At the close of trading, the VN-Index fell by 12.74 points (-0.74%), settling at 1,652.71 points, while the HNX-Index dropped by 3.67 points (-1.34%), closing at 269.55 points. The overall market sentiment leaned towards the negative, with 418 stocks declining and 216 advancing.

Market liquidity remained sluggish, with the order-matched trading volume of the VN-Index reaching nearly 770 million shares, equivalent to a value of over 22 trillion VND. The HNX-Index recorded more than 74 million shares, valued at over 1.5 trillion VND.

Total liquidity across all three exchanges stood at just over 24 trillion VND, significantly lower compared to the July-August period.

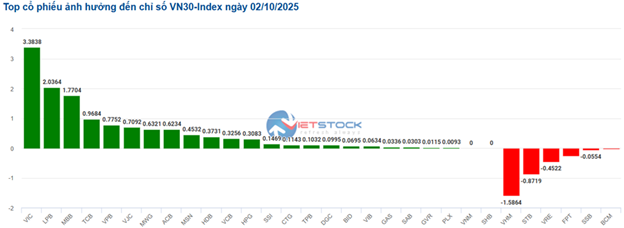

In terms of influence, VIC, MBB, TCB, and LPB were the most positively impactful stocks on the VN-Index. Conversely, VHM, VPB, and VRE were the most negatively influential.

| Stocks Impacting the VN-Index |

Similarly, the HNX-Index experienced a rather gloomy session, with KSV, SHS, and MBS being the most negatively impactful stocks.

| Stocks Impacting the HNX-Index |

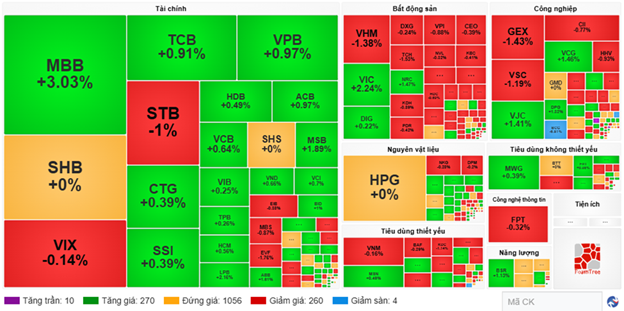

At the close, red dominated most sectors. The hardware and equipment sector, along with financial services, saw the most significant declines. Conversely, the trade and professional services sector had the most positive impact on the market.

Foreign investors continued to net sell over 2.2 trillion VND on the HOSE, focusing on VHM (240 billion VND), FPT (234 billion VND), VPB (222 billion VND), and STB (173 billion VND). On the HNX, they net sold over 44 billion VND, primarily in SHS (24 billion VND), IDC (9 billion VND), and HUT (7 billion VND).

| Foreign Investors Continue Strong Net Selling Across All Three Exchanges |

1:10 PM: Trading Stagnates After a Volatile Morning Session

Early in the afternoon session, the price movements of VIC and VHM diverged, leading to stagnant trading after a volatile morning.

As of 1:19 PM, the VN-Index rose by 2.5 points from the reference level. Trading liquidity on the HOSE stood at 11,524 billion VND, lower than the same period yesterday. VIC was the largest supporter of the VN-Index, contributing 4.05 points, while VHM exerted the most pressure, subtracting 2.04 points.

The banking sector generally remained a pillar for the index. Leading bank stocks saw notable increases, with BID up 1.1%, MBB up 2%, and LPB up 2.2% as of 1:23 PM.

The market traded sluggishly after experiencing significant volatility—rising above 1,679 points before falling back to the current level of around 1,669 points.

By 1:27 PM, prominent large-cap stocks were in the red, including VNM (-0.3%), GVR (-1.1%), FPT (-1%), VPB (-0.3%), and MWG (-0.4%).

Morning Session: Uptrend Shows Signs of Cooling

As of 10:30 AM, green continued to dominate the market, though the uptrend showed signs of cooling. The VN-Index rose nearly 8 points, trading at 1,672 points, while the HNX-Index dipped slightly, trading around 273 points.

The breadth within the VN30-Index basket leaned more towards green. Notable positive contributors included VIC, LPB, and MBB, adding 3.4 points, 2 points, and 1.8 points, respectively, to the VN30 index. Conversely, selling pressure concentrated on VHM, subtracting 1.6 points.

Source: VietstockFinance

|

Green dominated most sectors. The financial sector led the market with a 0.77% increase, primarily driven by bank stocks such as BID (+0.87%), TCB (+0.91%), VPB (+0.81%), MBB (+2.84%), LPB (+1.96%), and MSB (+1.51%).

The energy sector also stood out with gains in stocks like BSR (+1.13%), PLX (+0.44%), PVB (+2.37%), and MVB (+4.3%). However, some stocks remained at the reference price or faced selling pressure, such as GSP (-0.88%), TD6 (-1.25%), and PPT (-1.43%).

In contrast, the information technology sector recorded red, with selling pressure concentrated on leading stocks FPT and ELC, down 0.32% and 0.44%, respectively.

Compared to the opening, the overall market breadth was relatively balanced, with 280 advancing stocks and 264 declining stocks.

Source: VietstockFinance

|

9:30 AM: Market Opens Positively, BCG and TCD Hit Lower Limit After Trading Suspension Announcement

The market opened the October 2 session positively, led by bank stocks. As of 9:30 AM, the VN-Index traded around 1,673 points, while the HNX-Index surpassed 274 points.

Bank stocks led the index early in the session, with TCB, MBB, BID, and CTG contributing over 3 points to the VN-Index. No stock exerted significant downward pressure yet.

In other developments, BCG and TCD stocks both hit the lower limit after HOSE announced their transfer from restricted trading to suspension. The reason stems from both companies’ delay in submitting audited 2024 financial statements (both consolidated and separate) by more than 6 months past the deadline.

As of 9:30 AM, the sell queue at the lower limit for BCG exceeded 20 million shares, while TCD also recorded over 4 million shares at the lower limit, indicating significant selling pressure.

– 11:00 AM, October 2, 2025

HSC Expert: Foreign Block Net Selling Amid Exchange Rate Concerns

Recently, foreign investors have consistently engaged in net selling on Vietnam’s stock market. According to experts at HSC Securities, this trend poses potential risks, primarily driven by concerns over exchange rate fluctuations.