The US Dollar. (Photo: THX/TTXVN)

|

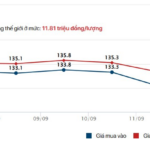

On September 18th, the exchange rate between the Vietnamese Dong (VND) and the US Dollar at various banks continued its downward trend following the Federal Reserve’s (Fed) first interest rate cut of the year.

Meanwhile, the exchange rate against the Chinese Yuan (CNY) saw an upward movement.

Specifically, the central rate at the State Bank of Vietnam was set at 25,186 VND/USD, a decrease of 12 dong compared to September 17th.

At commercial banks as of 8:30 AM on September 18th, Vietcombank further reduced both buying and selling rates by 12 dong, setting the USD exchange rate at 26,165-26,445 VND/USD (buy-sell).

Similarly, at BIDV, the USD exchange rate decreased by 17 dong for buying and 12 dong for selling, settling at 26,178-26,445 VND/USD (buy-sell).

Conversely, the Chinese Yuan continued to appreciate at both Vietcombank and BIDV.

Vietcombank increased the buying rate by 5 dong and the selling rate by 6 dong, setting the exchange rate at 3,654-3,771 VND/CNY (buy-sell).

At BIDV, the Chinese Yuan exchange rate stood at 3,669-3,755 VND/CNY (buy-sell), an increase of 4 dong for buying and 5 dong for selling compared to September 17th.

On September 17th, the Fed lowered interest rates by 0.25 percentage points and signaled further gradual cuts for the remainder of the year, addressing concerns about a weakening labor market.

Alongside this rate cut, the Fed projected two additional 0.25 percentage point reductions in the remaining policy meetings of the year.

This indicates that Fed officials are increasingly downplaying the risk of persistent inflation driven by President Donald Trump’s volatile trade policies. Instead, they are more concerned about slowing growth and the potential for rising unemployment.

This marks the first rate cut by the Federal Open Market Committee (FOMC), the Fed’s policy-setting body, since December last year, bringing the policy rate to a range of 4-4.25%.

– 09:54 18/09/2025

The Weakening US Dollar: Opportunities and Challenges for Emerging Economies?

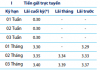

Standard Chartered forecasts a weaker USD over the next 6–12 months, predicting the DXY index to drop to around 96 as the Federal Reserve initiates rate cuts. This scenario presents opportunities for exchange rate stability, easing import inflation pressures, and attracting capital inflows into Asia. However, it also poses challenges for export competitiveness and capital flow risks should market expectations reverse.

“The State Bank’s ‘Triple Pronged Attack’ to Curb Rising Exchange Rates”

Amidst the backdrop of a steadily rising USD/VND exchange rate in late August and early September, the State Bank of Vietnam has implemented a series of measures to cool down the market. However, upward pressure on the exchange rate remains significant, despite the near-certainty of a Fed rate cut at its September meeting.

Today, September 13th: Ring Gold and Gold Bar Prices Continue Their Sharp Decline

Domestic gold prices continued their steep decline at the opening of today’s trading session. Ring and bullion gold prices at several enterprises plummeted by nearly 2 million VND per tael compared to the same time yesterday.