CAEX, headquartered at 5 Dien Bien Phu, Ba Dinh District, Hanoi, is led by Mr. Nguyen Hong Trung as CEO and legal representative. The company specializes in providing services related to digital assets, commercializing scientific research, technology development, and innovation. Additionally, CAEX offers technology transfer services and invests in technology incubators and science-based business incubators.

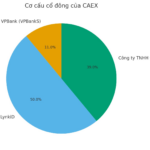

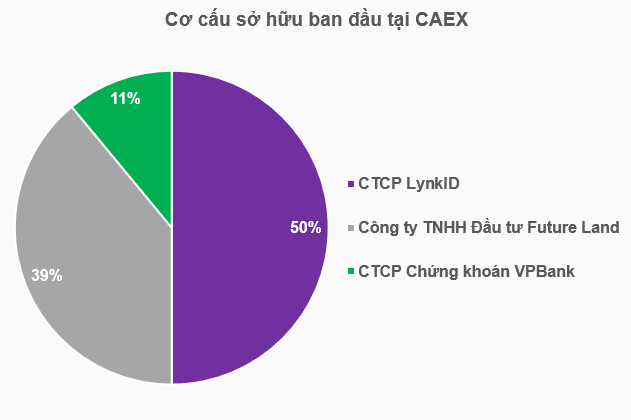

According to the company’s founding registration, CAEX has three founding shareholders: LynkiD JSC (50%), Future Land Investment LLC (39%), and VPBankS (11%).

Source: Compiled by the author

|

LynkiD, formerly known as LinkiD Technology and Services JSC, was established on May 14, 2020, in Hanoi. Its primary business focus is on information portals, including websites, social networks, e-commerce platforms, online promotions, and digital trading platforms. In January 2024, the company officially rebranded to LynkiD JSC.

Since its inception, LynkiD has maintained a charter capital of 2 billion VND, with 98% contributed by Thao Nguyen Investment and Services LLC. The remaining 1% is held by two individuals, Mr. Luong Phan Hien and Mr. Nguyen Duc Anh. Mr. Luong Phan Hien serves as Chairman of the Board and legal representative.

LynkiD is recognized as an open Loyalty platform, enabling businesses to reward loyalty points, retain customers, and connect ecosystems. The company collaborates with numerous international and Vietnamese brands, including the banking, securities, and insurance ecosystem of VPBank, VPBankS, and OPES, as well as partners like PNJ and Be Group.

CAEX’s second-largest shareholder, Future Land, was established on December 27, 2023, in Hanoi, focusing on real estate. The company is owned by Ms. Nguyen Thi Dieu Anh, with an initial charter capital of 3 billion VND.

On March 27, 2025, ownership transferred to Ms. Nguyen Thi Hoa, with Ms. Nguyen Thi Phuong as Director and legal representative. Shortly after, on March 31, the company increased its capital to 120 billion VND.

In the latest update on September 15, ownership reverted to Ms. Nguyen Thi Dieu Anh. Mr. Nguyen Tien Phong now serves as Director and legal representative, and the company shifted its focus to align with LynkiD’s business areas.

Another notable shareholder is VPBankS, which has openly expressed its ambition to develop a digital asset trading platform.

On September 15, VPBankS’ Board of Directors approved a mid-term development strategy for 2026–2030, emphasizing participation in the digital asset market through collaboration with VPBank and other partners.

This strategy aligns with Deputy Prime Minister Ho Duc Phoc’s Resolution No. 05, which launched a pilot program for the digital asset market in Vietnam, effective September 9, 2025, for a five-year period.

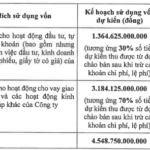

Under Resolution 05, digital asset trading platforms must have a minimum capital of 10 trillion VND, with at least 35% held by two or more entities from banking, securities, fund management, insurance, or technology sectors. Foreign investors are capped at 49% ownership in digital asset service providers.

With these regulations in place, VPBankS is taking concrete steps to establish itself in Vietnam’s digital asset sector.

Reports suggest Vietnam may license up to five pilot digital asset trading platforms. Several industry players, including SSI Securities, TCBS Securities, and VIX Securities, have expressed interest. Additionally, Military Commercial Joint Stock Bank (MB) signed an MoU with Dunamu Group to launch Vietnam’s first domestic digital asset trading platform.

– 16:24 23/09/2025

“VPBank’s Upcoming IPO: 375 Million Shares to Double 2025 Profit Plans”

With the written shareholder vote concluded on September 3rd, the plan to initiate an initial public offering (IPO) of VPBank Securities Joint Stock Company (VPBankS) has been approved. The IPO will offer a maximum of 375 million shares to the public. In addition, shareholders have also agreed to double the profit plan for 2025 and appoint an additional member to the board of directors.

Steel Stocks: A Magnet for Investment Funds

With the strong comeback of large-cap stocks, the VN-Index surged towards the 1,700-point mark. Steel stocks attracted significant trading volume in today’s session (September 4th).

‘Hot’ Rumor-Driven Surge in Bank Stock Ahead of Alleged IPO

The VN-Index soared to new heights today, reaching a peak of 1,654 points. This remarkable surge was fueled by the strong performance of large-cap stocks, particularly the banking sector. VPB stood out with an impressive ceiling-high increase, while HDB also witnessed significant upward momentum during the trading day.