According to the IDGX fanpage, on September 23rd, IDGX—a Vietnam-based digital asset investment firm under IDG Capital Vietnam—officially signed a strategic partnership with BDACS, a leading licensed digital asset custodian in South Korea.

This collaboration marks the beginning of a joint venture (JV) aimed at establishing Vietnam’s first internationally compliant digital asset trading and custody infrastructure.

IDGX and BDACS aim to create a digital asset financial hub, integrating critical services such as trading and custody platforms. This initiative aligns with Vietnam’s new legal framework and vision to become Southeast Asia’s premier digital asset center.

The JV is slated to launch this year, initially operating under a regulatory sandbox program.

Recently, BDACS introduced KRW1, South Korea’s first won-backed stablecoin, fully collateralized 1:1 at Woori Bank and deployed on the Avalanche blockchain.

However, the stablecoin remains in the Proof of Concept (PoC) phase and has not been publicly launched due to unclear regulatory guidelines in South Korea.

In August, Dunamu Group signed a Memorandum of Understanding (MoU) with Military Commercial Joint Stock Bank (MB) to launch Vietnam’s first domestic digital asset trading platform.

Under the agreement, Dunamu will serve as MB’s strategic partner, providing technology, infrastructure, regulatory compliance expertise, investor protection, and workforce development support.

These developments coincide with Vietnam’s push to formalize digital asset regulation. In July, the Digital Technology Industry Law was passed, legalizing digital assets and laying the groundwork for a regulated market.

Deputy Prime Minister Hồ Đức Phớc signed Resolution No. 5/2025/NQ-CP on September 9th, 2025, outlining the pilot implementation of Vietnam’s cryptocurrency market.

The resolution governs the pilot issuance, trading, and service provision of digital assets, establishing a national regulatory framework.

Four cryptocurrency exchange companies have already been established.

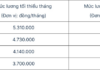

Vietnam Prosperity Cryptocurrency Exchange JSC (CAEX) registered on September 19th, 2025, with an initial charter capital of VND 25 billion. VPBank Securities (VPBankS) holds 11% (VND 2.75 billion), LynkiD 50%, and Future Land Investment 39%.

DNEX Digital Asset Exchange JSC, founded on September 9th, has a charter capital of VND 2 billion. Shareholders include Fundgo Fund Management (30%), Trustpay (30%), and Digital Asset Management Technology (40%).

VIX Cryptocurrency Exchange JSC (VIXEX), established on August 26th, boasts a charter capital of VND 1 trillion. Shareholders are VIX Securities (15%), FTG Vietnam (64.5%), and 3C Communication-Computer-Control (20.5%).

In May 2025, Techcom Cryptocurrency Exchange JSC (TCEX), part of Techcombank’s ecosystem, launched with an initial capital of VND 3 billion, later increased to VND 101 billion.

Several companies have proactively prepared for this emerging market. Notably, SSI Securities established SSI Digital Technology JSC (SSID) in 2022. Recently, SSID and SSI Fund Management partnered with Tether, U2U Network, and AWS to develop Vietnam’s digital finance, blockchain, and cloud infrastructure ecosystem.