Wearing a helmet is extremely important and necessary for those who ride motorcycles. Wearing a helmet while participating in traffic is considered to be one of the practical solutions to reduce road traffic accidents nowadays. According to the data from the World Health Organization (WHO), wearing a good quality helmet can help reduce 69% of brain injuries and reduce the risk of death by 42% in the event of a traffic collision.

In 2007, the Vietnamese government issued a resolution on urgent solutions to curb traffic accidents and traffic congestion, in which it emphasized the mandatory requirement to wear helmets. Specifically, from September 15, 2007, motorcycle riders in Vietnam are required to wear helmets on national routes. By mid-December 2007, this regulation will be expanded to cover all traffic routes nationwide.

As a result, the market for quality helmets has become vibrant and many businesses have participated.

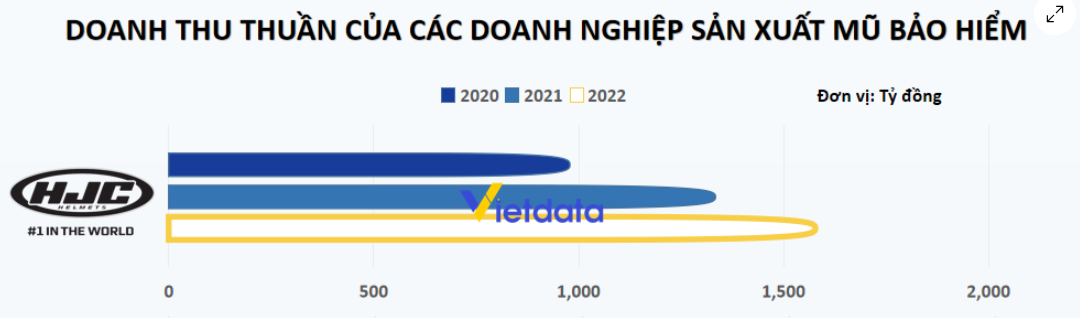

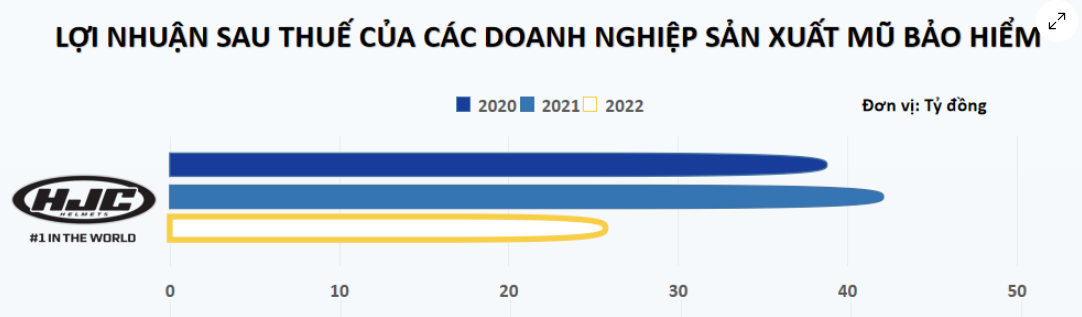

According to Vietdata’s data, the leading helmet company in terms of revenue and profit is HJC. In the period from 2020 to 2022, HJC’s net revenue maintained stable growth with an impressive figure of nearly VND 1,600 billion in 2022, an increase of over 60% compared to 2020. However, HJC’s after-tax profit showed a significant decline at just over VND 26 billion in 2022, a decrease of nearly 40% compared to the same period last year.

HJC’s revenue and profit are far surpassing the competition. Specifically, the second leading helmet company in terms of revenue is Non Son with a net revenue of nearly VND 260 billion in 2022, HJC’s revenue is over 6 times that of Non Son. As for profit, the second-ranked company is Protec, recording a net profit of nearly VND 5 billion, which is 1/5 of HJC’s profit.

HJC’s net revenue (Source: Vietdata)

HJC’s after-tax profit (Source: Vietdata)

According to the introduction on the website, HJC was established in 1971 in South Korea. HJC focuses on producing helmets for motorcycle riders. Since 1992, HJC has successfully maintained the number 1 position as a helmet brand in the North American market.

HJC states that their helmets are always tested in laboratories as well as in real outdoor conditions to ensure the best quality. HJC is one of the few helmet companies equipped with a wind tunnel testing system to test air circulation, ventilation systems, noise levels, etc. for helmets. HJC helmets meet strict standards (DOT, ECE, KC, etc.).

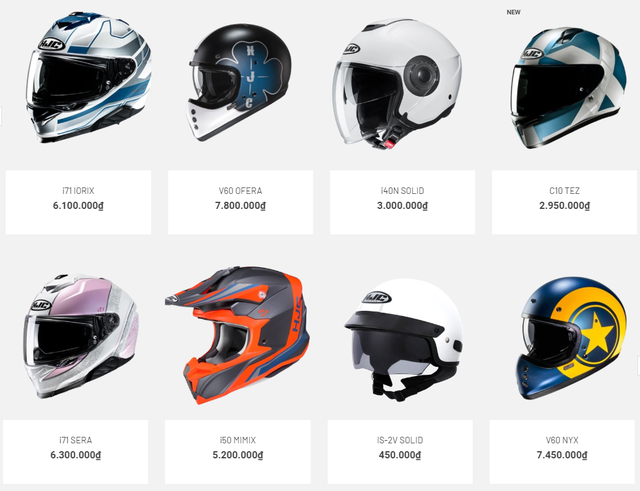

Some HJC helmet models (Source: HJC)

Currently, HJC has 3 helmet manufacturing factories in South Korea and Vietnam. HJC Vietnam Co., Ltd. was established in 2007 to focus on manufacturing mid-range and affordable helmets. In August 2023, the CEO and legal representative of HJC Vietnam changed from Mr. Yeo Sung Soo (1974) to Mr. Kim Young Dae (1963). The company’s charter capital is over VND 397.5 billion.

The scale of the factory in Vinh Phuc is 34,000 square meters with a workshop area of 11,200 square meters equipped with necessary closed-loop production lines for helmet production from preparation to assembly, with a capacity of 500,000 units per year.

After construction and development, HJC Vietnam Co., Ltd. expanded the factory scale to 50,000 square meters with a capacity of 1 million units per year, 90% of which are exported to 60 countries worldwide in Europe and America. The number of employees exceeds 1,000 people, making it the largest helmet manufacturing plant of the HJC Group in particular and the Asian region in general.

HJC has become a sustainable partner with major corporations such as Samsung, Honda, Yamaha, Suzuki, BIDV, Posco, MUJI, etc. in Vietnam.

On February 14, 2024, HJC inaugurated its first showroom in Vietnam in Me Tri, Nam Tu Liem, Hanoi.