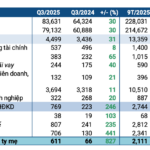

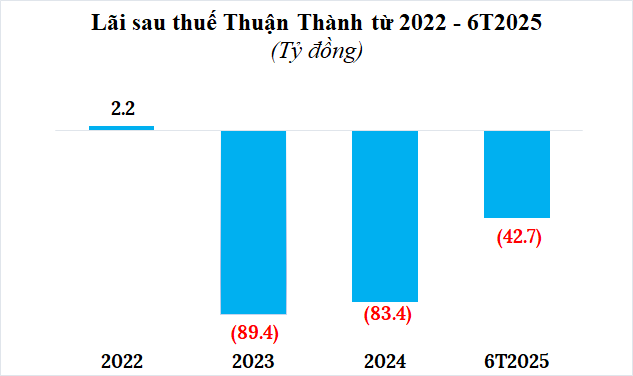

Social Housing Investment Joint Stock Company Thuan Thanh reports periodic financial information for the first half of 2025, with results continuing to show a post-tax loss of nearly VND 43 billion, compared to a loss of over VND 41 billion in the same period last year. This extends the company’s streak of losses from 2023 and 2024, totaling nearly VND 173 billion. In 2022, the company had recorded a meager profit of just over VND 2 billion.

Source: Author’s compilation

|

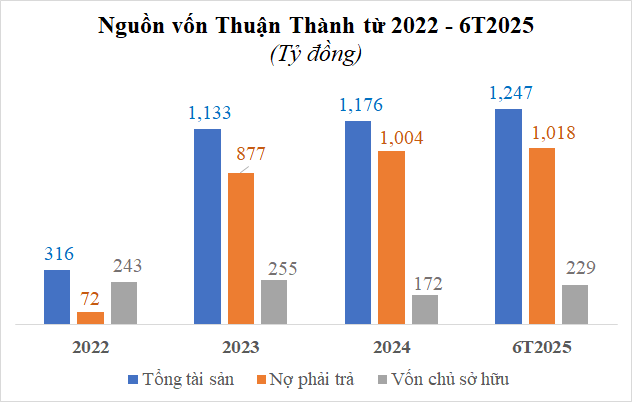

With continued losses, Thuan Thanh Social Housing has accumulated losses of over VND 243 billion as of the end of June. Owners’ equity increased by 33% from the beginning of the year to over VND 229 billion.

Total liabilities increased by 1% to nearly VND 1,018 billion; of which, bond debt accounted for the majority with nearly VND 800 billion, bank loans of VND 110 billion, and other payables of over VND 16 billion.

Source: Author’s compilation

|

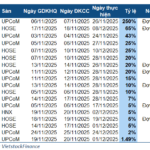

On HNX, Thuan Thanh Social Housing has only one outstanding bond lot TTHCH2328001, issued on 08/21/2023 with a value of VND 800 billion, a term of 59 months, maturing on 07/21/2028, and an interest rate of 14%/year. The collateral for this bond is Thuan Thanh’s property rights arising from the capital contribution transfer agreement between Thuan Thanh and the capital contributor at Hoang Gia Joint Stock Company.

Auditors express doubt over the recoverability of a VND 100 billion loan

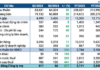

Notably, in the semi-annual report, the auditing firm has provided a significant exception regarding Thuan Thanh’s failure to estimate and account for interest payable on issued bonds, amounting to VND 56 billion. According to the auditors, if this amount had been recognized as per regulations, short-term payables on the balance sheet would have increased accordingly, along with a VND 56 billion increase in financial expenses on the income statement, resulting in a corresponding decrease in net profit.

Additionally, the auditors expressed concern about two of the company’s personal loans as of 06/30/2025, to Mr. Nguyen Van Trung and Mrs. Nguyen Thi Thuy, amounting to VND 40 billion and VND 60 billion, respectively.

Despite conducting the necessary review procedures, the auditors were unable to assess the recoverability of these loans or determine the potential loss and necessary adjustments to the consolidated interim financial statements of the enterprise.

|

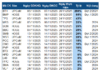

Thuan Thanh Social Housing was established by Dabaco Vietnam Joint Stock Company (Dabaco, HOSE: DBC) in December 2018 to develop a social housing project in Ho town, Thuan Thanh district, Bac Ninh province. In 2021, Dabaco divested its entire investment in Thuan Thanh. Currently, Thuan Thanh has a charter capital of VND 472 billion, with Mr. Nguyen Minh Duc holding the position of Director and legal representative. Hoang Gia Joint Stock Company, located in Vo Cuong ward, Bac Ninh city, is the investor of the social housing project “Hoang Gia” in the same area. The company was established in 2009. Before August 2023, Hoang Gia had a charter capital of VND 1,161 billion, of which Thuan Thanh owned 13.781%, and Mr. Vu Viet Cuong owned 86.219%. Since the beginning of September 2023, Thuan Thanh has become the sole owner of Hoang Gia. The company is currently directed by Mr. Vu Dac Quang (born in 1996) as Director and legal representative. Mr. Nguyen Van Trung, the borrower of VND 40 billion from Thuan Thanh, shares the same name as an individual who used to hold 70% of Hoang Gia’s capital in the 2016-2023 period. |

– 08:34 11/09/2025