According to the Ministry of Industry and Trade, multi-level marketing activities in Vietnam remained stable during the first eight months of 2025, despite a slight decline in participants and industry revenue compared to the same period last year.

As of August 2025, there are 16 companies holding valid multi-level marketing licenses, with one in the process of terminating operations.

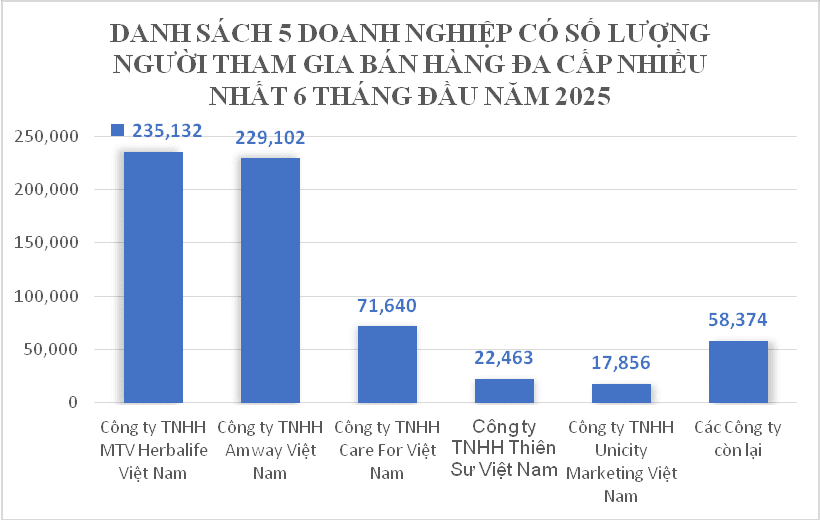

In the first six months of 2025, the total number of participants reached 634,567, a 13.43% decrease from 732,997 in the same period of 2024. The majority of participants (91%) are concentrated in five leading companies: Herbalife Vietnam, Amway Vietnam, Care For Vietnam, Tian Shi Vietnam, and Unicity Marketing Vietnam.

Notably, new participants (101,876, approximately 563 daily) were significantly fewer than those terminating contracts (130,893, approximately 723 daily), leading to an overall industry contraction compared to the previous year.

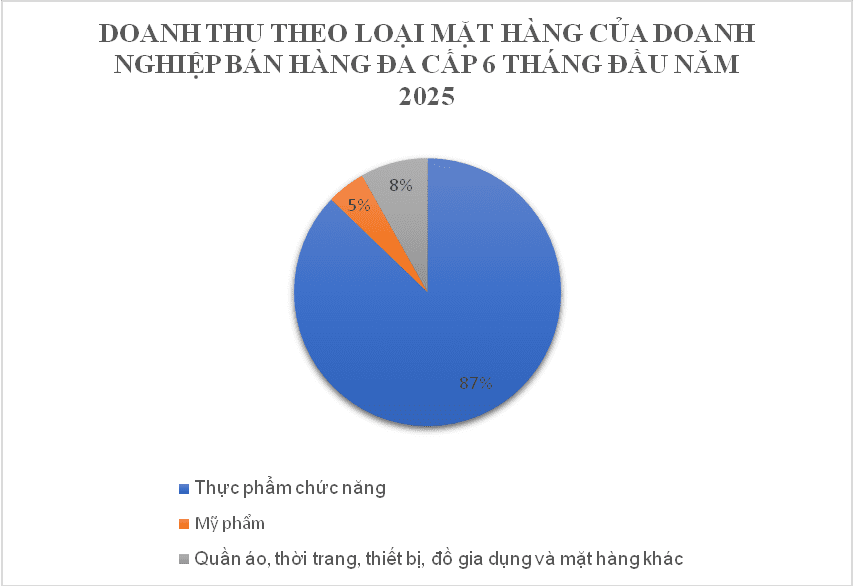

Total industry revenue for the first six months of 2025 exceeded 7 trillion VND, a 9% decrease from 2024. The top five companies accounted for nearly 93% of revenue, with Herbalife Vietnam leading at over 4 trillion VND (53%). Revenue primarily came from dietary supplements and cosmetics (92%), with the remainder from household goods, fashion, and other products (8%).

Companies paid 2.575 trillion VND in commissions and other benefits, equivalent to 37% of total revenue. However, the average commission per active participant was only 8% of the national average income.

Tax contributions from multi-level marketing activities reached 1.302 trillion VND in the first six months.

Government oversight has been strengthened. In the first eight months of 2025, the National Competition Commission (NCC) conducted inspections at five companies, imposing fines totaling nearly 1.2 billion VND. The NCC also collaborated with nine provincial Departments of Industry and Trade to assess implementation challenges and propose solutions.

The NCC continued its collaboration with law enforcement to combat multi-level marketing-related crimes, referring two unlicensed cases (Greenleaf and LucMall) and verifying six operations in Phu Tho, Lang Son, Lao Cai, and Son La provinces.

Regulatory bodies implemented tasks under Decree 146/2025/ND-CP, focusing on licensing, inspections, legal training, and activity termination notifications.

Additionally, the NCC advanced administrative reforms, launched online public services for multi-level marketing, and is drafting a new decree to replace existing regulations, expected for government submission in December 2025.

The Weakening US Dollar: Opportunities and Challenges for Emerging Economies?

Standard Chartered forecasts a weaker USD over the next 6–12 months, predicting the DXY index to drop to around 96 as the Federal Reserve initiates rate cuts. This scenario presents opportunities for exchange rate stability, easing import inflation pressures, and attracting capital inflows into Asia. However, it also poses challenges for export competitiveness and capital flow risks should market expectations reverse.