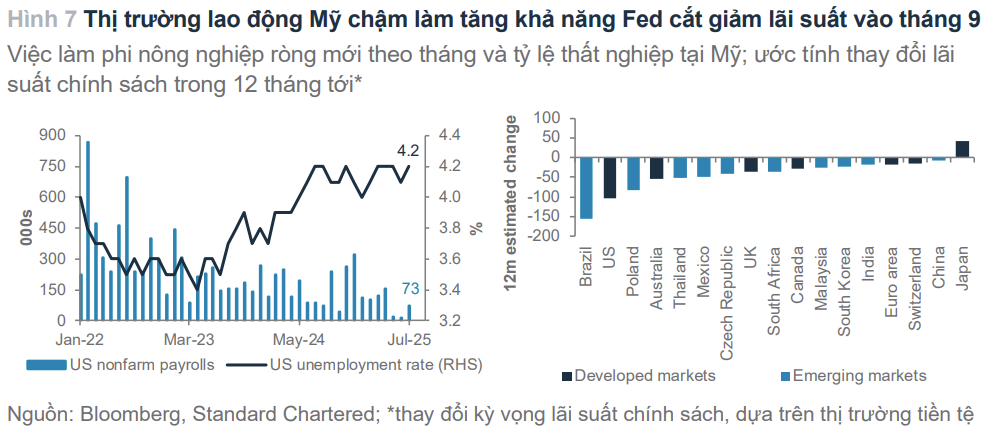

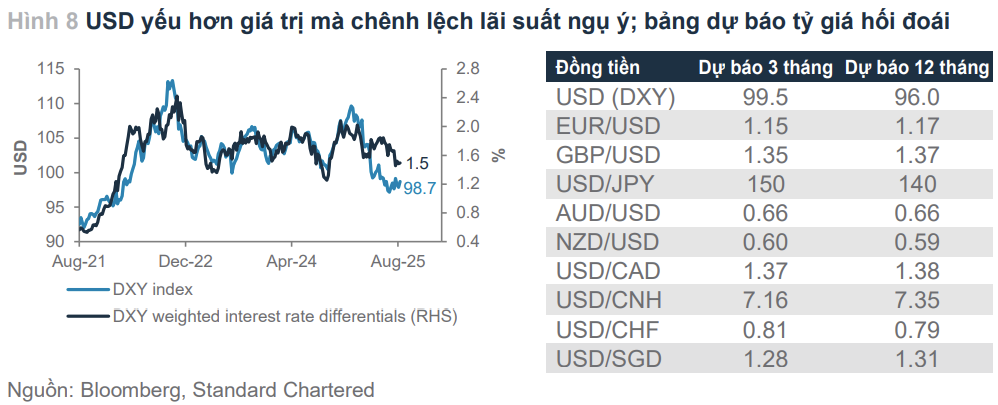

Standard Chartered forecasts a weaker USD trend over the next 6–12 months, predicting the DXY index to drop to around 96 as the Federal Reserve begins cutting interest rates. This scenario presents opportunities for exchange rate stability, reduced import inflation pressures, and increased capital inflows into Asia. However, it also poses challenges related to export competitiveness and capital flow risks if expectations reverse.

According to Standard Chartered’s Global Market Outlook for September 2025, the US Dollar Index (DXY) is expected to weaken from approximately 99–100 to around 96 over the next 6–12 months. This shift is primarily driven by market expectations of a Fed rate-cutting cycle following signs of weakening in the US labor market. If this scenario materializes, it could lower USD debt servicing costs for many emerging economies and stimulate yield-seeking capital flows outside the US.

Market sentiment is also leaning toward the possibility of Fed rate cuts. Recent unemployment claims and job data have led investors to increase bets on a 25-basis-point rate cut, triggering short-term USD sell-offs. The International Monetary Fund (IMF) acknowledges that the Fed has room to lower rates if labor data remains weak but urges caution to avoid reigniting inflation. This has prompted major institutions like UBS and Morgan Stanley to adopt a cautious stance on the USD, advising investors to reduce USD exposure or hedge against exchange rate risks.

How Does a Weaker USD Impact ASEAN?

Reports indicate that a weaker USD affects ASEAN through at least three direct channels: (1) exchange rates and import costs; (2) financial/investment capital flows; and (3) export competitiveness.

Exchange Rates and Import Costs: When the USD weakens, pressure on regional currencies eases, reducing import costs for energy and raw materials. Standard Chartered predicts that Asian currency pairs will stabilize as the DXY declines, benefiting emerging market local currency bonds due to lower USD debt costs. This is particularly significant for ASEAN’s net energy importers (Vietnam, Thailand, Philippines), as lower fuel, production, and transportation costs could help control inflation.

