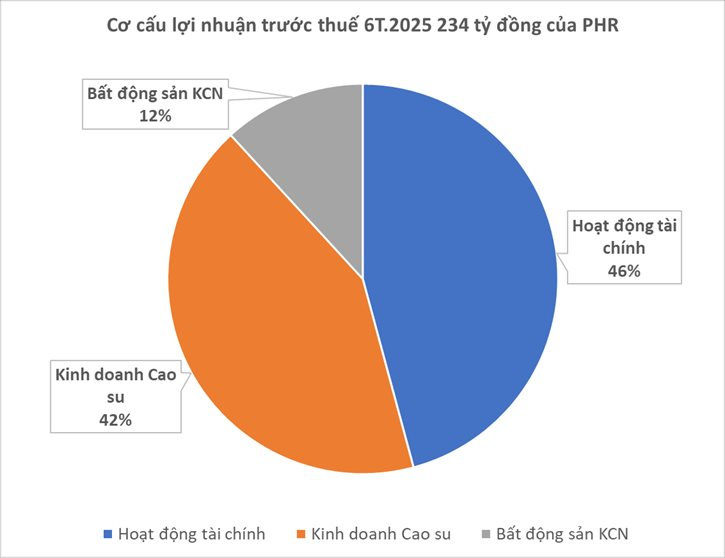

The consolidated financial report for the first half of 2025 from PHR showed a remarkable 32.7% year-on-year increase in post-tax profits, reaching VND 197.45 billion. This positive performance has been a contributing factor to the upward trajectory of PHR stock, which has surged by over 40% in the past three months.

The primary growth driver for the first half was the core business of rubber, with a VND 69.16 billion year-on-year increase in revenue from rubber products. The direct factor behind this achievement was the sustained high selling price, reaching VND 50 million/ton by the end of June 2025, a significant improvement from the VND 40.95 million/ton in the first half of 2024. The favorable price level expanded the company’s overall gross profit margin, resulting in a six-month gross profit of VND 201.5 billion, up by 55%.

With VND 1,651.4 billion in short-term term deposits, PHR earned VND 48.4 billion in interest income during the first half. Additionally, the investment in the associated company, Nam Tan Uyen Industrial Park (NTC), continued to contribute VND 55.4 billion to the profits. Combined, the financial activities generated over VND 103 billion, accounting for more than half of the company’s post-tax profits for the period.

The third piece of the puzzle, and a growth engine for the future, is industrial real estate. Despite being a newly initiated venture, this segment has already demonstrated its potential with a one-time infrastructure lease revenue of VND 14.48 billion.

However, the main attraction of PHR in the eyes of investors lies not only in its current performance but also in its potential to realize significant windfall profits from land conversion. PHR’s role in mega-projects is to hand over cleared land and receive compensation, thus “materializing” the value of its vast land bank into profits. History has proven the ability of this revenue stream to create windfalls. In 2022, PHR recorded VND 408.8 billion from land compensation for the VSIP III Industrial Park, with “Other Income” accounting for a substantial 28.8% of that year’s total net revenue.

