The First Wave of Digitalization

At 2 PM, while sitting in his office, Mr. Tran Ngoc Minh (32, Ho Chi Minh City) received a notification for his child’s tuition payment. Instantly, he opened his banking app, scanned the QR code, and completed the transaction. Later that evening, while browsing social media, Minh decided to save for a year-end trip. Without hesitation, he reopened the app, created an online savings account with a clear goal, and set up automatic monthly contributions. All of this happened on a single screen, with no paperwork, no waiting, and no restrictions tied to business hours.

Minh’s experience has become a daily routine for millions of Vietnamese. According to a report by global consulting firm McKinsey, Vietnam is currently the fastest-growing country in digital banking adoption in the region.

Banks are accelerating their digital transformation, investing trillions of VND annually in new technologies to optimize processes and enhance customer experiences. The concept of “banks that never sleep,” offering 24/7 services, has become a reality, marking a successful revolution in the financial sector.

Frankie Wai, Business Solutions Director at Temenos—a leading Swiss banking software provider—notes that Vietnam’s banking digitalization began between 2013 and 2014. Since 2021–2022, this trend has accelerated, aligning with regional developments.

According to Frankie, Vietnam’s digital banking surge is strongly supported by regulatory bodies, particularly Decision 810 issued in 2021, which approved the Digital Transformation Plan for the banking sector until 2025, with a vision to 2030.

In reality, digitalization is progressing faster than expected. The State Bank of Vietnam reports that the banking system has completed the initial phase of digital transformation, focusing on information digitization. Some banks have achieved up to 95% digitization, while most have implemented basic digital banking, including process and customer communication channel digitization.

Many banks have now entered the second phase, partially digitizing processes at varying levels, from low to high.

Distinct Choices

In simple terms, during the first phase of digitalization, banks focused on the “arteries”—core systems like core banking technology, internet banking, and mobile apps—targeting the majority of customers.

In the second phase, with a robust foundation, banks are upgrading the “capillaries”—smaller but critical systems distributing services to specific economic sectors and regions. This phase demands high specialization and personalization, reflecting each bank’s unique strategy.

Observing the current market, banks are pursuing diverse strategies. Some extend 24/7 services beyond traditional branches; others build ecosystems, integrating multiple services into a single app; and some embrace a “pure digital” model, focusing on online experiences.

Do Quang Vinh, Deputy Chairman of the Board and Deputy CEO of SHB, believes that digital banking is no longer a race to launch apps but a competition in experience, personalization, and genuine customer engagement.

“In the era of Industry 4.0, user habits are evolving. Customers need a flexible, intelligent platform integrating tailored services, not just basic financial transactions,” Vinh observes.

SHB is among the banks with a high digitization rate, leveraging advanced technologies like Big Data, AI, and Machine Learning in management and operations. Over 95% of SHB’s processes are digitized, with more than 98% of individual and corporate transactions conducted digitally. Having reached peak initial digitization, SHB’s leadership sought new directions.

Recently, SHB launched its next-generation digital banking app—SHB SAHA—which Vinh describes as a significant upgrade from SHB Mobile, reflecting SHB’s evolving digital banking philosophy.

While SHB Mobile focused on basic features like transfers, bill payments, and account inquiries, SHB SAHA goes beyond simple transactions. It offers a comprehensive digital banking experience with smart features, attractive incentives, and long-term financial solutions like investment and insurance. Enhanced security measures, including advanced authentication questions, ensure user peace of mind.

“SHB Mobile was essential for the early stages of digital banking, but SHB SAHA represents a strategic shift, realizing SHB’s digital transformation ambitions,” Vinh shares.

Challenges remain significant. While banks can quickly adopt advanced technologies, changing customer habits—especially among traditional users—is the biggest hurdle. Financial apps, often perceived as dry, must now deliver engaging, user-friendly, and secure experiences that integrate seamlessly into daily life. Additionally, app infrastructure requires substantial investment to support growing user bases and future service expansions.

“We believe technology not only improves bank operations but also enables flexible, connected customer service,” SHB’s representative concludes.

Vietnam Opens Gateway for South Korean Startups

With its dynamic economic growth and vibrant startup ecosystem, Vietnam stands as a pivotal market, unlocking new opportunities for Korean startups.

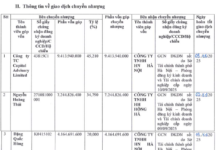

VPBank Successfully Issues $300 Million International Sustainable Bond

VPBank (HOSE: VPB), a leading Vietnamese commercial bank, has made history by becoming the first bank in Vietnam to successfully issue $300 million in sustainable bonds on the international market. This milestone marks a significant advancement for Vietnam’s banking sector on the global stage of sustainable finance.