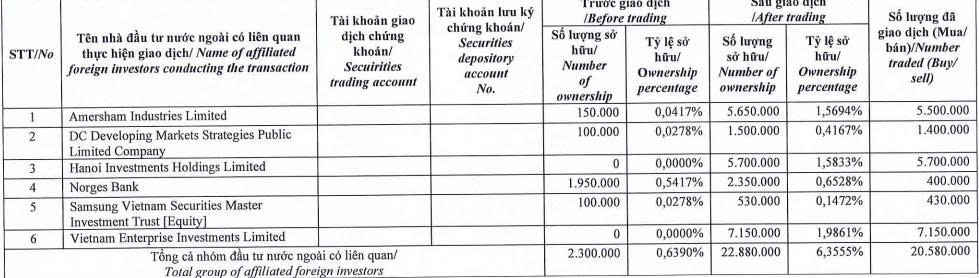

Recently, Taseco Land Joint Stock Company (Taseco Land, Stock Code: TAL, HoSE) released a report detailing the ownership of a related group of foreign investors who are major shareholders, holding 5% or more of the company’s shares.

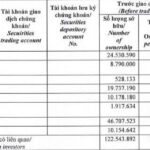

According to the report, Dragon Capital Group, through six member funds, successfully acquired 20.58 million TAL shares during Taseco Land’s private placement and via the stock exchange.

Specifically, Amersham Industries Limited purchased 5.5 million TAL shares; DC Developing Markets Strategies Public Limited Company acquired 1.4 million shares; HaNoi Investments Holdings Limited bought 5.7 million shares; Norges Bank obtained 400,000 shares; Samsung VietNam Securities Master Investment Trust (Equity) secured 430,000 shares; and VietNam Enterprise Investments Limited purchased 7.15 million shares.

Source: TAL

Following the transaction, this group of foreign funds increased their TAL holdings from 2.3 million shares to 22.88 million shares, raising their ownership stake from 0.639% to 6.3555%, thus becoming a major shareholder in Taseco Land.

According to Taseco Land’s private placement report, Dragon Capital acquired 20 million shares in this issuance. At an offering price of VND 31,000 per share, the fund is estimated to have invested approximately VND 620 billion in TAL shares.

Regarding Taseco Land’s private placement results, the company concluded the offering on September 22, 2025, successfully distributing 48.15 million shares to 15 professional securities investors.

Of these, domestic investors purchased 28.15 million shares, while foreign investors acquired the remaining 20 million shares.

At an offering price of VND 31,000 per share, Taseco Land raised VND 1,492.65 billion. After deducting expenses, the company’s net proceeds from the offering totaled VND 1,492.55 billion.

Following the successful issuance, Taseco Land’s outstanding shares increased from 311.85 million to 360 million, raising its chartered capital from VND 3,118.5 billion to VND 3,600 billion.

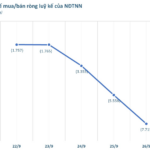

Real Estate Investment Funds Pull Back from the Market

During the week of September 22–26, 2025, investment funds exhibited a pronounced selling trend, particularly concentrated within the real estate sector. This activity unfolded against a backdrop of significant divergence in the VN-Index, highlighting a dynamic and shifting market landscape.

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

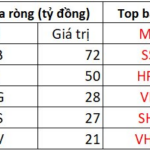

Foreign Block “Dumps” VND 2.2 Trillion in Vietnamese Stocks in Final Week’s Session, Spotlight on a Single Stock

In the afternoon trading session, VCB emerged as the most heavily bought stock across the entire market, with a net buying value of 72 billion.