Abundance of Positive News for Modern Retail Sector

In its latest retail industry report,

MBS Securities (MBS)

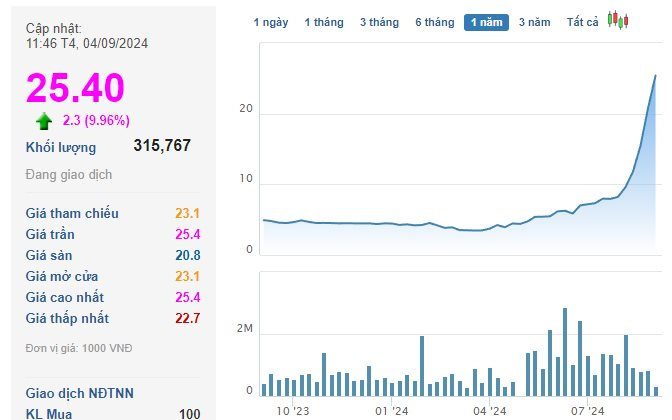

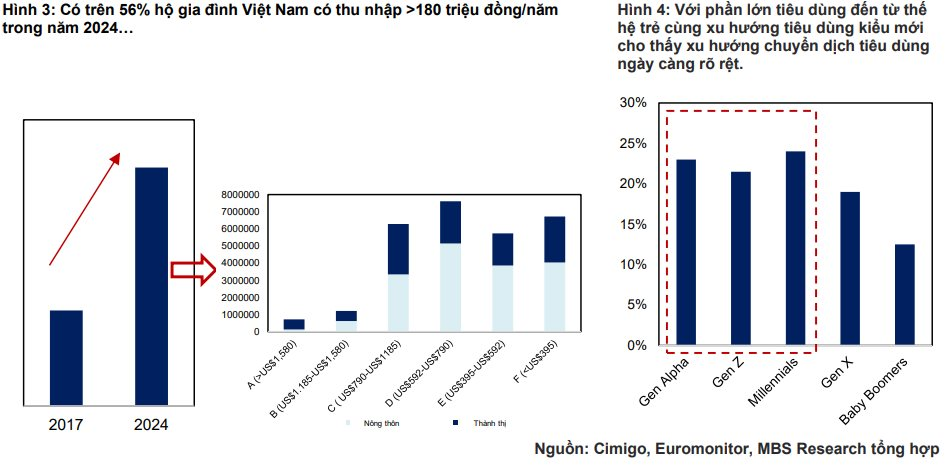

asserts that the modern retail market is increasingly benefiting from government policies. From the beginning of 2025, a series of supportive measures have been implemented to standardize the retail landscape. These include changes in tax policies for businesses with annual revenues exceeding VND 1 billion, cracking down on counterfeit and unclear-origin goods, and Decree 68 on private economic development, along with modifications in tax calculation methods.

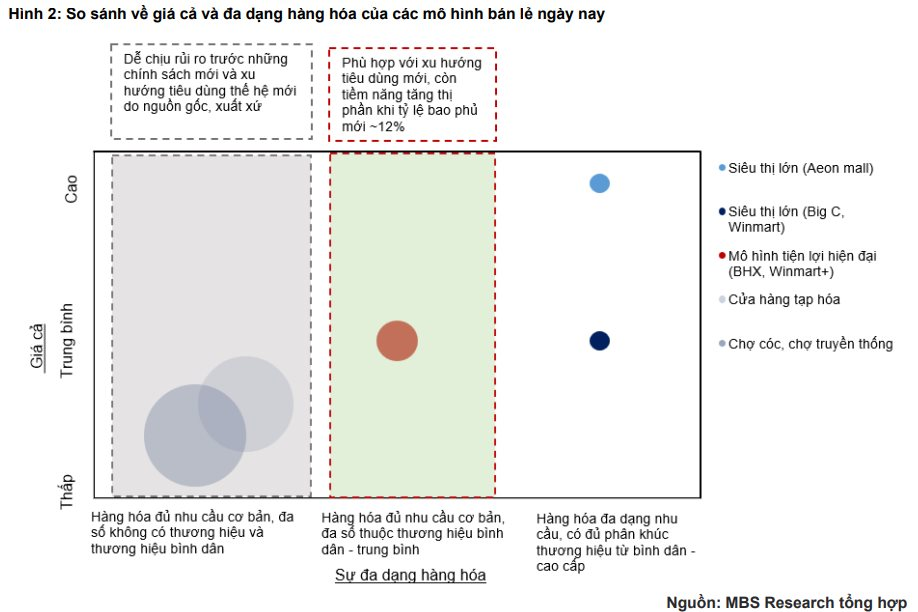

MBS believes that these moves will create a fair and transparent retail market, enhancing the competitiveness of modern retail chains compared to their previous position, as modern retailers already incur higher costs due to their adherence to product transparency and full tax compliance.

