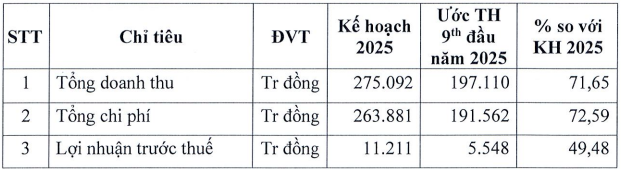

Compared to the 2025 business plan, GTA’s estimated 9-month results equate to nearly 72% of the total revenue target and over 49% of the pre-tax profit goal.

|

Estimated 9-month business results for 2025 of GTA

Source: GTA

|

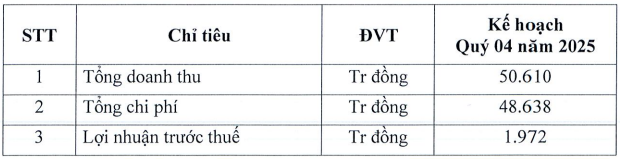

Following the approval of the estimated 9-month results, GTA’s management has outlined the Q4/2025 production and business plan, targeting a total revenue of nearly VND 51 billion and pre-tax profit of approximately VND 2 billion.

|

Q4/2025 Business Plan of GTA

Source: GTA

|

Notably, even if Q4 targets are met, GTA will still fall short of completing its 2025 plan. Specifically, achieving Q4 goals would result in cumulative 2025 revenue and pre-tax profit of nearly VND 248 billion and VND 7.5 billion, respectively, equivalent to 90% and 67% of the annual targets.

GTA’s struggle to meet its 2025 business plan is not entirely unexpected, given that its first-half revenue and pre-tax profit declined by 12% and 32% year-on-year, respectively, to approximately VND 121 billion and over VND 3 billion.

The company reported that its central refining plant ceased operations on March 31, 2025, leaving only the Binh Phuoc branch factory operational from Q2. However, the Binh Phuoc branch had to process all unfinished goods transferred from the central plant, many of which were damaged and failed to meet quality standards, requiring repairs and replacements to ensure export quality.

Additionally, rising selling expenses and volatile sea freight rates have disrupted the company’s shipping plans. Some customers have postponed or altered their shipping schedules, posing significant challenges to production line management.

– 11:35 29/09/2025

PVI Announces Dividend Payout: 3,150 VND per Share

PVI Holdings Corporation (HNX: PVI) has announced the closure of its shareholder registry for the 2024 cash dividend distribution. The ex-dividend date is set for October 1st.

Sonadezi Opposes Dowaco’s Two Critical Proposals

With nearly 64% of votes cast in opposition, the proposal to adjust the 2025 plan and the remuneration scheme for the Board of Directors and Supervisory Board of Dong Nai Water Supply Joint Stock Company (Dowaco, UPCoM: DNW) has been rejected. While the meeting minutes did not specify the reasons, the shareholder structure suggests that major shareholder Sonadezi was likely the opposing party.

The Ultimate Cable Car Experience: Soar High with Ba Na’s Sky-High Profits

The Ba Na Hills Cable Car has announced impressive financial results for the first half of the year, with an impressive after-tax profit of over 846 billion VND.