All banks achieve positive credit growth, bad debts increase 41%

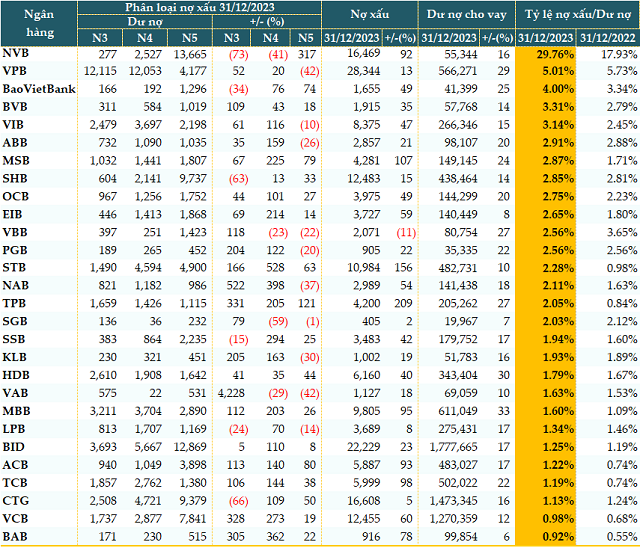

According to data from VietstockFinance, as of December 31, 2023, the total loan balance at 28 banks that have published financial statements is nearly 10.06 million billion VND, increasing nearly 18% compared to the beginning of the year.

Notably, all banks achieve positive credit growth. The strongest credit growth is at MB (MBB, +33%), followed by HDBank (HDB, +30%), VPBank (VPB, +29%), and Vietbank (VBB, +27%).

Meanwhile, the total bad debts at 28 banks at the end of 2023 is 194,994 billion VND, increasing nearly 41% compared to the beginning of the year. Except for VBB (-11%) with improved loan quality, the remaining banks have seen an increase in bad debts, with some banks even doubling their bad debts.

In terms of the structure of bad debts, doubtful debts (group 4) have the highest increase of 78%, followed by loans potentially losing capital (group 5) with an increase of nearly 30%, and substandard loans (group 3) with an increase of nearly 27%.

Bad debts in group 5 have significantly decreased at some banks like VAB (-42%), VPB (-42%), NAB (-37%), KLB (-30%)… However, both group 3 and group 4 debts have doubled at banks such as NAB, BAB, VCB…

|

Loan quality of banks as of December 31, 2023 (Unit: Billion VND)

