The 2025 IPO scale could exceed $1 billion

Kicking off the second half of 2025, the standout IPO is from Technocom Securities (TCBS), with a total issuance value of over 10,800 billion VND. This is currently the largest IPO since the beginning of the year, attracting an impressive 26,000 shareholders and an oversubscription rate of 2.5 times the offered volume.

However, VPBank Securities (VPBankS) recently announced an even larger IPO plan, totaling 12,700 billion VND, surpassing TCBS’s scale. This move underscores VPBank’s ambition to strengthen its position among leading securities firms.

Meanwhile, other deals such as VPS Securities, Hoa Phat Agriculture (HPA), and Gelex Infrastructure are also expected to raise thousands of billions of VND. Gelex Infrastructure, for instance, has just announced a planned issuance of around 3,000 billion VND.

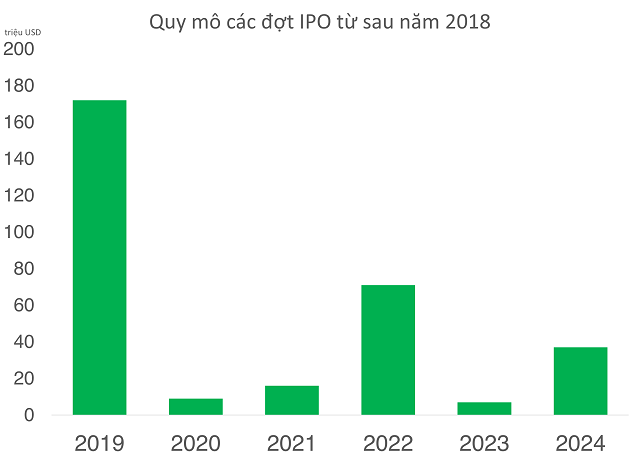

As a result, the total value of IPOs in 2025 could surpass $1 billion, marking the highest level in six years and second only to the record set in 2018.

IPO value statistics since 2018 (Source: Deloitte).

|

While the current wave primarily focuses on the financial and securities sectors, retail companies like Long Chau, Bach Hoa Xanh, and Dien May Xanh have also hinted at IPO plans for the 2026–2030 period.

This indicates that Vietnam’s primary market is regaining momentum after years of stagnation, with successive waves of opportunities emerging.

This resurgence coincides with the implementation of Decree 245, which reduces the time from IPO to listing from 90 days to 30 days and simplifies procedures, significantly benefiting businesses. Additionally, FTSE Russell’s market upgrade assessment in October is expected to attract substantial foreign capital, providing a strong boost to the domestic capital market.

The IPO wave has only just begun

Experts believe that the 2025 IPO wave is not the “destination” but rather the start of a new capital-raising cycle. Many large enterprises are still preparing their listing plans, either directly through IPOs or indirectly via UPCoM registration, as seen with F88.

Nguyen Anh Khoa, Director of Analysis at Agriseco, notes that with the positive performance of the stock market in 2025, the IPO wave is gaining momentum. Major IPOs from securities firms like TCBS and potentially VPBS will encourage companies across various sectors to plan their own listings. Notable enterprises such as Hoa Phat Agriculture (HPA), Masan’s The CrownX, and The Gioi Di Dong’s Bach Hoa Xanh have already signaled their IPO intentions.

“IPOs and capital increases are crucial drivers for the market. When companies successfully raise capital, market capitalization expands, liquidity improves, and investors gain access to quality assets. Notably, many IPOs also open doors to new industries and sectors, enhancing the market’s appeal,” Mr. Khoa explains.

Bui Van Huy, Research Director at FIDT, believes the IPO trend reflects growing business confidence in the market’s capital absorption capacity. It also contributes to broadening the range of listed products and increasing market depth and capitalization.

From an investor’s perspective, however, each capital raise or IPO should be carefully evaluated on three fronts. First, assess whether the capital will be directed toward core operations and long-term value-creating projects, as scattered investments may yield unsustainable results. Second, ensure that the issuance price and dilution ratio are reasonable to balance the interests of the company and existing shareholders. Lastly, monitor post-issuance performance, particularly its impact on EPS, ROE, and financial structure, as these factors determine whether the capital raise genuinely creates value or merely serves short-term goals.

Recent trends show that companies linking capital raises to concrete expansion strategies, such as securities firms increasing capital to boost margin limits or infrastructure and energy firms funding long-term projects, tend to achieve positive outcomes. Conversely, capital raises without clear strategic alignment often fail to generate meaningful impact.

“Overall, the IPO and capital-raising wave is a positive sign for the primary market’s recovery and a necessary step toward market upgrades, but it may not immediately stimulate the secondary market,” Mr. Huy concludes.

– 13:09 29/09/2025

Ho Chi Minh City Surpasses Bangkok in Key Index

According to the GFCI survey, Ho Chi Minh City is among the 16 financial centers projected to experience robust growth over the next 2-3 years.

Trade Defense Strategies for Vietnam in the New Global Context

For nearly two decades, trade defense cases targeting Vietnamese goods have been on a steady rise. Businesses are advised to proactively monitor shifts in supply chains, increase domestic value-added ratios, and reduce reliance on raw materials from countries facing tariffs.

“Digital Banking Unicorn Tyme Group Sets Sights on Vietnam Following Philippine Success”

The digital banking wave is sweeping across Southeast Asia, with digital lending growth surging over 20% annually, igniting fierce competition among the region’s tech giants. Amid this landscape, Tyme Group, a Singapore-based digital banking unicorn, has unveiled plans to enter Indonesia this year, with Vietnam on its radar for the near future.