ABR has announced a dividend of VND 2,000 per share, equivalent to a 20% dividend rate. With 20 million outstanding shares, the company will allocate approximately VND 40 billion for this dividend payment. Previously, in late May 2025, ABR disbursed nearly VND 40 billion in cash dividends for the 2024 fiscal year, also at a 20% rate. As of the end of 2024, the company’s accumulated undistributed after-tax profit reached nearly VND 96 billion.

For 2025, ABR targets net revenue of over VND 81 billion, more than triple the 2024 figure. However, after-tax profit is projected to increase only slightly by 3%, reaching nearly VND 19 billion.

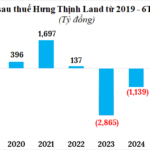

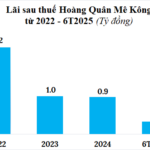

| ABR’s 6-Month Business Results Over the Years |

In the first half of the year, ABR recorded nearly VND 13 billion in net revenue, flat compared to the same period last year. Net profit declined by 32% to VND 7 billion, primarily due to a 27% drop in financial revenue to VND 7 billion, largely attributed to lower bank interest rates. After six months, ABR has achieved only 16% of its annual revenue target and 38% of its profit goal.

Source: VietstockFinance

|

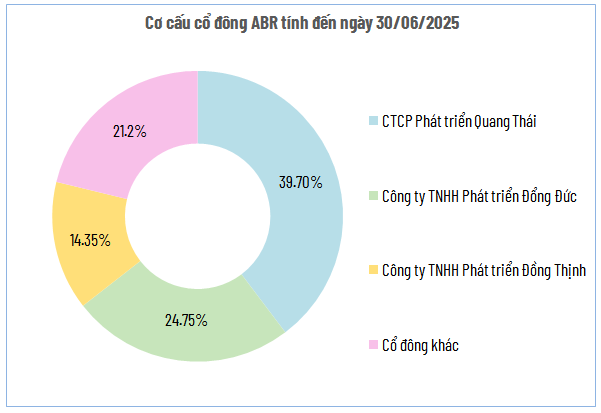

As of June 30, 2025, three institutional investors hold 78.8% of ABR’s capital. Quang Thái Development JSC owns 39.7%, expected to receive nearly VND 16 billion in dividends. The other two major shareholders, Dong Duc Development LLC and Dong Thinh Development LLC, are projected to earn approximately VND 10 billion and VND 6 billion, respectively.

– 08:43 18/09/2025

A Rewarding Venture: Viettel to Share a Whopping 2,150 VND Dividend Per Share

With over 114 million shares in circulation, Viettel Construction is set to dish out approximately VND 246 billion for this dividend payout.

Great News: Over VND 2,100 Billion is About to Flow into SSI Securities Corporation Shareholders’ Pockets

The SSI stock has been on a remarkable rally, surging to a new high of VND 42,450 per share, marking an impressive near 63% year-to-date gain.

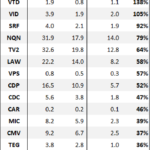

What’s the Bottom Line Impact of Half-Year Audit on Listed Companies?

According to statistics from VietstockFinance, 1,006 listed companies on the HOSE, HNX, and UPCoM exchanges experienced a collective loss of over VND 473 billion in net profit after audits, leaving them with just under VND 285 trillion. This decrease equates to nearly 0.2% of their pre-audit profits.