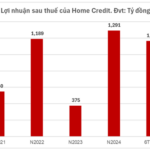

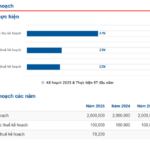

According to audited financial figures, pre-tax profits stood at over VND 16 billion, less than half of the previous year’s figure. Net profit decreased from VND 25 billion to VND 4.8 billion. While revenue figures were not disclosed, the 2024 annual report of DNP Holding (HNX: DNP) revealed that DNP Water recorded nearly VND 1.4 trillion in revenue, indicating thin profit margins if this trend persists into 2025.

| DNP Water’s half-year profit is the lowest in 3 years |

The decline in efficiency caused the debt service coverage ratio to drop from 1.31 to 1.18 times, with return on assets and return on equity falling to 0.06% and 0.12%, respectively.

Meanwhile, total liabilities increased from VND 4,360 billion to VND 4,430 billion, mainly due to bank loans of approximately VND 2,000 billion and other debts of over VND 2,100 billion. On the other hand, bond debt decreased from VND 322 billion to VND 242 billion.

Despite significant debt pressures, the Company’s ability to service its debt improved. The current ratio increased from 1.87 to 4.04 times, and the quick ratio rose from 1.79 to 3.92 times.

As of June 30, equity exceeded VND 4,000 billion, and there was no longer any accumulated loss. Retained earnings attributable to minority shareholders also remained high, at over VND 1,300 billion. Financial leverage ratios slightly decreased, with debt-to-total assets falling from 0.53 to 0.52 times and debt-to-equity decreasing from 1.12 to 1.09 times.

Currently, DNP Water has three bond issuances totaling VND 250 billion, with an interest rate of 11% per annum, issued in late 2023. No interest payments were due in the first half of the year, and the next payment is expected at the end of 2025.

DNP Water is the subsidiary of DNP Holding that specializes in providing clean water and environmental services. It is also one of the largest private enterprises in the water supply and sewerage industry, operating in 13 provinces and cities.

One of the key projects in DNP Water’s pipeline is the Song Tien 1 project, with a total capacity of 600,000 cubic meters per day, supplying raw water to Tien Giang, Ben Tre, and Long An provinces. The project has been approved by the government as part of the Master Plan for the Mekong Delta Region until 2030, with a vision towards 2050, and has received investment approval from the former Tien Giang province.

Nhi Thanh Water Plant (Long An) with a total capacity of 60,000 cubic meters per day of DNP Water – Photo: DNP Water

|

At the annual general meeting held in April, DNP Holding’s leadership shared that the Song Tien 1 project had completed the necessary investment procedures and obtained the investment registration certificate. The company has signed a raw water off-take agreement with a distributor in Long An, reached a preliminary agreement with a water retailer in Tien Giang, and is negotiating with the authorities in the former Ben Tre province regarding the volume and purchase price.

According to the management, the project’s progress has been impacted by complex legal procedures due to its presence in three provinces, especially during the province-city merger process. Additionally, multiple contracts for raw water supply with different treatment plants need to be negotiated, which is a prerequisite for completing loan procedures with credit institutions. The company has made significant progress in these negotiations and has engaged consultants for various aspects of the project, including an environmental impact assessment, a permit for surface water extraction, and other advisory services. The project is expected to commence construction in Q3 2025.

In parallel, at the beginning of this year, DNP Water proposed to the former Soc Trang province a plan to invest in the “Pumping Station for Raw Water from the Southwest of Hau River and Transmission Pipeline” to provide water to Ca Mau, Bac Lieu, and Soc Trang provinces.

This project has a total investment of approximately VND 4,800 billion in phase 1, of which DNP Water will directly invest VND 3,300 billion, while the local budget will allocate VND 1,500 billion for infrastructure connections. The first phase is expected to have a capacity of 300,000 cubic meters per day, meeting demand for domestic and production use until 2037. The second phase will increase the capacity to 600,000 cubic meters per day, with a further expansion potential of 100,000 cubic meters per day. The project is expected to be completed by Q1 2028, with an initial wholesale price of raw water set at VND 3,500 per cubic meter.

DNP Water Raises VND 300 Billion in Bond Issuance After Previous Maturity

– 10:22 11/09/2025

“May – Diêm Sài Gòn Raises Nearly 2.5 Trillion VND in Bond Sale in Less Than a Month”

The Ho Chi Minh City Garment and Cigarette Joint Stock Company has successfully issued its third bond lot within a month, raising nearly VND 2.5 trillion.

“A Soaring Stock: Surging Over 70%, Nears All-Time High as Leadership Assures, “Not Selling Means Not Losing””

“At the 2025 Annual General Meeting held in late May, the CEO addressed the stock price fluctuations, offering insights into the company’s performance and future prospects.”