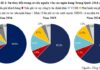

According to data released by the State Bank of Vietnam, as of June 2025, individual deposits in credit institutions reached VND 7,694 trillion, an 8.91% increase compared to the end of 2024. In June alone, individuals deposited an additional VND 91.498 trillion, following a VND 65.427 trillion increase in May.

For businesses, deposits exceeded VND 8,104 trillion, a 5.7% rise from the previous year-end. In June, business deposits grew by over VND 362.825 trillion, while May saw an increase of VND 116.370 trillion.

In June alone, individuals and businesses deposited over VND 450 trillion into the banking system. Previous months saw incremental deposits of approximately VND 181 trillion (May), VND 172 trillion (April), and VND 262 trillion (March). By mid-2025, total deposits from individuals and businesses hit a record high of VND 15,800 trillion.

Despite commercial banks collectively lowering interest rates in June, deposit inflows remained robust. After a period of high deposit rates exceeding 6% annually, such rates have largely disappeared.

Illustrative image

What is the current interest rate landscape in Vietnamese banks?

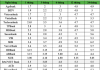

Deposit interest rates show clear segmentation: Smaller/private banks often offer higher rates than large, state-owned banks. Online savings typically yield slightly higher rates than in-branch deposits, usually by 0.1–0.3 percentage points or more, depending on the bank.

Higher interest rates often come with conditions such as minimum deposit amounts, online deposits, longer commitment periods, or smaller banks. Major banks (state-owned, Big 4 like Vietcombank, BIDV, VietinBank, Agribank) generally offer lower rates for the same terms but provide greater stability and trust.

For 1-month terms, deposit rates range from 1.6% to 4.1% annually. Banks like Vietcombank, VietinBank, and BIDV offer the lowest rate of 1.6% annually. Smaller banks may reach around 4%. CBBank leads with a 4.1% annual rate.

For 3-month terms, rates typically range from 1.9% to 4.4% annually. The lowest rates are still offered by Vietcombank, VietinBank, BIDV, and SCB. CBBank and OceanBank top the list with 4.3% annually.

For 6-month terms, rates fluctuate between 2.9% and 5.3% annually. Vikki Bank and OceanBank lead in deposit rates.

For 9-month terms, rates range from 2.9% to 5.5% annually, with higher rates often found among private banks.

For 12–13-month terms, many banks commonly list rates between 5% and 5.7% annually. Vikki Bank and OceanBank continue to lead in deposit rates.

For terms of 18–24 months or longer, some banks offer even higher rates for extended periods like 18, 24, or 36 months, ranging from 5.8% to 5.95% or more (depending on deposit conditions).

According to the State Bank of Vietnam’s Q3 2025 business trend survey, credit institutions and foreign bank branches expect both deposit and lending rates to continue declining in Q2, particularly lending rates. This trend is projected to persist in Q3 and the final months of the year.

Reporting Requirements for Transactions Over 500 Million to Anti-Money Laundering Units

The State Bank mandates that all domestic money transfers of 500 million VND or more, or equivalent foreign currency values, must be reported to the Anti-Money Laundering Department.

Domestic Money Transfers of 500 Million VND or More Require Reporting

The State Bank of Vietnam (SBV) has recently issued Circular 27/2025/TT-NHNN, providing guidance on the implementation of key provisions within the Anti-Money Laundering Law. This regulatory update introduces several new measures designed to enhance the effectiveness of monitoring and preventing money laundering and terrorist financing activities within the financial sector.

Nearly 15.8 Quadrillion VND Deposited in Banks

As of June 2025, the State Bank of Vietnam (SBV) reports that customer deposits have surged to nearly 15.8 quadrillion VND, marking a 3.2% increase compared to the previous month.