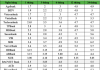

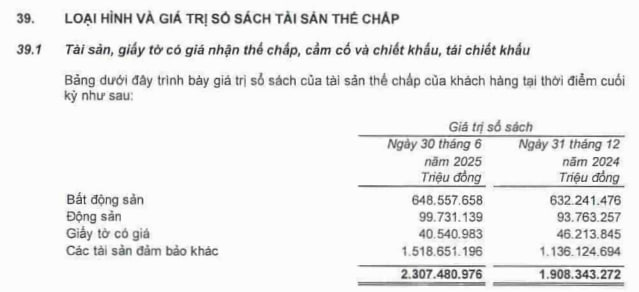

According to the audited semi-annual financial report of Vietnam Prosperity Joint Stock Commercial Bank (VPBank), the bank’s total collateralized assets as of the end of June reached over VND 2,307 trillion, an increase of VND 399 trillion compared to the beginning of the year (equivalent to a nearly 21% rise).

With this figure, VPBank holds the largest volume of collateralized assets among private banks in the system, second only to the four state-owned commercial banks: Vietcombank, VietinBank, Agribank, and BIDV. Notably, VPBank’s collateralized assets are nearly double those of Techcombank, despite similar asset scales.

Among VPBank’s collateralized assets, real estate accounts for 28%, totaling nearly VND 649 trillion. Movable assets stand at VND 99.7 trillion, representing 4.3%, while securities make up 1.8%, valued at over VND 40.5 trillion.

Remarkably, other collateralized assets at VPBank exceed VND 1.5 quadrillion, constituting nearly 66% of the total. While VPBank does not provide detailed explanations for this category, its scale began to surge in 2023 and has remained high since. In the second quarter alone, these other collateralized assets increased by over VND 330.5 trillion, equivalent to nearly 28%.

Unlike other banks, where real estate dominates collateralized assets, two-thirds of VPBank’s collateral portfolio consists of these other assets.

Source: VPBank’s 2025 Semi-Annual Financial Report (Audited)

VPBank not only leads in collateralized asset scale but also boasts the largest total assets among private banks in the system.

As of the end of June, VPBank’s consolidated total assets surpassed VND 1,100 trillion, while the bank’s standalone assets approached VND 1,050 trillion. Consolidated credit outstanding reached over VND 842 trillion, up 18.6% year-to-date and 30.3% year-on-year.

VPBank’s consolidated pre-tax profit for the first half of the year hit VND 11,229 billion, a 30% increase year-on-year. In the second quarter alone, profit reached VND 6,215 billion, up more than 38%.

PVI Sets Date to Disburse Nearly VND 738 Billion in 2024 Dividends

PVI is set to distribute a substantial cash dividend of nearly VND 737.9 billion for the year 2024, offering shareholders a 31.5% payout ratio. The final registration date for eligibility is October 2, 2025, with the expected payment date scheduled for October 22, 2025.