Source: VietstockFinance

|

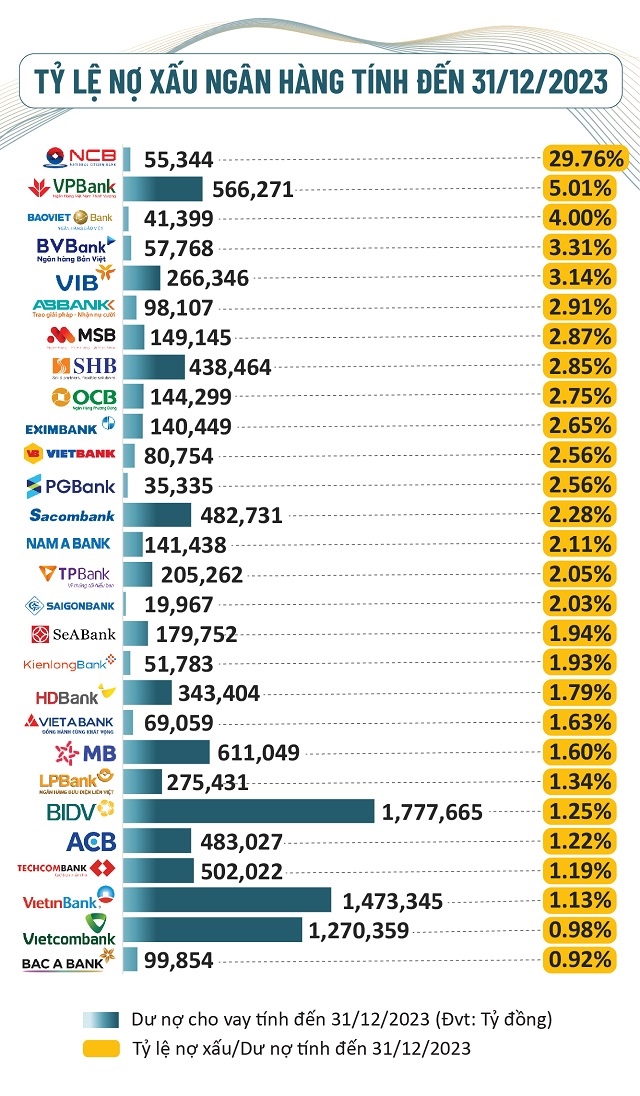

22 out of 28 banks increase the bad debt to loan ratio

As of December 31, 2023, up to 22 out of 28 banks have increased the bad debt to loan ratio compared to the beginning of the year. However, only 5 banks have exceeded the permissible threshold (3%), while in the end of the third quarter, there were 9 banks exceeding the threshold. Nevertheless, some banks have raised the bad debt ratio to nearly 30%.

6 banks have improved their bad debt ratio, including VPB, VBB, PGB, LPBank (LPB), and VietinBank (CTG), although the decrease in the ratio is very small.

Source: VietstockFinance

|

How to accelerate bad debt resolution?

Assoc.Prof. Dr. Dinh Trong Thinh – Economic expert assessed that the bad debts in 2023 have increased significantly, although this number does not yet reflect the actual bad debts held by banks.

The Circular 02/2023/TT-NHNN, allowing the extension and deferral of debts until June 30, 2024, contributes to restraining the increase of bad debts. Therefore, when Circular 02 expires, restructured debts will be classified correctly, leading to a surge in bad debts, narrowing the provisioning buffer of banks, and leaving less capacity to resolve bad debts this year.

In addition, when the effectiveness of Circular 02 ends (currently being considered for extension by the State Bank of Vietnam), the pressure to set aside provisions for restructured debts or non-restructured bad debts will increase, leading to a significant decrease in bank profits.

|

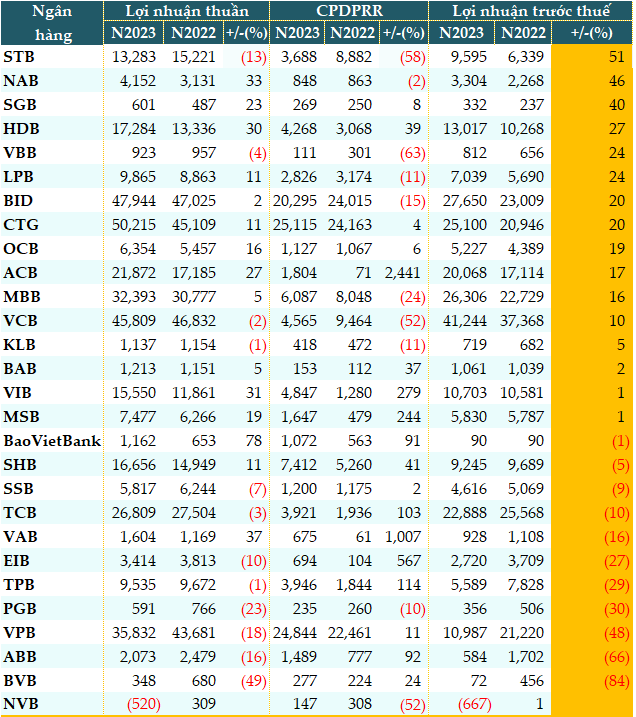

The erosion of bank profits in 2023 due to credit risk provisions The total credit risk provisions of 28 banks in 2023 is 123,980 billion VND, increasing 3% compared to the previous year. Up to 18 out of 28 banks have increased provisions, reducing bank profits. As a result, 11 banks have reduced pre-tax profits in 2023, and 1 bank has reported losses. Sacombank has the highest pre-tax profit growth in 2023 with 9,595 billion VND, an increase of 51%. The bank has completed provisioning 100% for bad debts sold to VAMC that have not been recovered. This is one of the important goals of Sacombank’s Restructuring Project. With the completion of provisioning, Sacombank has addressed one of the main factors that caused the bank’s profits to decline in recent years.

|

Mr. Ngo Dang Khoa – Head of Forex, Capital Market and Securities Services Division, HSBC Vietnam believes that bad debts tend to increase and there is differentiation in the operating results among banks.

