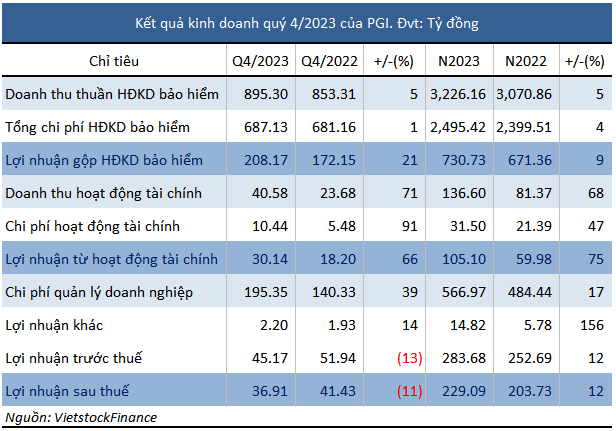

In Q4/2023, the original insurance fee revenue of PGI increased by 5% compared to the same period last year, reaching nearly 1,142 billion VND. However, reinsurance expenses remained unchanged at 332 billion VND, resulting in a 5% increase in net insurance revenue to over 895 billion VND.

The insurance operating costs increased at a slower pace as insurance compensation costs decreased by 1% to over 336 billion VND and other expenses increased by 3% to nearly 343 billion VND. As a result, the gross profit from insurance activities increased by 21% to over 208 billion VND.

The financial profit also increased significantly, rising by 66% compared to the same period last year to over 30 billion VND. However, net profit still decreased by 11% to nearly 37 billion VND, due to a 39% increase in business management costs to over 195 billion VND.

Overall in 2023, the operating profit from insurance activities increased by 9% to nearly 731 billion VND, along with a 75% increase in operating profit from financial activities to over 105 billion VND. PGI recorded a 12% increase in net profit compared to the previous year, reaching over 229 billion VND.

In 2023, PGI set a target of nearly 256 billion VND in pre-tax profit, nearly flat compared to the achievement in 2022. The company surpassed this target by 11%.

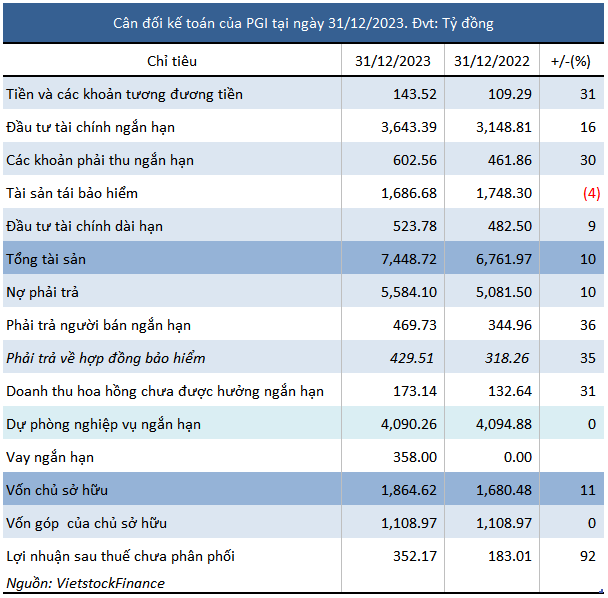

As of the end of 2023, PGI’s total assets increased by 10% compared to the beginning of the year, reaching nearly 7,449 billion VND. Among them, short-term financial investments (over 3,643 billion VND) increased by 16%, and long-term financial investments increased by 9% to nearly 524 billion VND.

PGI’s short-term financial investment portfolio includes short-term invested stocks (nearly 51 billion VND), a 10% decrease compared to the beginning of the year, and the remainder (over 3,595 billion VND) is time deposits, which increased by 16%. Among them, PGI recorded 440 billion VND in deposits at Vietcombank – a major shareholder of this insurance company. In return, Vietcombank brought in nearly 74 billion VND in original insurance fee revenue and nearly 35 billion VND in deposit interest after one year.

The payable debt increased by 10% compared to the beginning of the year to nearly 7,449 billion VND, mainly due to new short-term loan balances of 358 billion VND. Meanwhile, the short-term business provision remained unchanged compared to the beginning of the year, at over 4,090 billion VND.