Source: VietstockFinance

|

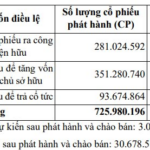

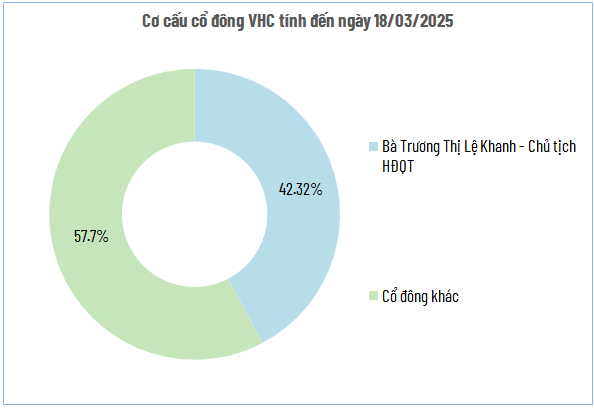

With nearly 224.5 million outstanding shares, VHC will allocate approximately VND 449 billion for this dividend payout. Notably, Mrs. Truong Thi Le Khanh, Chairwoman of the Board and the largest shareholder with a 42.32% stake, is expected to receive nearly VND 190 billion.

Source: VietstockFinance

|

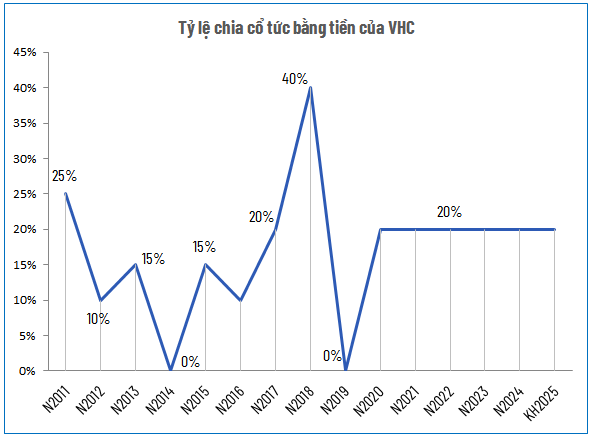

Remarkably, Vinh Hoan has consistently maintained a 20% cash dividend ratio for six consecutive years (2020-2025), despite fluctuating profits. Previously, the highest payout was 40% in 2018, when the company first recorded a net profit exceeding VND 1 trillion.

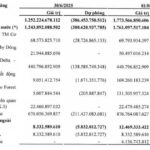

| VHC’s Financial Performance Over the Years |

In 2025, despite a cautious business plan with consolidated net revenue of VND 10,900 billion and net profit of VND 1,000 billion (down 12% and 18% respectively from 2024) due to concerns over U.S. tariffs, the company has maintained its stable dividend policy.

| VHC’s 6-Month Financial Performance Over the Years |

The decision to proceed with the dividend payout aligns with the company’s strong first-half 2025 results: net profit reached VND 708 billion, up 45% year-on-year, despite a slight 3% revenue decline to VND 5.84 trillion due to effective cost management. This marks the best semi-annual performance since 2023, with VHC achieving 53% of its optimistic profit target (VND 1,300 billion) and 70% of its base-case scenario.

– 11:28 17/09/2025

Steel Company’s Stock Surges 140% in 5 Months Following Debt Recovery from Novaland

Novaland Group’s debt at SMC, encompassing Delta – Valley Binh Thuan Co., Ltd., Dalat Valley Real Estate Co., Ltd., and The Forest City Co., Ltd., has decreased by nearly VND 287 billion. Specifically, Dalat Valley’s debt reduced by over VND 157 billion, while The Forest City’s debt saw a decline of more than VND 126.5 billion.

“VinFast Gears Up for Short-Term Financial Endeavor: Projected Expenditure of $400-600 Million per Quarter”

These costs are expected to decrease over time as operational leverage is effectively employed and profit margins improve.

The Commercial Banking Sector: Accelerating Budgetary Contributions and Strengthening National Resources

On September 9, at the Private 100 and VNTax 200 Awards, organized by CafeF (VCCorp), the banking industry once again demonstrated its pivotal role in the economy. This prestigious event recognized the top 200 businesses making the most significant contributions to the national budget, with several prominent banking institutions featuring prominently in the rankings.