Latest interest rates in March from BVBank

BVBank has officially adjusted the deposit interest rates since March 4th. In specific terms, the average deposit interest rates have decreased by 0.3-0.4% at different tenors.

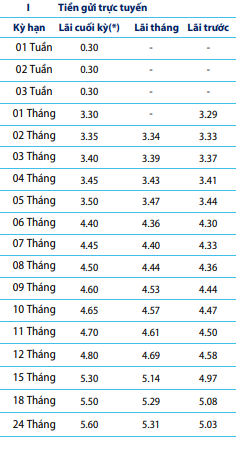

Latest interest rates at BVBank.

Specifically, for the tenors of 1-4 months, the deposit interest rates have decreased by 0.4%, to 3.3% per annum (1 month), 3.35% per annum (2 months), 3.4% per annum (3 months), and 3.45% per annum (4 months).

For the 5-month tenor, the interest rate has dropped by 0.3% to 3.5% per annum. Meanwhile, the bank has also reduced the interest rates by 0.25% for the tenors of 6, 7, and 8 months, resulting in the rates of 4.4%, 4.45%, and 4.5% per annum, respectively.

Similarly, at the 9-month tenor, the interest rate has decreased by 0.2% to 4.6% per annum, and for the 10-month tenor, it is now 4.65% per annum. The 11-month tenor is subject to a 4.7% per annum interest rate. Finally, the deposit interest rate for the 12-month tenor has reduced by 0.15% to 4.8% per annum.

For the tenors longer than 15 months, the interest rates remain above 5% per annum. However, compared to the most recent adjustments, the decrease in interest rates ranges from 0.1% to 0.25% on average. Specifically, the interest rate for the 15-month tenor is 5.3% per annum, 5.5% per annum for the 18-month tenor, and the highest rate of 5.6% per annum for the 24-month tenor.

Latest interest rates in March at BaoViet Bank

BaoViet Bank has also decreased the average interest rate by 0.2% per annum for some tenors.

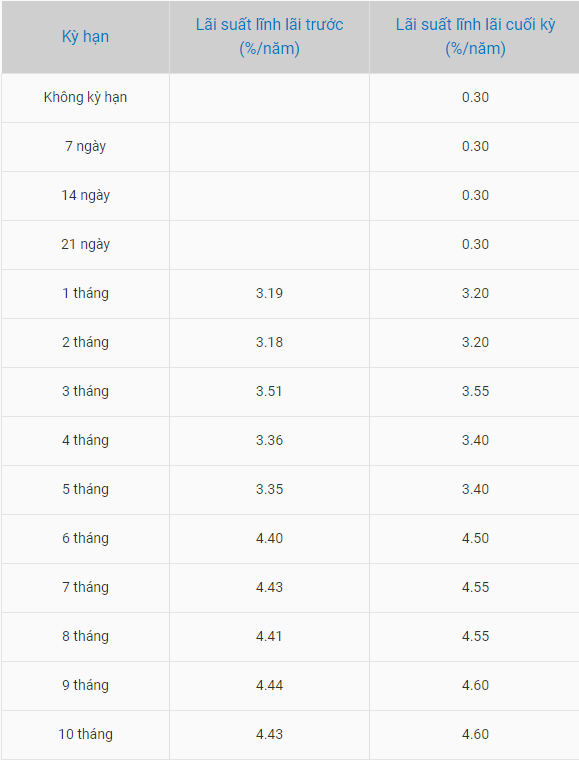

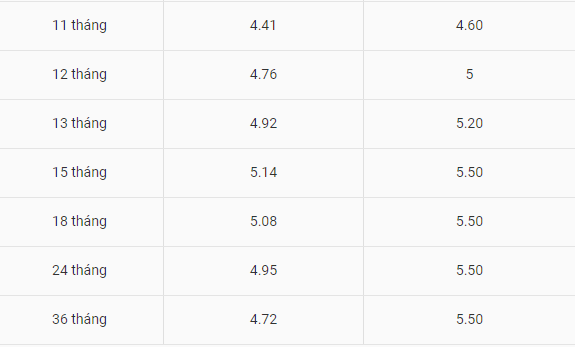

Latest interest rates at BaoViet Bank.

For the end-of-term interest payment method, the interest rates for various tenors have decreased by an average of 0.2%. Specifically, the interest rates for the 1-month and 2-month tenors have been fixed at 3.2% per annum. BaoViet Bank offers a rate of 3.55% per annum for the 3-month tenor. The interest rate of 3.4% per annum is implemented for the 4-month and 5-month tenors.

For the 6-month tenor, the savings interest rate is 4.5% per annum. The rates of 4.55% per annum are applicable to the 7-month and 8-month tenors. From the 9th to the 11th month, the interest rates are set at 4.6% per annum. The interest rate for the 12-month tenor is 5% per annum. For the 13-month tenor, the deposit interest rate is 5.2% per annum. The highest interest rate from 15-month to 36-month tenors is 5.3% per annum.

Latest interest rates in March at PGBank

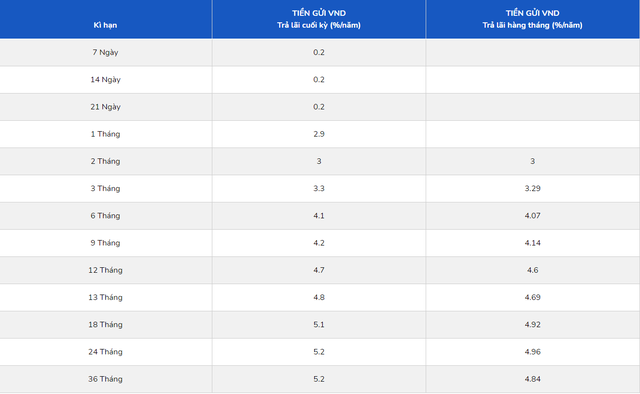

PGBank has reduced the deposit interest rates by an average of 0.2% per annum. Currently, the applicable interest rates are 2.9% (1 month), 3% (2 months), and 3.3% per annum (3 months).

For the 6-month tenor, the interest rate has decreased by 0.1% to 4.1% per annum. On the other hand, the bank has also reduced the interest rates by 0.2% for the tenors of 9 to 13 months, corresponding to interest rates from 4.2% per annum to 4.8% per annum.

From the 18-month tenor to the 36-month tenor, the interest rates remain unchanged. Specifically, the interest rate for the 18-month tenor is 5.1% per annum, and for the remaining tenors, it is 5.2% per annum.

Latest interest rates at PGBank.