SMC’s Future Plans

On September 8, SMC, a commercial investment company, provided explanations regarding its ability to continue operations, as highlighted in its audited semi-annual financial statements for 2025.

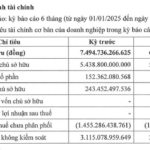

Specifically, the auditors emphasized that during the first half of 2025, SMC incurred a loss of over 102 billion VND, resulting in a cumulative loss of nearly 242 billion VND as of June 30, 2025. The company also experienced a negative cash flow from operating activities of 129 billion VND during the same period. As of June 30, 2025, short-term debt exceeded short-term assets by 972 billion VND, raising doubts about the company’s ability to continue as a going concern.

Addressing these concerns, SMC stated that its short-term debt as of June 30, 2025, amounted to 3,621 billion VND. The company expressed confidence in receiving support from its suppliers and individuals through debt repayment extensions.

Additionally, SMC is committed to decisively resolving outstanding debts, especially from customers associated with the Novaland group, within 2025. The company aims to maintain stable bank loans with optimized costs to ensure capital and efficiency for its business operations. Furthermore, SMC seeks long-term capital sources to compensate for short-term assets (difficult-to-collect receivables) occupied by customers.

Cost-control measures, production efficiency improvements, and working capital optimization are also being implemented by the company.

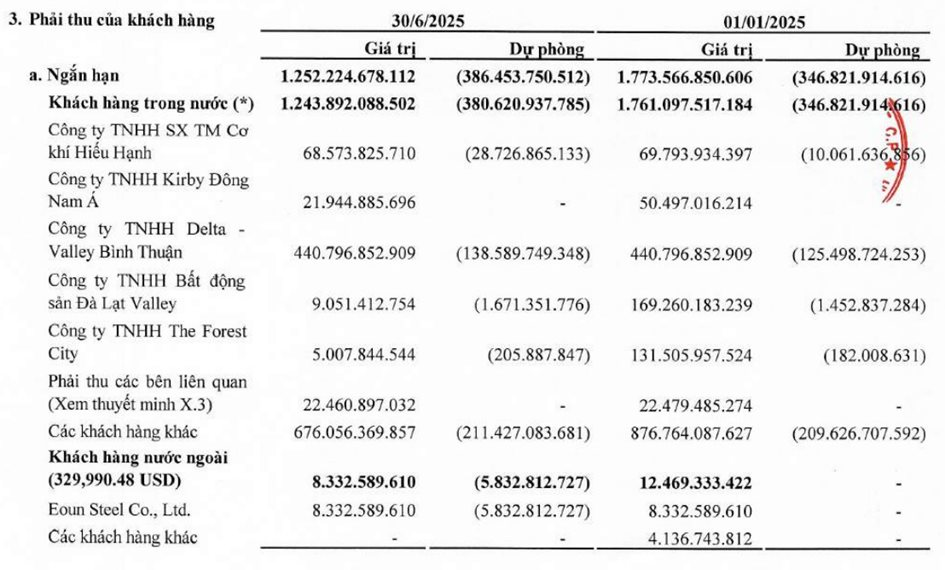

On December 20, 2024, SMC and Novagroup, along with its member companies, signed a debt acknowledgment and repayment commitment. In March and April 2025, SMC and the Novaland group entered into several contracts and agreements for the sale and purchase of real estate. Consequently, SMC recognized an increase in construction-in-progress expenses of 279 billion VND and made advance payments to sellers related to the purchase/long-term lease of real estate worth 156 billion VND to offset the group’s receivables.

Novaland Group’s Debt Reduction

According to the audited financial statements, the Novaland group’s debt to SMC (including Delta – Valley Binh Thuan Co., Ltd., Da Lat Valley Real Estate Co., Ltd., and The Forest City Co., Ltd.) decreased by nearly 287 billion VND. Specifically, Da Lat Valley’s debt decreased by over 157 billion VND, and The Forest City’s debt decreased by over 126.5 billion VND.

In terms of financial performance, SMC reported a semi-annual revenue of 3,798 billion VND, a 15% decrease compared to the previous year. The company incurred a gross loss of nearly 3 billion VND and a loss after tax of over 102 billion VND attributable to the parent company’s owners.

Dr. Nguyen Van Phung: ‘While Many Businesses Pay Taxes in the Billions, I Value Those Who Contribute a Modest 100 Billion’

On September 9, CafeF, a leading finance and economic news portal in Vietnam, organized a prestigious event to honor the country’s top tax-contributing enterprises. The PRIVATE 100 and VNTAX 200 lists, curated by CafeF, stand as the sole comprehensive recognition of businesses’ significant fiscal contributions across all sectors of the Vietnamese economy.

The End of Lump-Sum Tax: A New Era for Personal Taxation in Vietnam?

The proposed tax reform by the Ministry of Finance, which suggests a shift from a flat tax to a 17% profit-based tax for small and medium-sized enterprises from 1/1/2026, has sparked mixed reactions. While some view it as a positive step towards encouraging individual businesses to incorporate, others express concern over the potential burden of proving expenses, which may prove challenging for sole proprietors.

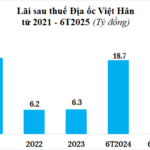

“Real Estate Giant Việt Hân’s Profits Plummet by Over 40%, Burdened by $400 Million Debt”

In the first half of 2025, Dia Oc Viet Han reported a net profit of nearly VND 11 billion, a significant 42% decrease compared to the same period last year. Meanwhile, the company is burdened with a staggering debt of over VND 20.1 trillion, more than half of which comprises bond debt.