Miza’s Paper Recycling Plant – Illustrative Image

|

Miza has announced an offering of nearly 10.6 million shares to existing shareholders at a price of 10,000 VND per share, with a 10% execution ratio (for every 10 shares held, shareholders can purchase 1 new share). The company aims to raise approximately 106 billion VND to reduce its debt. The ex-rights date is set for September 30, and the subscription period will run from October 7 to October 27. Upon completion, Miza’s charter capital will increase to 1,165 billion VND.

According to the plan, the entire proceeds will be used to repay the principal or a portion of the outstanding debt, including both matured and premature loans. This includes nearly 76 billion VND for a loan from Vietnam Modern Limited Liability Bank, 19 billion VND for a loan from MB, and 11 billion VND for a loan from BIDV. The disbursement is expected to occur from Q4 2025 to 2026.

On the stock market, MZG shares were trading at 16,900 VND per share on the morning of September 22, 69% higher than the offering price. Over the past three months, the stock has surged by 125%, more than doubling its price from a year ago. Average liquidity stands at around 360,000 shares per day.

MZG shares debuted on UPCoM on November 12, 2024, at a price of 11,900 VND per share, followed by a sharp decline, dropping below 6,000 VND per share in early 2025. However, the stock rebounded from late June 2025, reaching a peak of 17,800 VND per share on September 17, tripling in value within three months, before slightly adjusting to its current level.

| MZG Stock Price Movement Since Listing |

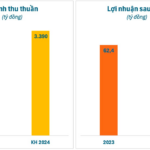

Miza operates in the field of recycling waste paper to produce packaging paper and other recycled paper products. In the first six months of 2025, the company recorded revenue of 2,314 billion VND and a net profit of 47 billion VND, up 14% and 88% year-on-year, respectively. These results enabled MZG to achieve 48% of its revenue target and 52% of its profit goal for the year.

As of the end of June 2025, Miza’s total financial debt stood at nearly 2,800 billion VND, with over 2,300 billion VND in short-term loans (bank loans accounting for nearly 93%).

| Miza’s Semi-Annual Business Results Over the Years |

– 09:42 22/09/2025

“Long Châu and Ho Chi Minh City University of Medicine and Pharmacy Hospital: A Comprehensive Strategic Alliance.”

On August 28, 2025, Long Chau pharmacy and vaccination center signed a strategic partnership with Ho Chi Minh City University of Medicine and Pharmacy Hospital. This marks a significant milestone in the journey of creating a comprehensive and sustainable healthcare ecosystem for the people of Vietnam.

“HPX Swaps HQC Shares – A Move to Recover Outstanding Debt”

The real estate market is witnessing a gradual recovery from its slump, and the debt swap agreement between Hai Phat Investment Joint Stock Company (HPX) and Hoang Quan Trading Services Real Estate Consultancy Joint Stock Company (HQC) is a testament to their proactive financial restructuring efforts. This bold move showcases their commitment to sharing growth opportunities and navigating through challenging economic times.

The Paper Giant: Unveiling the Billion-Dollar Secrets of a Vietnamese Company

The reference price on the first trading day was VND 11,900 per share, equivalent to a valuation of nearly VND 1,200 billion. A formidable valuation, no doubt, and one that sets a precedent for future listings. This introductory paragraph sets the tone for an intriguing story of a company’s journey onto the stock exchange and its potential future trajectory.