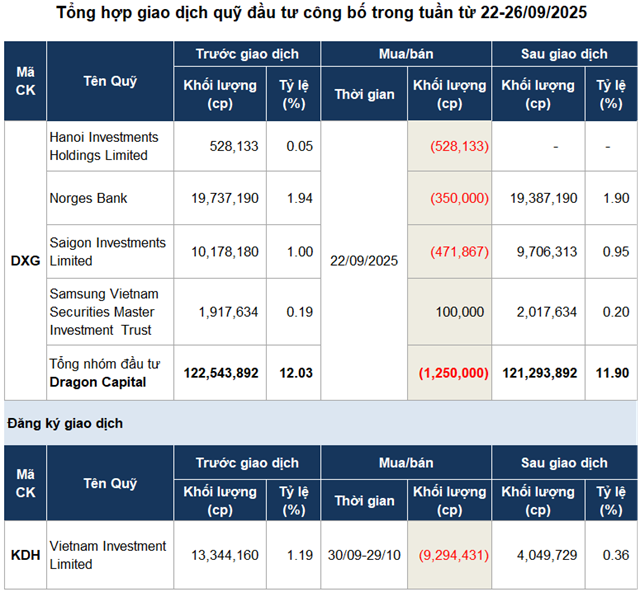

Specifically, during the session on September 22, Dragon Capital sold a total of 1.25 million shares of DXG (Dat Xanh Group), thereby reducing its ownership stake to below 12%, equivalent to 121.3 million shares. This transaction is estimated to yield approximately VND 28 billion for the foreign fund.

Previously, in late August, Dragon Capital also sold a net of 3.75 million DXG shares, decreasing its ownership from 13.04% to 12.67%.

| Price movement of DXG stock from the beginning of 2025 to the session on September 26 |

|

|

The selling trend continued as DXG shares adjusted approximately 6% from mid-September, reaching VND 22,800 per share by the session on September 26. However, compared to the low point in early April, the stock price of DXG remains 2.2 times higher.

| Price movement of KDH stock from the beginning of 2025 to the session on September 26 |

Similarly, Vietnam Investment Limited – a member of VinaCapital – has registered to sell nearly 9.3 million shares of KDH (Khang Dien House) during the period from September 30 to October 29 to restructure its portfolio.

If the transaction is successful, the fund’s ownership in KDH will decrease from 1.2% to 0.4%, equivalent to over 4 million shares. Based on the closing price of VND 34,500 per share on September 26, the deal could generate approximately VND 321 billion.

This move comes as KDH shares have declined by about 7% since early September, although they remain at their highest level since mid-2022.

Source: VietstockFinance

|

– 07:28 28/09/2025

VinaCapital Member Fund Seeks to Offload Over 9 Million KDH Shares

VinaCapital’s fund, Vietnam Investment Limited, has recently filed to offload approximately 9.3 million shares of KDH as part of its portfolio restructuring strategy.

TAL Defies Market Trends, Attracts Foreign Investor Capital

Taseco Land (HoSE: TAL) has successfully secured nearly VND 1.5 trillion in fresh capital from its investors, marking a significant milestone for the company. This influx of funds has officially increased the company’s chartered capital from VND 3.118 trillion to VND 3.6 trillion. As a result, Taseco Land’s equity has surged from VND 4.3 trillion to an impressive VND 5.8 trillion.

Dragon Capital, SHS, VietinbankSC, and Others Inject Nearly VND 1.5 Trillion into Taseco Land, Instantly Yielding Over 50% “Paper Profit”

Taseco Land has successfully concluded its private placement round, raising a total of VND 1.492 trillion. Notably, the offering attracted significant interest from prominent market players. Among them, the fund group managed by Dragon Capital stood out, investing approximately VND 620 billion to acquire a 5.55% stake, thereby becoming a major shareholder in this real estate enterprise.

Investment Fund Transactions: Selling Pressure Dominates

By mid-September (15-19/09/2025), newly announced investment funds revealed their trading activities from the beginning of the month. The data indicates a closely contested balance between buying and selling pressures, with a slight tilt towards selling. This dynamic unfolds as the VN-Index fluctuates near its historical peak.