Following the review, 51 enterprises incurred further losses, 25 reduced losses, 201 increased profits, 272 reduced profits, 9 turned profits into losses, 1 turned losses into profits, and 447 remained unchanged compared to self-prepared reports.

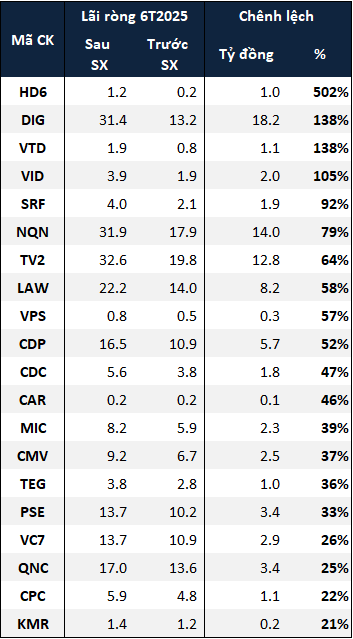

201 enterprises increased profits.

Among the enterprises with higher net profits after the review, Hanoi Investment and Development Joint Stock Company (UPCoM: HD6) recorded the highest increase, with profits six times higher than the self-prepared report, at VND 1.2 billion. This was mainly due to HD6‘s generation of VND 895 million in profit from associated companies. In addition, the current corporate income tax value was also reduced by VND 146 million due to the auditor’s re-determination of the corporate income tax payable.

Ranking after HD6 is Investment and Construction Development Joint Stock Company (HOSE: DIG), with a net profit increase of more than VND 18 billion after the review, amounting to over VND 31 billion, which is 2.4 times higher than the self-prepared profit. This change was attributed to the reduction in most expenses.

Specifically, cost of goods sold, financial expenses, selling expenses, and management expenses decreased by 4%, 4%, 20%, and 2%, respectively, amounting to VND 278 billion, VND 34 billion, VND 26 billion, and VND 93 billion.

Among these, the cost of real estate transfers decreased from nearly VND 113 billion to almost VND 104 billion (a decrease of nearly 9%), and other financial expenses decreased from VND 1.6 billion to VND 748 million (a reduction of over 53%).

|

Top 20 Enterprises with Increased Net Profit after the 2025 Semi-Annual Review (in trillion VND)

Source: VietstockFinance

|

On another note, if we consider the absolute increase, Vietnam National Petroleum Group (HOSE: PLX) recorded the highest profit increase during this semi-annual review, with an additional profit of nearly VND 83 billion, bringing the net profit for the first half of 2025 to approximately VND 1,500 billion. This was mainly due to adjustments in management expenses and profit allocation to non-controlling interests.

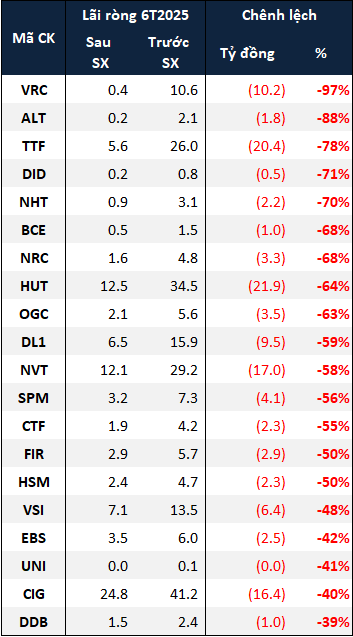

272 enterprises reduced profits.

Regarding the group of enterprises with reduced profits, Real Estate and Investment Joint Stock Company VRC (HOSE: VRC) led this group, with a net profit reduction of up to 97%, resulting in a profit of less than VND 400 million. In the self-prepared report, VRC recorded other income of nearly VND 15 billion, which was compensation, support, and resettlement money received due to the state’s revocation of 962.6 square meters of land for the implementation of the Duong Hang Dieu Project in Phuoc Thang Ward, Ho Chi Minh City. However, the Company retrospectively adjusted this compensation amount, reflecting it in the 2024 financial statements instead, leading to a significant reduction in profit after the review.

Truong Thanh Wood Industry Corporation Joint Stock Company (HOSE: TTF) also experienced a 78% reduction in net profit after the review, equivalent to more than VND 20 billion, leaving a profit of nearly VND 6 billion. Compared to the self-prepared report, the gross profit for the first six months of the year increased by nearly 27%, reaching VND 46 billion. However, financial and management expenses also increased. Notably, other income decreased from over VND 62 billion to nearly VND 52 billion, including more than VND 51 billion arising from the write-off of penalty amounts with OJI.

|

Top 20 Enterprises with Reduced Net Profit after the 2025 Semi-Annual Review (in trillion VND)

Source: VietstockFinance

|

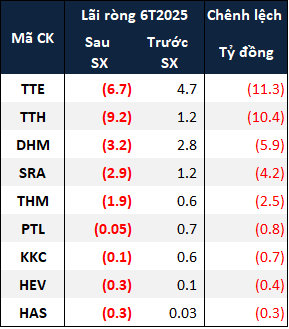

Many enterprises incurred further losses, and some even turned profits into losses.

