The State Bank of Vietnam has released the latest data, revealing that by the end of June, the total means of payment in the economy surpassed 19.58 quadrillion VND, marking a 9.32% increase compared to the end of 2024.

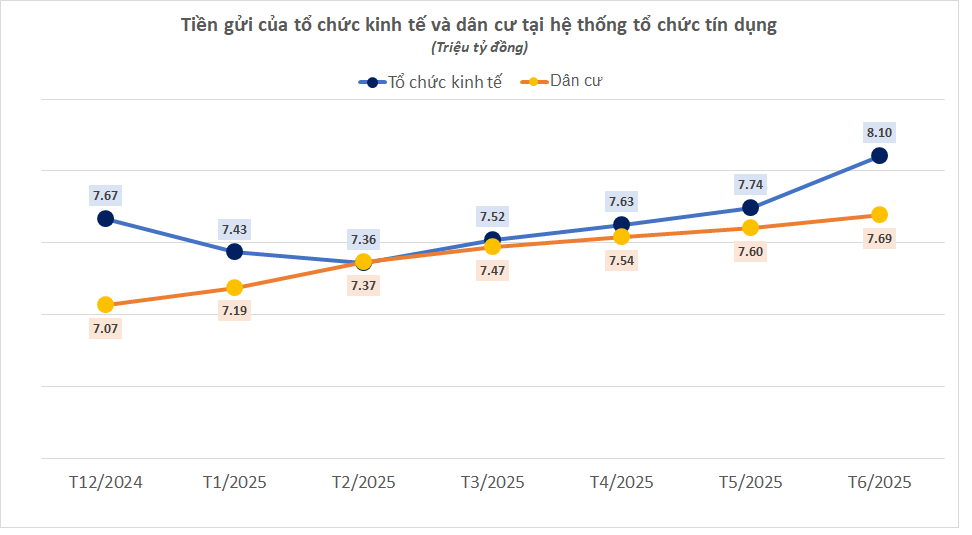

Deposits from individuals at credit institutions continued to set records, reaching 7.694 quadrillion VND, an 8.91% rise from the previous year-end. In June alone, individuals deposited an additional 91.498 trillion VND, following a 65.427 trillion VND increase in May.

Corporate deposits exceeded 8.104 quadrillion VND, a 5.7% growth compared to the end of 2024. In June, economic organizations added more than 362.825 trillion VND to the banking system, while in May, this figure was 116.370 trillion VND.

Thus, in June alone, both individuals and businesses deposited over 450 trillion VND into banks.

In the first half of the year, individuals and businesses deposited an additional 1 quadrillion VND into banks, equivalent to a 7.2% growth. In contrast, during the same period last year (the first 6 months of 2024), deposits in the system increased by only 350 trillion VND, a 2.62% rise.

Notably, bank deposits surged despite the low-interest rate environment. Currently, the 12-month deposit interest rate for amounts under 1 billion VND is only around 5-6% per annum.

Mr. Phạm Chí Quang, Director of the Monetary Policy Department at the State Bank of Vietnam, stated that capital mobilization has grown significantly, outpacing previous years. However, the growth in capital mobilization remains lower than credit growth, typically only half of the credit growth rate in recent years.

“Many question whether the rapid increase in capital mobilization and the substantial deposits by individuals indicate economic hardship or recession. Capital mobilization growth is merely an indicator for the banking sector, not a macro-economic barometer. Other indices are needed to assess this,” said Mr. Quang.

In reality, as credit expands, capital mobilization also increases significantly. Mr. Quang explained that when individuals and businesses borrow and receive funds, they also deposit money into banks for transactions, and the money eventually returns to banks as deposits. For instance, if person A borrows from a bank to pay customer B, the money goes into B’s account. With the high credit growth rate this year, the increase in capital mobilization is understandable. “This is the money creation function of commercial banks,” the SBV leader noted.

According to SBV data, by the end of June 2025, the total credit balance in the economy reached over 17.16 quadrillion VND, a 9.91% increase from the beginning of the year. By the end of August 2025, credit growth had reached 11.09%. It is estimated that this year, credit will grow by approximately 20.19%, the highest level in many years, compared to the average of around 14.5%.

Stock Market Faces Dual Headwinds: Experts Highlight Select Sectors Poised for Renewed Investment Inflows

Market experts suggest that, despite current valuations not being cheap, the market is not yet in an overheated phase compared to historical levels, leaving room for further growth. This juncture calls for discerning decision-making from investors.

Reporting Requirements for Transactions Over 500 Million to Anti-Money Laundering Units

The State Bank mandates that all domestic money transfers of 500 million VND or more, or equivalent foreign currency values, must be reported to the Anti-Money Laundering Department.

Domestic Money Transfers of 500 Million VND or More Require Reporting

The State Bank of Vietnam (SBV) has recently issued Circular 27/2025/TT-NHNN, providing guidance on the implementation of key provisions within the Anti-Money Laundering Law. This regulatory update introduces several new measures designed to enhance the effectiveness of monitoring and preventing money laundering and terrorist financing activities within the financial sector.