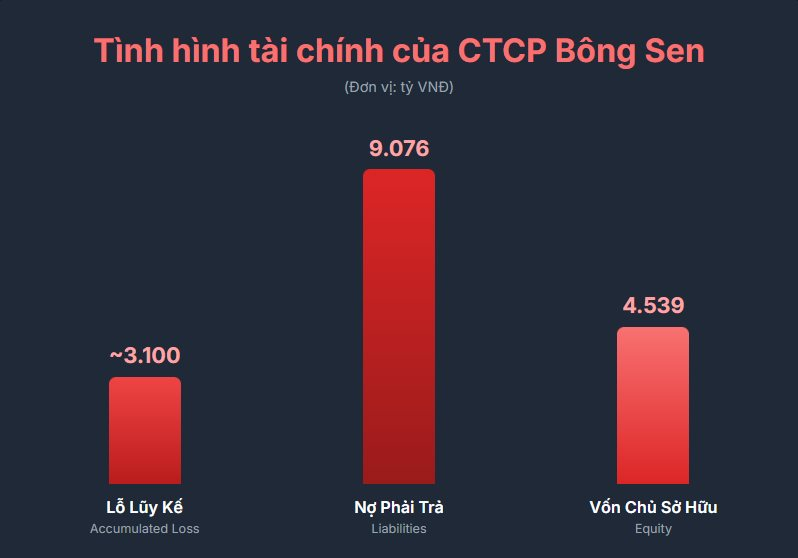

According to the consolidated financial statements submitted to the Hanoi Stock Exchange (HNX), Bong Sen continues to record a period of trading below cost, with a post-tax loss of nearly

VND 356 billion

in the first half of 2025. This result has increased the company’s total accumulated loss as of June 30, 2025, to nearly

VND 3,100 billion.

While owner’s equity has been eroded, decreasing to only

VND 4,539.3 billion

, total liabilities have increased by nearly 9% to

VND 9,076 billion.

The auditing firm (A&C)

refused to give an opinion

on Bong Sen’s financial statements. The reason given was the “inability to obtain sufficient appropriate audit evidence,” which raises questions about the transparency and reliability of the financial figures published by the company.

Bong Sen’s situation becomes particularly serious due to legal issues. The main burden of debt is the single outstanding bond

BSENCH2126003

with a balance of

VND 4,800 billion.

The company explained that the direct cause of the inability to pay was the

freezing of all bank accounts

to facilitate the investigation of the Van Thinh Phat case.

The sudden “freeze” on cash flow has paralyzed Bong Sen’s financial activities, making it impossible to fulfill basic payment obligations, including interest due in June 2025. This is not the first time the company has missed a payment to bondholders, as the 2024 interest payment could not be made for similar reasons. It is understood that this bond will mature in October 2026 and has a very high-interest rate of 15.75% per annum.

The irony of owning prime real estate and the court’s resolution

93-95-97 Dong Khoi, District 1, Ho Chi Minh City

Despite poor financial performance, Bong Sen owns a series of prime real estate in the heart of District 1, Ho Chi Minh City. Notable properties include: 55-56 Nguyen Hue (Palace Saigon Hotel), 117-123 Dong Khoi (Bong Sen Saigon Hotel and headquarters), 61-63 Hai Ba Trung (Palace Saigon Hotel), 5 Nguyen Thiep, 93-95-97 Dong Khoi, and 24-24 Dong Du.

Bong Sen Hotel at 117 – 123 Dong Khoi, District 1, Ho Chi Minh City.

During the trial of the Van Thinh Phat case, the Court determined that all of these properties are related assets that need to be handled to remedy the consequences. Accordingly, these prime assets will be prioritized for execution and compensation to the victims under the strict supervision of the authorities.

Bong Sen Corp was once a member of Saigontourist Holding Company with a chartered capital of VND 130 billion. The company underwent privatization in January 2005 and subsequently carried out several capital increases, reducing state ownership to a low level.

After the change of ownership, the company made a resounding acquisition of Daeha JSC (owner of Daewoo Hotel, 360 Kim Ma, Ba Dinh, Hanoi) by spending thousands of billions of dong to own 51.05% of the shares in this company.

At the trial in mid-March 2024, Ms. Truong My Lan confirmed that Bong Sen Corp belongs to her family and holds 93.6% of the shares in Daewoo Hotel Hanoi. Ms. Lan offered to sell this hotel to pay for the consequences of the case.

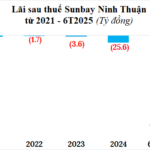

“Sunbay Ninh Thuận: A Troubled Resort’s Financial Woes Persist with a Staggering First-Half Loss of VND 290 Billion”

The first half of 2025 saw Sunbay Ninh Thuan JSC (SBPC) plunge into a staggering loss of nearly VND 290 billion, marking yet another period of relentless losses for the company. This persistent streak of unprofitability dates back to 2021 when the enterprise first started disclosing its financial reports on HNX, and profitability remains elusive.

Former Vice Head of the National Assembly’s Office, Pham Thai Ha, Appears in Court Over Thuân An Case

Former head of the National Assembly Office Pham Thai Ha has been accused of abusing his position to introduce and influence opportunities for Thuan An Group to participate in bidding and construction project implementation.

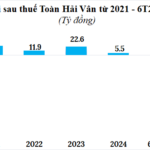

“Devastating Losses for TTC Phu Quoc: A Grueling First Half with a Staggering $150 Million Deficit, Erasing Four Years’ Worth of Profits”

The first half of 2025 saw a surprising turn of events for Toàn Hải Vân (TTC Phú Quốc, THVC), as the company reported a record loss of nearly VND 150 billion. This stark contrast to the previous year’s profits of VND 21 billion during the same period wiped out the cumulative gains of the four years from 2021 to 2024, which totaled just under VND 64 billion.

The Great Heist: Uncovering the Latest Scheme to Swindle Your Bank

“To protect themselves from financial loss and identity theft, it is imperative that bank customers remain vigilant. With the ever-present threat of cybercrime, being cautious and aware is the best defense against potential online dangers.”