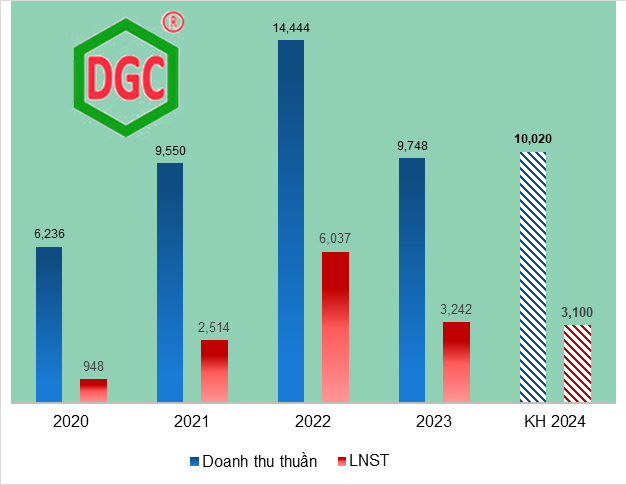

In particular, in 2024, the chemical giant is targeting a revenue of 10.2 trillion VND, an increase of 4.7% compared to the 2023 performance; after-tax profit of 3.1 trillion VND, a slight decrease of 4%; the dividend plan is 30%.

|

The business results from 2020 and the 2024 plan of DGC

Source: VietstockFinance

|

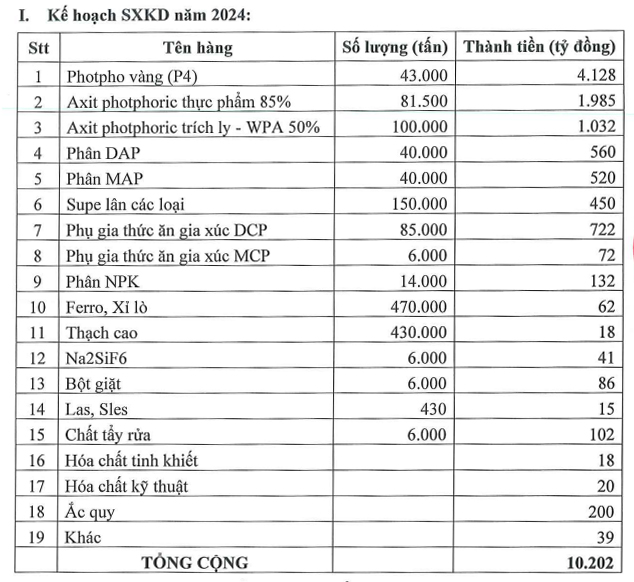

Regarding production targets, yellow fertilizer is expected to continue to be the main source of income for DGC, with a target output of 43 thousand tons and a plan to bring in over 4.1 trillion VND. The other two main products are food-grade phosphoric acid 85% and lactic acid (WPA 50%), which are expected to bring in nearly 2 trillion VND and over 1 trillion VND respectively.

|

The production plan of DGC in 2024

Source: DGC

|

In 2024, DGC plans to propose the construction plan for several projects, including the Plastic Salt Complex in Nghi Son (Phase 1) with an investment capital of 500 billion VND; continue researching the Alumin project, conducting surveys to obtain investment licenses; expand and upgrade the storage capacity in Khai Truong 25 with an investment capital of 10 billion VND.

In addition, DGC plans to propose at the General Meeting of Shareholders the merger of Phu Tho 6 into Duc Giang Lao Cai Chemical Company (a subsidiary of DGC). At the same time, research on the merger of Phu Tho Apatit Vietnam Joint Stock Company (UPCoM: PAT) into DGC.

PAT can be seen as the “grandchild” company of DGC, which is owned through Duc Giang Lao Cai and was listed in June 2022. In terms of business performance, in 2023, PAT brought in nearly 286 billion VND in profit, which is less than 1/3 of the record-breaking year of 2022 (963 billion VND), but is the second-highest profit since its establishment in 2014.

In addition, DGC’s documents also reveal that the dividend ratio for 2023 is 30% – as planned and approved by the General Meeting of Shareholders in 2023. This dividend has been fully advanced, and the company still retains over 5.6 trillion VND in profit. At the General Meeting of Shareholders in 2023, Chairman of the Board of Directors Dao Huu Huyen said that the company wants to keep the money to serve development, project construction, and especially readiness for M&A projects if any.

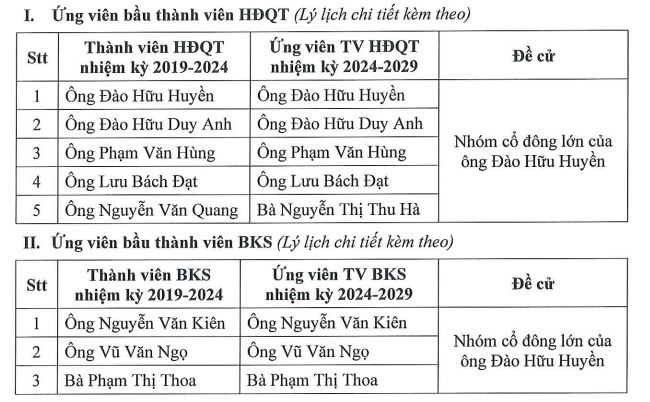

In addition, the General Meeting of Shareholders in 2024 will elect members of the Board of Directors and the Supervisory Board for the 2024-2029 term. Generally speaking, the next term of DGC’s executive board is almost unchanged, except for the nomination of Ms. Nguyen Thi Thu Ha to replace Mr. Nguyen Van Quang as a member of the new term of the Board of Directors. Ms. Ha, born in 1983, is a Bachelor of Economics and currently holds the position of Deputy Director at Van Minh Co., Ltd.

|

The expected members of the new term of the Board of Directors and the Supervisory Board of DGC

Source: DGC

|

The annual General Meeting of Shareholders of DGC in 2024 will take place at 8:30am on March 29, 2024, at the Almaz International Conference Center, Hoa Lan Street, Vinhomes Riverside Urban Area (Long Bien, Hanoi).

Chau An