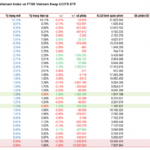

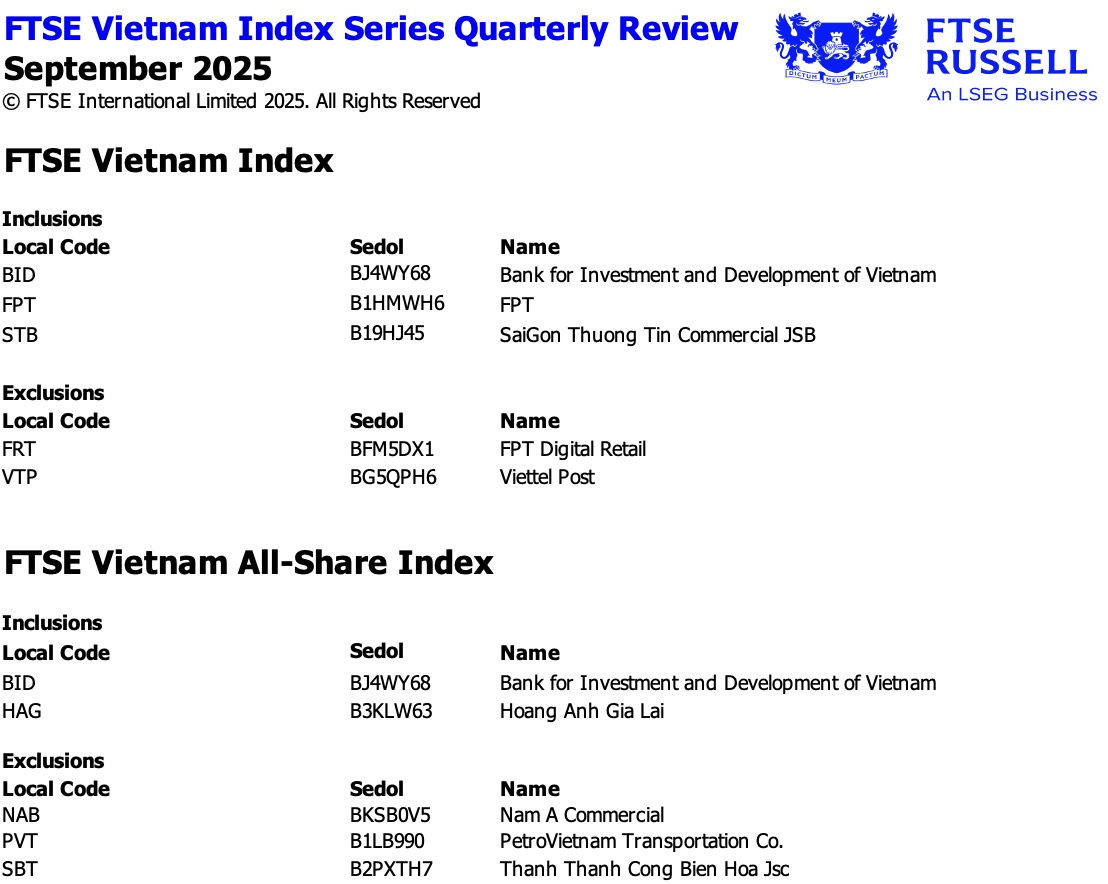

The FTSE Vietnam Index has announced changes to its constituents, with the addition of three stocks: BID, FPT, and STB. Conversely, FRT and VTP will be removed from the index.

BID is one of two stocks added to the FTSE Vietnam All-Share Index, alongside HAG. Meanwhile, the All-Share Index will remove NAB, PVT, and SBT.

The new constituents will take effect after the market closes on Friday (September 26) and will be officially traded from the following Monday (September 29).

In a notable development, the FTSE Vietnam Index is no longer the reference index for the FTSE Vietnam ETF (FTSE ETF).

According to asset management company DWS, the $352 million FTSE ETF will be renamed “Xtrackers Vietnam Swap UCITS ETF,” and its reference index will change from the FTSE Vietnam Index to the STOXX Vietnam Total Market Liquid.

FTSE ETF Renames and Changes Reference Index: Potential Impact on FPT and SHB

The STOXX Vietnam Total Market Liquid index will undergo periodic reviews in March and September each year. According to DWS, this change aims to improve liquidity compared to the previous index. The transition period extends from July 17 to October 16, during which the portfolio may be gradually restructured through swap transactions on both indexes.

On September 13, MarketVector will announce the constituents of the MarketVector Vietnam Local Index, the reference index for the VNM ETF.

– 06:53 09/06/2025

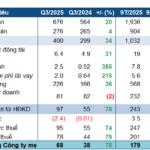

What Stocks Will the Two Foreign ETFs Sell Off in the Q3 Review?

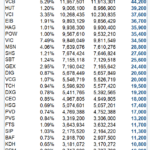

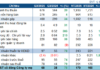

According to forecasts by Yuanta Securities Vietnam (YSVN), the FTSE and VNM ETFs are expected to actively purchase FPT and SHB stocks while offloading HPG, SSI, and VND stocks during their third-quarter 2025 review.

The Two Large-Scale ETFs Gear Up to Purchase Tens of Millions of Shares in the Securities Group

Two large-scale ETFs, comprising of diverse stocks such as VIX and VCI, are set to make a significant impact on the market. With a combined worth of tens of millions of shares, these ETFs are poised to offer a unique opportunity for investors seeking exposure to a wide range of industries and sectors.