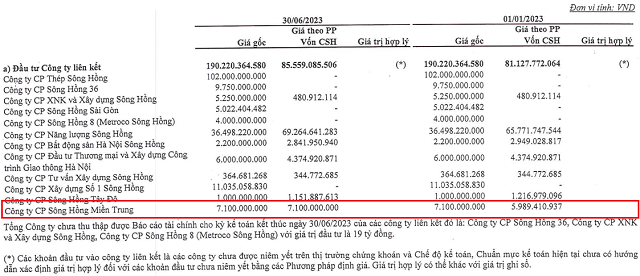

Specifically, SHG will divest its stake in its affiliate company, Sông Hồng Miền Trung Construction Joint Stock Company, which specializes in construction, production, and trading of materials, equipment, and construction supplies. Currently, SHG owns 710,000 shares in this company, equivalent to a 35% stake, with a book value of 7.1 billion VND.

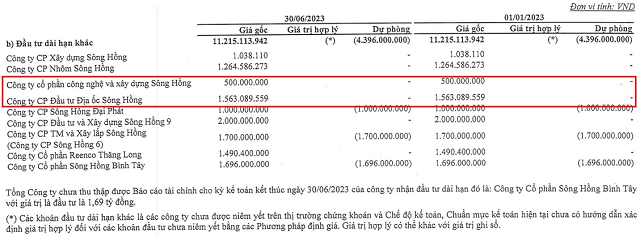

In addition, two other long-term investment companies are also on the divestment list: Sông Hồng Real Estate Investment Joint Stock Company, with over 156,000 shares, representing a 1.56% stake and a book value of over 1.56 billion VND; and Thảo Nguyên Technology and Investment Joint Stock Company (formerly known as Sông Hồng Technology and Construction Joint Stock Company), with over 50,000 shares, representing a 1.67% stake and a book value of 500 million VND.

All transactions will be executed through negotiation at a price not lower than the value recorded in SHG’s accounting books, after deducting the provision for investment losses.

Although the latest updated data on these 3 investments is not available, based on the consolidated financial statements for the first half of 2023, which were recently published, SHG is expected to receive no less than 9.1 billion VND.

Source: SHG’s consolidated financial statements for the first half of 2023

|

Source: SHG’s consolidated financial statements for the first half of 2023

|

SHG stated that the transactions will be carried out in January and February 2024, with the aim of restructuring investments in other companies and supplementing capital to pay off necessary debts.

As of June 30, 2023, SHG has 1.972 trillion VND in payable debts, which is twice the total capital, as the equity has been negative by nearly 987 billion VND after years of continuous losses.

Most of the short-term liabilities amount to nearly 913 billion VND, mainly from loan interest payable to Ban Vũng Áng and Triều Châu Medical Equipment and Construction Limited Liability Company, in addition to the provision for long-term debts of over 212 billion VND owed to Triều Châu Medical Equipment and Construction Limited Liability Company.

SHG also owes more than 313 billion VND, almost entirely short-term loans from OceanBank Hà Tĩnh Branch to supplement working capital and provide guarantees for the construction of Vũng Áng 1 Thermal Power Plant.

| Payable debts have been higher than total assets at SHG since 2016 |

In another development, SHG recently caused a stir when its Executive Board Member and former CEO, Lã Tuấn Hưng, was temporarily detained by the Investigation Agency of the Ministry of Public Security for his involvement in bidding violations related to AIC Company and the Project Management Board of the Bac Ninh Provincial Health Construction Project. The incident occurred on January 8.

Immediately after that, on January 10, SHG issued a press release affirming that the legal violations of Lã Tuấn Hưng were personal and not related to his role as CEO of SHG.

Furthermore, there has been a significant change in the ownership structure of SHG, with two individuals, Nguyễn Thái Toàn and Trần Bích Thủy, increasing their ownership to 24.5% after purchasing over 6.6 million shares, totaling 13.23 million shares. On the other hand, Song Hong Land sold a similar amount on the same day, January 19, accepting a loss of over 56% and leaving after less than a month in the “hot seat.”

“Song Hong Group’s hot seat fluctuates again, as Song Hong Land accepts over a half loss?”

Huy Khải