The draft law allows foreign investors to establish businesses before having a specific project, fostering greater equality and transparency between domestic and foreign investors. (Image: Vietnam+)

|

The comprehensive revision of the current Investment Law, replacing it with a new act titled the “Business Investment Law,” has been hailed by the Vietnam Chamber of Commerce and Industry (VCCI) as a timely, necessary, and strategically significant move.

On September 24th, VCCI provided valuable input during the “Feedback on the Draft Business Investment Law” workshop.

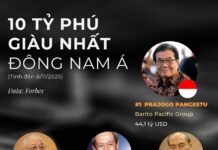

Bold Reforms

According to VCCI representatives, this draft law embodies a spirit of bold reform, promising to establish a robust legal foundation that will propel the economy forward during this critical transition phase.

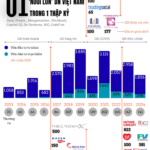

Reflecting on Vietnam’s economic development journey, it’s impossible to overlook the foundational role of the legal framework surrounding investment. Notably, the 2020 Investment Law laid a solid legal groundwork, contributing to a stable business environment, attracting private and FDI capital, fostering private sector growth, and significantly impacting GDP growth, job creation, and national competitiveness.

Previously, the existing law clearly outlined conditional investment business sectors and established a rigorous control mechanism for issuing these sectors, ensuring the freedom to conduct business based on the principle that “individuals and businesses are allowed to engage in any business not prohibited by law.”

However, Dau Anh Tuan, Vice Secretary General and Head of the VCCI Legal Department, emphasized that the current development landscape has undergone profound changes. New demands for growth model innovation, digital transformation, climate change adaptation, regional and global competition, and investor expectations for a transparent, efficient, stable, and predictable business environment pose significant challenges to the existing legal system.

“Therefore, the comprehensive revision of the Investment Law, replacing it with a new act titled the ‘Business Investment Law,’ is a timely, necessary, and strategically significant step,” Mr. Tuan affirmed.

New demands pose significant challenges to the existing legal system. (Image: Vietnam+)

|

According to VCCI representatives, the business community particularly appreciates and commends the bold reform spirit reflected in the numerous significant new points within this draft law. Specifically, VCCI highlighted several encouraging reform aspects.

For instance, the draft significantly reduces conditional business sectors, which have been a major barrier to investors’ freedom to conduct business. New regulations also simplify investment approval procedures, narrow the scope of projects requiring such approval, and substantially decentralize investment approval authority to local levels.

The draft law also permits foreign investors to establish businesses before having a specific project, fostering greater equality and transparency between domestic and foreign investors.

Notably, the new regulations shift the approach to investment incentives, targeting sectors with genuinely high value-added potential, promoting innovation, digital transformation, and sustainable development. This includes proposing significant reforms to overseas investment management, aligning with international practices and Vietnamese businesses’ investment realities, such as eliminating the Overseas Investment Registration Certificate to reduce administrative burdens.

Law as a Guiding Tool

Alongside the positive aspects, VCCI candidly pointed out areas where the draft law requires further refinement to maximize its effectiveness.

Mr. Dau Anh Tuan shared several crucial perspectives from the business community. He emphasized the need to clarify boundaries between the authorities of different laws, avoiding overlaps and conflicts between the Business Investment Law and specialized laws.

“This is a primary cause of project suspensions and repeated evaluations, leading to wasted time, costs, and business opportunities,” Mr. Tuan analyzed, stressing the need to address overlaps between the Business Investment Law and other laws (such as the Land Law, Construction Law, Housing Law, Real Estate Business Law, and Planning Law).

Regarding investment approval procedures, this aspect has sparked diverse opinions among businesses. VCCI representatives noted that many believe the requirement for investment approval complicates and prolongs the process, while subsequent project stages are already governed by various specialized laws.

The question arises whether to maintain this procedure and, if so, how to reasonably define its scope and applicable subjects to avoid burdening investors.

Additionally, many suggested tightening the control mechanism for issuing conditional business sectors. Mr. Tuan explained that while the 2014 Investment Law’s Conditional Business Sector List marked a significant step towards transparency, recent additions to the List have been relatively easy, sometimes based on unconvincing policy justifications.

VCCI candidly pointed out areas where the draft law requires further refinement to maximize its effectiveness. (Image: Vietnam+)

|

“This poses challenges to the control mechanism’s effectiveness and risks a return to arbitrary issuance of conditional investment business sectors and conditions,” Mr. Tuan warned.

VCCI representatives recommended avoiding trend-based incentives or those without demonstrable technology transfer, job creation, or local value chain transformation impacts. Incentives should serve as genuine levers, delivering sustainable value-added to the economy.

Furthermore, many suggested continuing to refine decentralization and authority delegation mechanisms, coupled with responsibility assignment and enhanced oversight. While delegating authority to local levels is necessary to expedite procedures, it must be accompanied by clear execution capabilities and accountability, preventing a “free-for-all” approach that complicates investor operations and policy consistency.

Vietnam stands at a critical economic transition juncture, shifting from a resource- and cheap labor-based growth model to one driven by innovation, technology, productivity, and institutional quality. For this transition to succeed, Mr. Tuan emphasized that institutions, particularly foundational laws like the Business Investment Law, must lead the way.

“The law must be a tool that promotes the new, guides trends, and does not hinder businesses with caution and passivity,” Mr. Dau Anh Tuan concluded./.

Hanh Nguyen

– 14:43 24/09/2025

Vietnam’s $100 Billion Market Roars to Life: Two Korean Giants Race to Secure Early Dominance

Following Dunamu’s strategic partnership with MB Bank—the parent company of Upbit—Bithumb, South Korea’s second-largest cryptocurrency exchange, has unveiled its own plans to enter Vietnam’s market. The rivalry between these two giants is intensifying, signaling a fierce competitive phase in Vietnam’s nascent digital asset landscape.

Global Fund Gathers 200 Top Scientists, Offering Support to Elevate Bac Ninh Province to Centrally Governed City Status

The World’s Leading Scientists Development Fund in Shanghai, China, has announced its readiness to mobilize an international team of experts across various fields. Their mission is to provide consultation and support to Bac Ninh Province in realizing its ambition to become a centrally governed city.