The Vietnamese stock market experienced a turbulent session on October 2nd, with the VN-Index maintaining its green hue throughout the morning before succumbing to intense selling pressure in the final hours. The index closed the day down 12.34 points at 1,652. Trading volume remained subdued, with the Ho Chi Minh City Stock Exchange (HOSE) recording a turnover of over VND 22.6 trillion.

Foreign investors were net sellers, offloading a substantial VND 2,399 billion across the market.

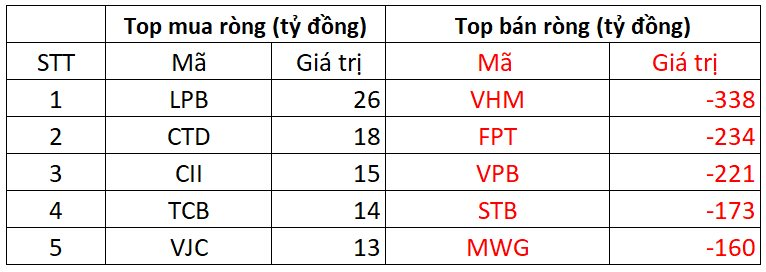

On the HOSE, foreign investors were net sellers to the tune of VND 2,354 billion.

On the buying side, LPB emerged as the most favored stock among foreign investors on the HOSE, attracting over VND 26 billion in purchases. CTD followed closely behind, with VND 18 billion in foreign buying. CII and TCB also saw significant foreign interest, with VND 15 billion and VND 14 billion in purchases, respectively.

Conversely, VHM bore the brunt of foreign selling, with VND 338 billion worth of shares offloaded. FPT and VPB also witnessed significant selling pressure, with VND 234 billion and VND 221 billion in foreign outflows, respectively.

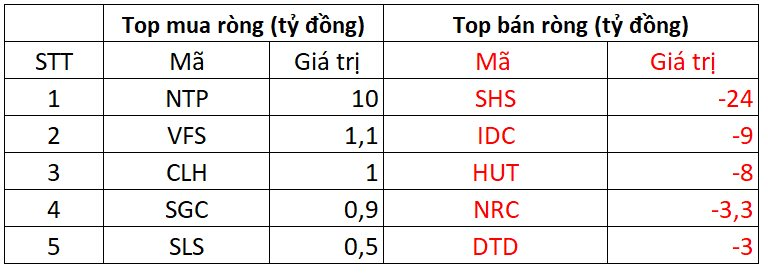

On the Hanoi Stock Exchange (HNX), foreign investors were net sellers of VND 44 billion.

NTP was the most sought-after stock on the HNX, with foreign investors buying a net VND 10 billion. VFS followed suit, attracting VND 1 billion in foreign purchases. CLH, SGC, and SLS also saw modest foreign buying interest.

On the selling side, SHS faced the most significant foreign selling pressure, with nearly VND 24 billion in net outflows. IDC, HUT, and NRC also experienced notable selling, with VND 3-9 billion in foreign outflows each.

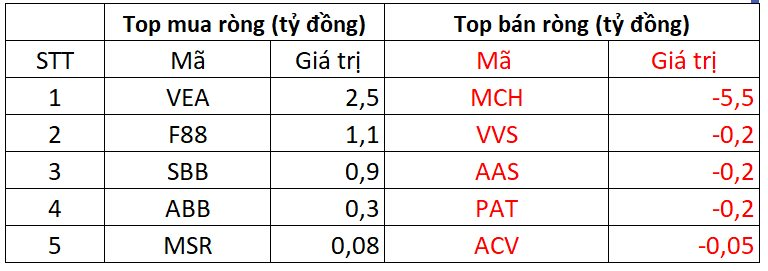

On the UPCOM, foreign investors were net sellers of VND 1 billion.

VEA was the most favored stock on the UPCOM, with foreign investors buying VND 2.5 billion. F88 and SBB also saw modest foreign buying interest.

MCH faced the most significant foreign selling pressure on the UPCOM, with VND 5.5 billion in net outflows. VVS and AAS also witnessed foreign selling.

Market Pulse 02/10: Market Shifts, Liquidity Dips, Foreign Investors Continue Heavy Selling

After a promising start to the session, Vietnamese stock indices took a sharp downturn in the afternoon, weighed down by lackluster liquidity and persistent foreign selling pressure.