Despite the reduction in profits, the aforementioned enterprises were still better off than those that turned from profits to net losses after the review. A typical example is Truong Thinh Energy Investment Joint Stock Company (HOSE: TTE), which changed from a profit of nearly VND 5 billion to a loss of almost VND 7 billion due to the need to make additional provisions of nearly VND 10 billion for investments in associated companies. Additionally, the corporate income tax payable also increased.

Similarly, Tien Thanh Trading and Services Joint Stock Company (HNX: TTH) also shifted from a profit of over VND 1 billion to a loss of nearly VND 9 billion due to provisions. Specifically, the auditor made an additional provision of 20% (equivalent to nearly VND 11 billion) for doubtful accounts receivable from three customers: International Relations – Investment Production Joint Stock Company, Dai Kim Joint Stock Company, and Hung Thinh Service and Trading One-Member Limited Liability Company, as the debt age increased from the “over 6 months to under 1 year” bracket to the “1 to under 2 years” bracket.

|

9 Enterprises Turning Profits into Losses after the 2025 Semi-Annual Review (in trillion VND)

Source: VietstockFinance

|

On the contrary, only one enterprise recorded a turnaround from a loss to a profit: Clever Group Joint Stock Company (HOSE: ADG), which changed from a loss of VND 3 million to a profit of nearly VND 40 million. The Company adjusted the cost of goods sold downward compared to the pre-review report, resulting in a corresponding increase in gross profit. Additionally, after a review, the Company made certain adjusting entries for other expenses incurred during the period.

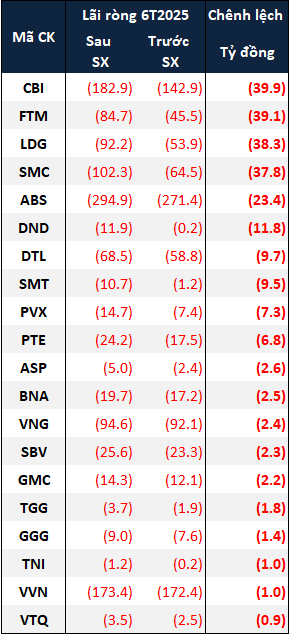

On the other hand, for a listed company, it is concerning to report increased losses after the first six months of the year, and it is even worse to see those losses continue to grow after the review. A typical example is Cao Bang Steel Joint Stock Company (UPCoM: CBI), which incurred an additional loss of VND 40 billion after the review, bringing the total post-tax loss to nearly VND 183 billion. This difference was mainly due to a 2% increase in the cost of goods sold and a 2.5-fold increase in management expenses compared to the pre-review figures.

|

Top 20 Enterprises with Increased Net Loss after the 2025 Semi-Annual Review (in trillion VND)

Source: VietstockFinance

|

Another notable enterprise that increased its loss after the review is LDG Investment Joint Stock Company (HOSE: LDG), with its net loss ballooning from VND 54 billion to over VND 92 billion. The main reason for this was that the cost of goods sold after the review was 2.8 times higher than the self-prepared report, at nearly VND 57 billion, leading to a 60% decrease in gross profit, amounting to nearly VND 24 billion.

LDG stated that compared to the Company’s self-prepared report, the auditor made additional provisions for inventory obsolescence of over VND 36 billion in LDG‘s cost of goods sold for the first six months of the year. The auditor also made additional provisions for doubtful accounts of over VND 2 billion, bringing the total to nearly VND 548 billion.

– 12:00, September 12, 2025

“From Billion to Billions: The Story of a Struggling Cybersecurity Giant”

Since 2019, Bkav Pro has witnessed a significant decline in its profits. As of the first half of this year, the company’s return on equity (ROE) stood at a mere 0.98%.

Title: Hano-Vid Records Nearly VND 10 Billion Profit in H1, Extends Maturity of VND 5.6 Trillion Bond Notes to 2027

The first half of 2025 saw Hano-Vid Real Estate record a promising performance with a net profit of nearly VND 10 billion, a remarkable surge of 4.6 times compared to the same period last year. Despite this impressive feat, the company still grapples with a substantial bond debt that necessitates a two-year extension to alleviate impending cash flow pressures.