Capital Flows: A weaker USD (with narrowing real interest rate differentials in the US) reduces the appeal of USD assets, increasing demand for yield in emerging markets. Major bank reports suggest that investors will shift capital into Asian equities and bonds, especially if US inflation stabilizes and the Fed enters an easing cycle. This presents an opportunity for ASEAN to attract foreign capital, reduce corporate financing costs, and boost asset prices. However, this benefit comes with the risk of increased hot money volatility if expectations reverse.

Export Competitiveness: A weaker USD makes ASEAN goods more expensive when converted to USD, reducing price advantages in the US market—a critical consideration for major US exporters like Vietnam. With a high export share to the US, Vietnam must address risks of declining demand by improving productivity or diversifying markets. The IMF, World Bank, and ADB highlight growth risks from supply chain shifts and trade uncertainties, emphasizing the need for policy actions alongside enhanced competitiveness.

Perspectives and Opportunities for Vietnam

In Vietnam, the State Bank (SBV) maintains a flexible monetary policy, prioritizing growth, which enhances the ability to leverage advantages in a weaker USD environment.

Standard Chartered’s forecast of the DXY index dropping to 96 within 12 months, contingent on Fed rate cuts, could significantly ease pressure on the VND exchange rate. This provides the SBV with greater flexibility to sustain a balanced monetary policy, supporting both stability and growth.

In practice, the SBV has consistently emphasized exchange rate stability without rigid pegging, intervening by selling USD when necessary to preserve foreign reserves and enhance resilience to external shocks. This is a key advantage for Vietnam in maintaining macroeconomic stability.

Additionally, as a net importer of energy, raw materials, and essential consumer goods, Vietnam benefits from lower import costs in VND when the USD weakens, helping to reduce inflationary pressures. Meanwhile, Standard Chartered predicts WTI crude oil prices to remain around $65/barrel due to OPEC+ oversupply. This dual effect enables the government to keep inflation within the 4–4.5% target for 2025 without overly tightening monetary policy.

This is particularly crucial as Vietnam seeks to boost credit growth to meet its 2025 GDP targets. A low-inflation environment and stable exchange rates will keep domestic capital costs reasonable, aiding businesses in recovering from challenging periods.

Furthermore, a weaker USD reduces the appeal of US assets, driving capital toward emerging markets. With expectations of a market upgrade from frontier to emerging status in 2025–2026, Vietnam is well-positioned to attract foreign investment.

Moreover, Fed rate cuts lower international borrowing costs, encouraging investors to seek high-growth economies with stable political environments. Vietnam, with its strong GDP growth within ASEAN and role as a supply chain relocation hub, is poised to attract new capital, particularly in manufacturing, technology, and renewable energy.

Despite these opportunities, Vietnam is not immune to risks. A weaker USD could make Vietnamese exports to the US less price-competitive. According to 2024 General Customs data, the US accounts for nearly 30% of Vietnam’s total exports, meaning any price advantage shifts will directly impact the trade balance. This necessitates businesses focusing on quality enhancement, market diversification, and leveraging FTAs (e.g., EVFTA, CPTPP).

Additionally, while capital inflows may increase in the short term, reversal risks remain. Standard Chartered warns that if US inflation unexpectedly rises, the Fed might delay or slow rate cuts, leading to a strong USD rebound and capital outflows from emerging markets. The 2022 experience shows that even minor shifts in US rate expectations can cause forex market volatility in Vietnam.

Broader perspectives from the IMF highlight that geoeconomic fragmentation and global supply chain shifts could increase risks for emerging economies, especially those reliant on FDI and international trade. Meanwhile, the Asian Development Bank (ADB) suggests that ASEAN nations should enhance competitiveness, leverage digitalization, and regional trade to turn supply chain risks into opportunities.

These assessments indicate that a weaker USD offers both opportunities—cheaper capital and lower import costs—and challenges related to trade and exchange rate stability that economies like Vietnam cannot ignore. Standard Chartered emphasizes that emerging markets should capitalize on inflows while maintaining macroeconomic balance and managing capital flow–exchange rate risks, as USD expectations can quickly shift.

USD Bank Exchange Rates Remain at Ceiling Despite Fed’s Rate Cut

According to analysts, upward pressure on the exchange rate remains significant despite the Fed’s interest rate cut, driven by domestic internal factors.

Prime Minister Criticizes 29 Ministries, Agencies, and 12 Localities for Below-Average Disbursement Rates

According to reports, 18 ministries, central agencies, and 30 localities have yet to fully allocate the capital plans assigned by the Prime Minister, totaling nearly VND 38,400 billion. By the end of August 2025, 29 ministries, agencies, and 12 localities recorded disbursement rates below the national average.