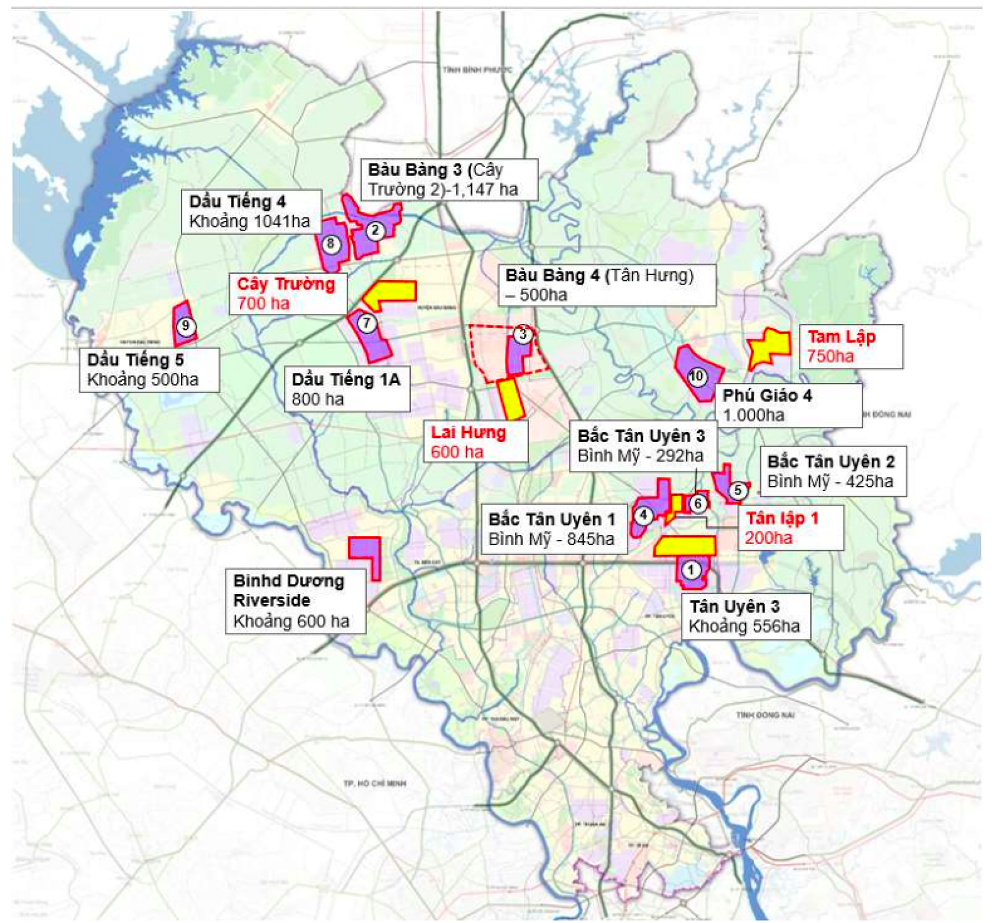

Analyst reports from securities companies highlight the anticipated land compensation for PHR from the large-scale project Bac Tan Uyen 1 Industrial Park. This is not just an ordinary industrial park but a new-generation industrial hub, strategically invested in by Thaco. With a total investment of over VND 75,000 billion (approximately USD 3 billion) across nearly 786 hectares, Thaco aims to establish a modern industrial ecosystem for mechanics and support industries, integrating smart technology and automation. The project is envisioned to become a leading industrial center, comprising specialized zones for mechanical manufacturing, research and development, and supporting industries, promising to reshape the southern region’s supply chain.

Location of additional industrial parks to be invested in during 2031 – 2050 in Binh Duong province – now Ho Chi Minh City

VCBS estimates that PHR could consistently record VND 200-250 billion/year from land compensation.

Panorama of Bac Tan Uyen commune, taken by Do Truong for Thanh Nien newspaper

PHR manages an extensive land bank, including over 16,500 hectares in Binh Duong, nearly 1,000 hectares in Dak Lak, and almost 9,800 hectares in Cambodia. Approximately 5,000 hectares of this land are earmarked for conversion into industrial parks.

The Real Estate Market: A Wealth of Opportunities.

As of Q2 2025, real estate inventory levels climbed to new heights, with many businesses burdened by massive work-in-progress assets, accounting for up to 85% of their total holdings in some cases. This paints a picture of mounting pressure on companies to alleviate this mounting inventory conundrum.

“Real Estate Tycoon with Thousands of Hectares of Land, Dang Thanh Tam, Flourishes with Trump International Hung Yen Development”

The urban development giant, Kinh Bac, is projected to reach staggering figures in revenue and profit for the year 2025. According to a securities analysis by DSC, the corporation is estimated to attain a revenue of VND 6,213 billion and a profit of VND 2,054 billion. This impressive performance is attributed to the strategic launch and sale of real estate projects, which have injected significant capital into the company’s coffers.

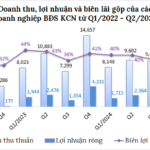

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.