HSBC has observed that the bad debt ratio remains stable at banks with relationships with large corporations, but it has sharply decreased at banks with concentrated risks in the retail and SME sectors, as well as banks with high real estate risks. However, abundant liquidity and reduced borrowing costs may limit the decline in credit quality. Even if the bad debt ratio continues to increase in the future, high provisioning buffer can limit the impact on business performance and banks’ balance sheets.

Assoc.Prof. Dr. Nguyen Huu Huan – Lecturer at Ho Chi Minh City University of Economics believes that Circular 02 is likely to be extended because the economy is gradually recovering, rather than an immediate recovery. Therefore, bad debts will increase significantly in 2024 when Circular 02 expires. At that time, the bad debt ratio in the entire system may increase dramatically as debts start moving into higher risk categories.

To solve the problem of bad debts, two issues need to be addressed: economic recovery and real estate market resolution.

Firstly, when the economy recovers and businesses operate efficiently, they will have cash flow to repay their debts, which means that cash flow can be resolved. However, these solutions need to be continuously and strongly implemented. When the economy and businesses recover, bad debts will decrease.

Secondly, we have to rescue the real estate market whether we want it or not because most of the capital is currently in this market, and most of the bad debts in the banking system are also related to real estate, with 80-90% of bank collateral being real estate. If we want to resolve bad debts quickly, we have to revive the real estate market. If the real estate market remains frozen, banks cannot resolve bad debts.

In the report on the Banking Industry Outlook 2024 released on December 7, 2023, VPS Securities Company states that the overall bad debt ratio in the industry will slightly improve. With the policy support of Circular 02, the pressure on bad debts will be deferred until the first half of 2024, giving banks and borrowers time to restructure and gradually resolve bad debts without experiencing a sudden increase in bad debts.

According to the calculation principle, with Circular 02, the bad debt ratio will not be as high as initially expected, while the total provision (numerator) includes restructured loans, but the denominator does not. The recovery from processed debts of banks is not optimistic compared to the same period, showing that although there have been efforts, banks still need policy support to handle bad debts.

Meanwhile, the report from SSI Securities Company suggests that the bad debt ratio may increase again in the first half of 2024, as credit growth slows down and macroeconomic factors have not shown significant improvement.

Although the bad debt ratio at the end of 2024 is expected to remain relatively stable compared to 2023, as banks are planning to aggressively write off bad debts and the economy is expected to recover more strongly at the end of the year. However, problem debts (group 2 debts, restructured loans, overdue corporate bonds, and old loans) still need to be closely monitored.

In addition, if the draft amendment to Circular 16/2021/TT-NHNN that relaxes the restrictions on bank investments in corporate bonds is approved, there is a possibility that some credit risks will return to banks actively repurchasing corporate bonds.

On January 15, 2024, the Governor of the State Bank of Vietnam issued Instruction 01/CT-NHNN on the organization of implementing the key tasks of the banking industry in 2024. The instruction includes tasks to vigorously and effectively implement the Project “Restructuring the system of credit institutions associated with handling bad debts in the period of 2021-2025”, contributing to the development of a sound, quality, effective, transparent, and accountable system of credit institutions according to the provisions of the law and approaching international standards; focusing on effectively implementing the plan to handle weak credit institutions, restructuring commercial banks under special control as instructed by the competent authorities; directing credit institutions to enhance the handling and recovery of bad debts; improving credit quality, preventing and limiting the occurrence of new bad debts.