Trung Do, a long-standing leader in the granite and fired clay brick construction materials industry in Northern Vietnam, boasts a strong market presence.

|

Trung Do has recently approved a plan to issue 7.5 million shares to existing shareholders, representing a 25% increase (4 shares owned allow the purchase of 1 additional share). The offering price is set at 10,000 VND per share, with the newly issued shares being freely transferable.

The issuance is expected to take place in Q3 or Q4 of 2025, following the approval of the offering registration document by the State Securities Commission (SSC). The registration was approved on September 26th. Upon successful completion, the company’s chartered capital will rise to 375 billion VND.

According to the plan, Trung Do anticipates raising 75 billion VND from this issuance. The entire proceeds will be allocated to debt restructuring, specifically to settle loans from Vietinbank – Vinh Branch, including a 66.8 billion VND loan agreement signed on August 8, 2025, and an 8.2 billion VND investment project loan agreement signed on March 1, 2022. The company plans to disburse these funds in Q1 2026.

TDF stated that the issuance aims to alleviate financial pressure and enhance capital autonomy amidst challenging cash flow conditions and high interest expenses.

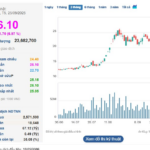

On the stock market, TDF shares have maintained a reference price of 9,100 VND per share for nearly a week, approximately 9% lower than the offering price. Over the past year, the stock has lost nearly 37% of its value, with average liquidity of only 517 shares per session. Compared to its all-time high of 27,500 VND per share in April 2022, TDF’s current market price has declined by over 67%.

| TDF Share Price Performance Over the Past Year |

Burden of Inventory and Debt

In terms of business results, Trung Do continues to report losses. In the first half of 2025, the company recorded a net loss of 21 billion VND, up from a 19 billion VND loss in the same period in 2024, marking the second consecutive semi-annual period without profit. Revenue for the first half of the year reached 219 billion VND, a 6% decrease and the lowest semi-annual figure in nine years, achieving only 33% of the annual target.

| TDF’s Semi-Annual Business Results Over the Years |

As of the end of June 2025, TDF’s inventory stood at nearly 465 billion VND, with provisions of approximately 3 billion VND. The entire inventory value is financed by loans from Vietinbank – Vinh Branch and Vietcombank – Nghe An Branch, which also serve as collateral for these loans. The company’s total outstanding debt exceeds 637 billion VND, with nearly 296 billion VND in short-term loans and finance leases.

– 13:50 29/09/2025

Vietjet to Repurchase VND 1 Trillion Bond Issuance One Year After Launch

Vietjet is set to repurchase the VJCH2429002 bond series, valued at VND 1 trillion at face value, just over a year after its initial issuance.

Billions in Profits on the Horizon for Leading Businesses

Phuoc An Port Joint Stock Company successfully raised VND 1.325 trillion through a private placement of 125 million shares. Meanwhile, Chuong Duong Joint Stock Company plans to issue up to nearly 53 million shares to double its chartered capital. Miza Joint Stock Company also offered nearly 10.6 million shares to existing shareholders, generating VND 106 billion in proceeds.