The National Innovation Center’s 2025 Investment Report on Technology and Innovation, released in June 2025, revealed that private equity (PE) investment in Vietnam dropped by 35% to $2.3 billion in 2024, with 141 recorded deals.

Despite the decline in investment value, the number of transactions remained relatively stable for both venture capital (VC) and PE, indicating investor confidence in Vietnam’s market potential.

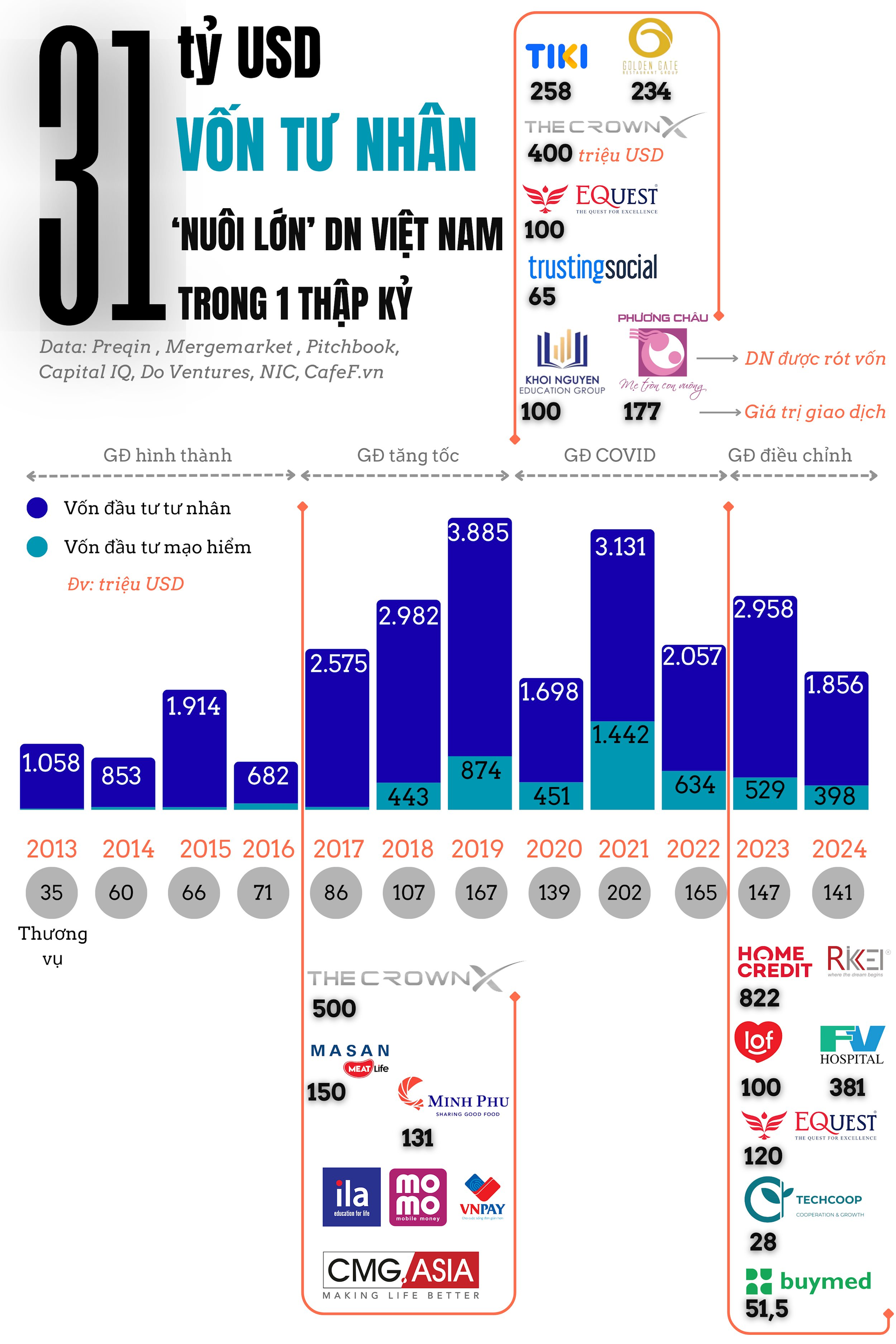

Vietnam’s private equity market has undergone significant transformations over the past decade. After its formative years before 2017, the market experienced rapid growth, peaking in 2019. The COVID-19 pandemic disrupted this momentum, stalling large PE deals while VC investments continued steadily.

More recently, the market has entered an adjustment phase, characterized by slower capital flow and more cautious investor decisions.

Acceleration Phase (2017-2019)

During this period, private equity grew rapidly in both value and deal size, peaking in 2019 with $4.8 billion in investments across 167 deals. A favorable macroeconomic environment and increased investor attention marked the market’s maturity.

Leading the way in attracting private equity during this phase was Vincommerce, which in 2019 was owned by Vingroup and later became part of The CrownX under Masan Group.

Specifically, in September 2019, the Government of Singapore Investment Corporation (GIC) invested $500 million in CTCP Phát triển Thương mại và Dịch vụ VCM, the company owning 100% of Vincommerce, which operates the Vinmart and Vinmart+ supermarket chains. GIC’s ownership stake was recorded at 16.26%.

