Nam Long Tower

Pioneering ESG Enterprise Driving National Sustainable Development

Nam Long has established itself as a company committed to environmental and social responsibility, with transparent governance. The corporation has proactively developed a sustainability reporting framework based on international standards, integrating the United Nations’ 17 Sustainable Development Goals (SDGs) into its long-term strategy.

This commitment is evident through Nam Long’s incorporation of ESG principles into its governance, product design, and development, alongside active community engagement. For consecutive years, Nam Long has been honored with prestigious ESG awards, recognizing its dedication to transparency, robust governance, community-centric value creation, and maintaining stakeholder trust.

Nam Long also demonstrates its social responsibility through diligent, transparent, and reputable tax compliance, contributing significantly to Vietnam’s national budget. The company ranked among the Top 20 private real estate firms with the highest tax contributions in Vietnam, as per the PRIVATE 100 and VNTAX 200 lists by CafeF, with a tax payment of 1.153 trillion VND in the 2024 fiscal year.

Nam Long’s community service ethos is vividly reflected in its social housing projects like EHome, EHomeS, and Flora, as well as large-scale events such as fireworks displays and cultural entertainment activities in its urban developments. Additionally, the “Swing for Dreams” scholarship program, running for 15 years, has awarded thousands of scholarships, inspiring and supporting Vietnamese youth in their academic pursuits.

Nam Long’s EHome Social Housing Line

Robust Financials and International Partnership Appeal

Nam Long boasts strong financial capabilities. In 2024, the company reported net revenue of 7.196 trillion VND, a 126% increase from 2023, marking its highest revenue in the past five years. Net profit reached 518 billion VND, a 7% rise from the previous year.

For 2025, Nam Long aims for a post-tax profit of 701 billion VND, a 35% increase from 2024’s 518 billion VND.

According to the Q2/2025 consolidated financial report, Nam Long achieved 2.064 trillion VND in net revenue and 207 billion VND in post-tax profit in the first six months of 2025, quadrupling and tripling the figures from the same period last year, respectively.

Nam Long prioritizes financial safety and high liquidity. As of June 30, 2025, total liabilities decreased by 11% to 13.995 trillion VND, with a debt-to-equity ratio below 1 at the end of Q2/2025.

Beyond strong financial performance, Nam Long’s strategy shines in attracting reputable international investors. Over a decade, the company has successfully partnered with major Japanese entities like Hankyu Hanshin Properties and Nishi-Nippon Railroad, as well as global financial institutions such as Goldman Sachs and IFC (World Bank Group).

These partnerships not only provide substantial capital and project assurance but also enable Nam Long to adopt international best practices, enhancing its governance and project development to meet global standards, ultimately delivering high-quality products to homebuyers.

Vision for an Integrated Real Estate Group

Amid urbanization and the trend of population dispersal to suburban areas, Nam Long has demonstrated foresight by pioneering the “Integrated Township” model. For Nam Long, urban development transcends modern infrastructure, focusing on creating safe, healthy, and harmonious living environments. According to Nam Long’s CEO, Vietnam needs more meticulously planned urban areas with comprehensive amenities and services to meet this trend.

Nam Long’s integrated townships, such as Waterpoint, Mizuki Park, and Akari City, feature all-in-one ecosystems encompassing education, healthcare, commerce, entertainment, and culture, ensuring safety and community well-being. The company prioritizes sustainability with low construction densities of 16-30%, allocating most land to green spaces and water bodies.

Nam Long has planted over 10,800 trees and preserved native ecosystems through ecological corridors and canals. Each integrated township is designed to fully meet residents’ needs for living, learning, working, and entertainment, fostering community connections.

Each integrated township at Nam Long is designed to fully meet residents’ needs for living, learning, working, and entertainment

Nam Long strategically selects locations for development based on population potential, urbanization levels, and infrastructure planning, rather than pursuing nationwide expansion. This approach enhances residents’ quality of life while aligning with national urban development strategies, contributing to the formation of modern, sustainable urban centers. Nam Long aims not just to build townships but to cultivate authentic communities with unique identities.

Aiming for comprehensive and sustainable urban development, Nam Long implements a multi-segment housing strategy focused on real occupants. For each segment, Nam Long optimizes value by offering the most “reasonable” pricing, emphasizing the creation of genuine value for customers.

With a strong ESG foundation, transparent financials, international partnership capabilities, and a clear integrated urban development strategy, Nam Long exemplifies a responsible business committed to creating sustainable value for customers, communities, shareholders, and Vietnam’s overall development.

The Stock Market’s Volatile Week: What’s Next?

Today (September 12th) marks the fourth consecutive session of stock market gains, propelled by Vingroup stocks, real estate, and steel sectors. While the market extended its positive momentum, trading liquidity weakened as foreign investors continued to offload holdings. Amid this upbeat performance, the market also received a boost from positive news on potential upgrades.

Profitable Yet Modest: Unraveling HQC’s Billion-Dollar Receivables Tangle

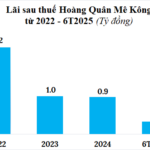

In the first half of 2025, Hoang Quan Mekong reported a modest profit of over VND 315 million. However, with a hefty VND 500 billion bond burden and cash flow pressures, the company’s business outlook remains challenging.