As of June 30, 2025, Shinhan Bank Vietnam’s equity capital reached over VND 36,545 billion, a 13% increase compared to the same period last year. Of this, the owner’s investment capital stands at VND 5,723 billion.

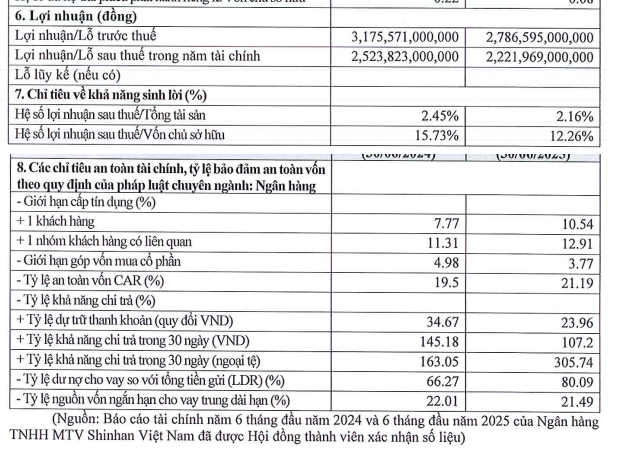

In the first six months of 2025, Shinhan Bank Vietnam recorded pre-tax profits of nearly VND 2,787 billion, a 12% decrease year-on-year.

Total liabilities at the end of Q2/2025 amounted to VND 170,632 billion, down 2% from the same period. The debt-to-total assets ratio decreased from 0.83 to 0.81, while the debt-to-equity ratio dropped from 5.34 to 4.59.

All capital safety metrics comply with the State Bank of Vietnam’s (SBV) regulations. The Capital Adequacy Ratio (CAR) stands at 21.29%. The loan-to-deposit ratio (LDR) is 80.09%, and the ratio of short-term funding for medium- to long-term loans is 21.49%.

Regarding bonds, as of June 30, 2025, Shinhan Bank Vietnam has three outstanding bond issuances—SBVCL2427001, SBVCL2427002, and SBVCL2427007—totaling VND 3,000 billion. These bonds were issued in May-June 2024 with a 2-year term, maturing in 2026, and carry a coupon rate of 5.4% per annum.

Shinhan Bank Vietnam noted that its Net Interest Margin (NIM) has declined in line with broader banking sector trends. As a 100% foreign-owned bank, its higher USD deposit ratio compared to VND also impacts NIM. Additionally, the bank remains committed to SBV directives, implementing low-interest credit packages to support customers and uphold its social responsibility.

Moving forward, the bank aims for sustainable growth by strengthening support for small and medium-sized enterprises (SMEs), diversifying funding sources, and expanding its retail credit portfolio. Notably, it will focus on home loans for young customers under 35, offering preferential rates as low as 4.5% per annum, in alignment with the Prime Minister’s directive. Shinhan Bank Vietnam will also enhance and diversify its loan products to better serve both individual and corporate clients.

Hàn Đông

– 16:52 25/09/2025

VietnamGroove Emerges as Strategic Distributor for Vinhomes Green Paradise Can Gio

On September 22, 2025, at Vinpearl Landmark 81, Vinhomes and VietnamGroove officially signed a strategic partnership agreement, marking VietnamGroove as the exclusive F1 strategic distributor for the Vinhomes Green Paradise oceanfront megacity. This iconic development in Can Gio, Ho Chi Minh City, embodies the ultimate fusion of living, leisure, and investment opportunities.

Banks Race to Boost Capital, Strengthening Their Financial Cushion

Numerous banks are actively issuing dividend-paying shares and employee stock ownership plans (ESOPs) to bolster their chartered capital, enhance financial capabilities, and comply with regulatory capital adequacy requirements.