The company was sold to Masan Group later that year. Subsequently, The Sherpa and The CrownX were established to merge Vincommerce with Masan Consumer Holdings, forming one of Vietnam’s leading retail and consumer goods companies.

Earlier, in 2017, KKR invested $150 million for a 7.5% stake in Masan Meatlife (MML).

Also in 2019, Minh Phú Seafood Corporation (MPC) received $131 million from MPM Investment Pte. Ltd., a subsidiary of Mitsui (Japan), through the issuance of 60 million shares at 50,630 VND per share.

Other notable deals included EQC’s investment in ILA (2017), Warburg Pincus’ investment in Momo (2018), GIC and Softbank’s acquisition of VNPay (2019), and Fitness & Lifestyle Group’s purchase of CMG Asia (2019), with undisclosed transaction values.

COVID-19 Disruption Phase (2020-2022)

Investment declined, but the number of deals remained relatively stable. Total VC investment peaked at $1.4 billion in 2021, offsetting the slowdown in PE. This phase demonstrated long-term investor confidence in Vietnam amidst global uncertainty.

The CrownX remained a standout, raising $400 million from Alibaba Group Holding and EQT Private Capital Asia in 2021. Tiki followed with $258 million from Mirae Asset, Taiwan Mobile, STIC, and Golden Gate with $234 million from SeaTown Holdings International, Periwinkle, and Temasek Holdings (2022).

Conversely, Masan acted as a “shark,” investing $65 million in Trustingsocial.

This phase also saw a significant education sector deal, with KKR investing $100 million in EQuest in 2021.

Adjustment Phase (2023-2024)

Global tightening and valuation adjustments led to a 35% drop in VC-PE investment to $2.3 billion in 2024. Investors adopted a more selective approach, favoring sectors with strong fundamentals and long-term potential.

The largest deal in this phase was Siam Commercial Bank’s $822 million investment in HomeCredit. EQuest received an additional $120 million from KKR in 2023. Thomson Medical Group acquired FV Hospital for $381 million, and Buymed secured $51.5 million from UOB Ventures, Cocoon Capital, and SmileGate.

The Thomson Medical Group and FV deal was recognized as Southeast Asia’s largest healthcare M&A transaction in 2023.

Notably, startup Techcoop raised $28 million in VC funding and $42 million in loans from HSBC, Lendable, AVV, and TNB Aura.

In 2024, total venture capital investment fell to $398 million, a 24.7% decrease from 2023. The number of deals also dipped slightly to 118, reflecting investor caution amid global economic uncertainty.

However, in the second half of 2024, investment surged to $298 million, a threefold increase from the first half.

“Transaction values in the second half of the year increased by 36% compared to the same period in 2023, indicating sustained market growth,” the NIC report stated.

Meanwhile, Lightspeed Venture Partners’ September 2025 report, “The Southeast Asian Consumer Barbell,” revealed that venture capital in Southeast Asia is contracting, dropping from $25.1 billion in 2021 to an estimated $3.2 billion in 2025. Ninety percent of this capital is concentrated in Singapore, bypassing markets like Vietnam, Indonesia, and the Philippines.

In terms of investment focus, digital transformation solutions for businesses saw a 562% surge to $84 million. Agriculture was the second-most invested sector, rising by 857%. Financial services ranked third, despite a 61% decline in investment due to market saturation and shifting investor interests. AI companies in Vietnam witnessed an eightfold increase in investment, from $10 million in 2023 to $80 million in 2024.

Vietnam’s PE market recorded $1.9 billion in investments with a similar number of deals as the previous year. The average deal size remained stable at $116 million, highlighting investor focus on high-value transactions.

Global Fund Gathers 200 Top Scientists, Offering Support to Elevate Bac Ninh Province to Centrally Governed City Status

The World’s Leading Scientists Development Fund in Shanghai, China, has announced its readiness to mobilize an international team of experts across various fields. Their mission is to provide consultation and support to Bac Ninh Province in realizing its ambition to become a centrally governed city.

Billionaire Nguyen Thi Phuong Thao Meets with NYSE Chairman as Market Surges 48 Points

New York, USA – September 22, 2025 – As part of the official visit coinciding with President Luong Cuong’s attendance at the United Nations General Assembly, Dr. Nguyen Thi Phuong Thao, Chairwoman of Vietjet and Vietnam’s leading female billionaire, toured the New York Stock Exchange (NYSE), the world’s largest and most historic financial hub.

Ho Chi Minh City’s New Term: Realizing the Vision of a World-Class ‘Super Metropolis’

The draft Political Report for the 1st Party Congress of Ho Chi Minh City’s Party Committee, term 2025-2030, outlines a clear vision: by 2030, the city aims to emerge as a civilized, modern metropolis, leading as a dynamic hub of innovation and integration in Vietnam’s industrialization and modernization efforts. It seeks to establish a prominent position in Southeast Asia, rank among the top 100 global cities, and become a high-income, livable urban center with a world-class innovation ecosystem.