Additionally, the decision by Hanoi authorities to completely eliminate temporary and makeshift markets in 2025 is another positive factor for modern retail chains. Hanoi’s recent approval of document No. 4373/UBND-KT on implementing the City Council’s resolution to definitively handle unplanned markets, spontaneous trading locations, and small-scale livestock and poultry slaughtering activities further reinforces this positive development.

Consequently, modern grocery/mini-market models, which are already widespread in both rural and urban areas, stand to gain from these policy changes.

On another note, e-commerce platforms are entering a phase of consolidation. Average fees on these platforms increased by 5-10% svck in 2025, placing a significant cost burden on sellers, especially small-scale ones. In addition to fixed fees per order, sellers need to allocate additional expenses for affiliate marketing and advertising to boost their sales, resulting in total selling costs of approximately 20-25% on average (excluding labor, office, and other overhead costs).

Following a period of robust growth, e-commerce platforms are tightening their rules, including (1) increasing selling fees and (2) directly collecting VAT and personal income tax for successful orders.

According to MBS, the development of e-commerce laws to specify conditions, including tightening product origins, presents an opportunity for transparent businesses. This move favors domestically produced goods, creating competitive pressure on smuggled goods, undocumented products, counterfeits, and substandard items.

Which Businesses Will Benefit?

MBS analysts suggest that standardizing the retail market, including the e-commerce space, and eliminating temporary and makeshift markets will create a level playing field and enhance the competitiveness of modern retail chains that have already embraced transparent management practices.

In their retail investment strategy, MBS focuses on companies with attractive valuations and high growth rates, notably Mobile World Investment Corporation (ticker: MWG) and Masan Group (ticker: MSN).

For

Mobile World

, MBS estimates net profits for 2025 and 2026 to reach VND 5,807 billion and VND 6,663 billion, respectively, reflecting increases of 57% and 15% year-over-year. This growth is attributed to regained market share and sales promotion programs, with the Mobile World and Dien May Xanh chains expected to achieve revenue growth of 14% in 2025 and 13% in 2026.

Bach Hoa Xanh, a subsidiary of Mobile World, is accelerating its expansion with the addition of 478 new stores, over 50% of which are located in new areas. With an average revenue of VND 1.8 billion per store per month, Bach Hoa Xanh is projected to increase its net profit by sixfold compared to the previous year.

Regarding

Masan Group

, MBS forecasts net profit growth of 44% and 40% for 2025 and 2026, respectively, driven mainly by the consumer goods (MCH) and retail (WCM) segments.

The consumer goods segment maintains double-digit growth, supported by increased consumption of Masan’s products, particularly through the WCM chain. WCM is expanding its store network after turning profitable, with expected growth rates of 14% in both 2025 and 2026. Looking ahead to 2026-2028, MSN anticipates the MCH segment’s move to the stock exchange and the potential IPO of WCM, which could lead to a revaluation of MSN with even more compelling narratives.

For consumer goods companies, the analysts believe that tightening rules on product origins will positively impact domestic producers such as VNM, MCH, and SAB.

“Courier Costs Cut: From 25,000 VND to 14,000 VND for Inner-City Deliveries, Says Proship Director”

The cost of shipping has decreased due to larger volumes of cargo and improved transportation infrastructure. This has led to a more efficient and cost-effective logistics system, making it more affordable to deliver goods to customers.

“Provincial Party Secretary of Tay Ninh Delivers Committing Speech at a Significant Conference”

With a thriving business landscape, Tay Ninh province boasts over 37,000 enterprises with a total registered capital of an impressive 912 trillion VND. In addition, the province is home to more than 3,000 domestic projects and nearly 1,900 FDI projects, showcasing its attractiveness to both local and foreign investors.

Crafting a Compelling and SEO-Friendly Headline: “Leveling the Playing Field: Amendments to the E-Commerce Law”

The proposed Electronic Trade Act is set to revolutionize the digital landscape, fostering a level playing field for businesses and empowering users with greater choice. This landmark legislation aims to create a fair and transparent environment, where online enterprises can thrive and consumers can make informed decisions. With a focus on regulating the industry, the act promises to shape a vibrant and competitive market, ensuring a win-win situation for all stakeholders involved.