Agribank Insurance Joint Stock Company (Agribank Insurance, Stock Code: ABI) has announced changes to the number of voting shares in circulation following the completion of its 2024 dividend payment in shares and capital increase from equity, concluding on September 12, 2025.

The total number of shares has increased from 72.3 million to 101.3 million. The chartered capital has risen by VND 289.6 billion to VND 1,013 billion.

Of the 28.9 million newly issued shares, 14.47 million shares were allocated for the 2024 dividend payment at a 20% rate to 1,550 shareholders, and another 14.47 million shares were issued for the capital increase from equity, also at a 20% rate to the same 1,550 shareholders. All 818 fractional shares were canceled. The company plans to transfer the shares in October 2025.

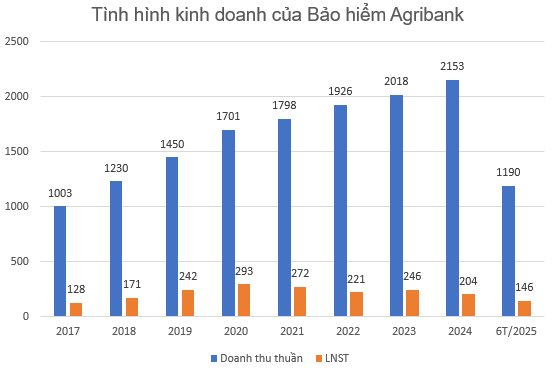

In terms of business performance, ABIC released its Q2/2025 financial report, showing a net insurance business revenue of VND 638 billion, an 11% increase.

Pre-tax profit reached VND 82 billion, a 15.2% decrease compared to the same period last year. After-tax profit stood at VND 65 billion, down 19% year-on-year.

For the first six months of the year, the company’s pre-tax profit was VND 138 billion, flat compared to the same period last year and achieving 58% of the 2025 annual plan.

Sonadezi to Disburse Nearly VND 490 Billion in Dividends at 13% Rate

Sonadezi is set to distribute over VND 489.4 billion in dividends for 2024, with a payout ratio of 13%. The final shareholder registration date is October 8, 2025, and the expected payment date is October 23, 2025.

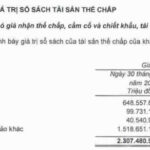

Vietnam’s First Private Bank Surpasses VND 2,000 Trillion in Collateral Assets: 2/3 Non-Real Estate, Only 1/4 in Property

Unlike other banks that primarily rely on real estate as collateral, this bank distinguishes itself with a unique portfolio where two-thirds of its secured assets are non-real estate collateral.