Man Sugar Joint Stock Company has just announced periodic financial information for the first half of 2025.

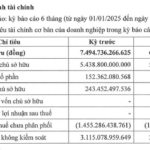

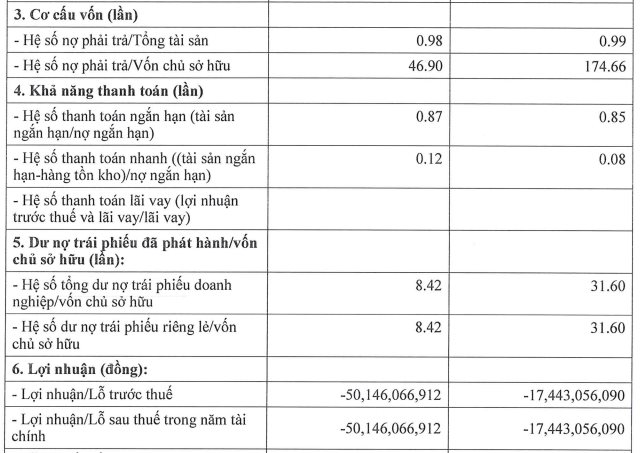

Accordingly, the company recorded a post-tax loss of over VND 17.4 billion in the first six months of 2025. This is an improvement from a loss of over VND 50 billion in the same period last year.

With this period’s loss, Man Sugar’s equity on June 30, 2025, continued to decrease to over VND 6.3 billion.

Although total liabilities slightly decreased to over VND 1,102 billion, Man Sugar’s debt-to-equity ratio surged from 46.9 times to 174.7 times. Its private bond debt stood at nearly VND 190.4 billion, equivalent to over 31 times its equity. Bank loans amounted to VND 286 billion.

In March 2025, Man Sugar announced abnormal information about the delay in paying interest for four periods of the DMBOND2017 bond issue, totaling nearly VND 25 billion. The company attributed this to the prolonged economic difficulties, which prevented them from arranging payment as planned.

Additionally, the company has also overdue the entire VND 200 billion principal payment. Man Sugar is currently negotiating with investors regarding the repayment of both principal and interest of this bond issue.

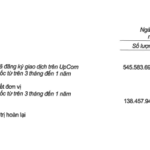

DMBOND2017 is the only bond issue of Man Sugar currently in circulation. It was issued on November 20, 2017, with a term of seven years and a maturity date of November 20, 2024. The total issuance value of this bond issue was VND 200 billion.

At the time of issuance, the collateral for this bond issue was Man Sugar’s gold plating system, valued at nearly VND 160 billion. In March 2018, the collateral was changed to machinery, vehicles, and office equipment.

Man Sugar Joint Stock Company is a member of the ecosystem of Hoa Binh Co., Ltd., a company associated with the businessman Nguyen Huu Duong, commonly known as “Duong ‘bia’.”

Man Sugar is introduced as the first and only company in Vietnam and Southeast Asia to produce malt, the main ingredient in beer production.

Man Sugar has a charter capital of VND 277.5 billion, of which Mr. Nguyen Huu Duong holds 88%, equivalent to VND 244 billion. The company’s current legal representative is Mr. Tran Minh Thong.

Hoa Binh Co., Ltd. (Hoa Binh Group) was established in 1987, formerly known as Hoa Binh Union, with a charter capital of VND 415 billion. The group operates in multiple industries, including beer, liquor, and beverage production; beer raw materials; food industry machinery; civil and industrial construction; real estate business; and hotels. Mr. Nguyen Huu Duong is currently the General Director and legal representative of Hoa Binh Group.

To date, Hoa Binh Group has eight member companies: Hoa Binh Commercial Development Joint Stock Company; Hoa Binh Steel Construction and Production Joint Stock Company; V+ Hoa Binh Commercial Center Joint Stock Company; Hoa Binh Beer and Beverage Joint Stock Company; Thuan Phat Printing and Packaging Production Limited Company; Hoa Binh International Stainless Steel Joint Stock Company; Viet – French Liquor Joint Venture Company; and especially Man Sugar Joint Stock Company, a key player in the beer raw material industry.

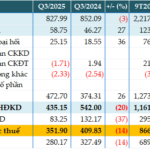

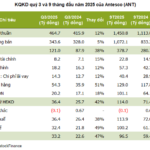

Taseco Group’s Half-Year Profit Surges 68%: Borrowing 5000 Billion VND from Banks to Focus on Real Estate

The Taseco Group’s 2025 semi-annual financial report showcases a robust picture of growth, with a significant surge in profits and a substantial expansion in asset size.

The Second Largest Insurer in Vietnam Invests over $820 Million in Stocks, Recording a Profit of $35 Million in the First Half of the Year

As of June 30th, Prudential Vietnam Insurance’s short-term investment portfolio was predominantly comprised of listed stocks and UPCoM-traded equities, accounting for over half of its total value at VND 19,438 billion.